Walt Disney Earnings Preview: Magic Could Be Fading

2023.05.10 08:32

- Walt Disney Company is set to announce earnings today after the market closes

- According to InvestingPro, the company’s recent financial history shows increasing revenues but shrinking profits

- Current valuations are high, and investors looking to buy at current levels should exercise caution

Walt Disney Company (NYSE:) will release its quarterly earnings report today, with an expected EPS of 0.9465 and revenue of $21.8 billion. This is one of the most highly anticipated earnings on wall street this week.

The global entertainment company operates through two major segments: Disney Media and Entertainment Distribution (DMED) and Disney Parks, Experiences, and Products (DPEP). DMED is responsible for producing and distributing film and episodic television content on a global scale. It includes Linear Networks, Direct to Consumer, and Content Sales/Licensing.

DPEP engages in selling theme park admission tickets, food, beverages, and merchandise at its theme parks and resorts, offering cruise vacations, renting vacation club properties, earning royalties from licensing its intellectual property (IP) for consumer goods, and selling branded merchandise.

The content sales/licensing business sells movie and episodic television content in the subscription video-on-demand (TV/SVOD) and home entertainment markets.

With our InvestingPro tool, we will take deep dive into Disney’s financials to better understand where we stand right now. Readers can do the same for virtually every company in the market just by using the following link.

Financial History at a Glance

Let’s begin by analyzing the historical financial statements, using InvestingPro tools, to extract several valuable insights.

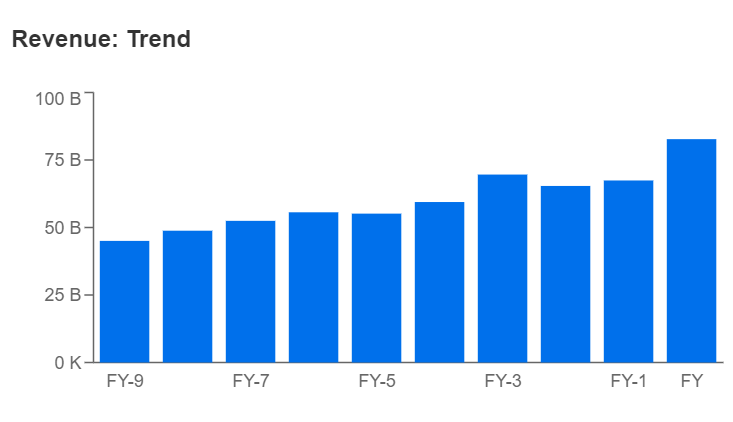

The company has witnessed an increasing revenue trend over time. However, profits have suffered, particularly from the pandemic period onwards, primarily due to the significant impact on theme parks.

Source: InvestingPro

Source: InvestingPro

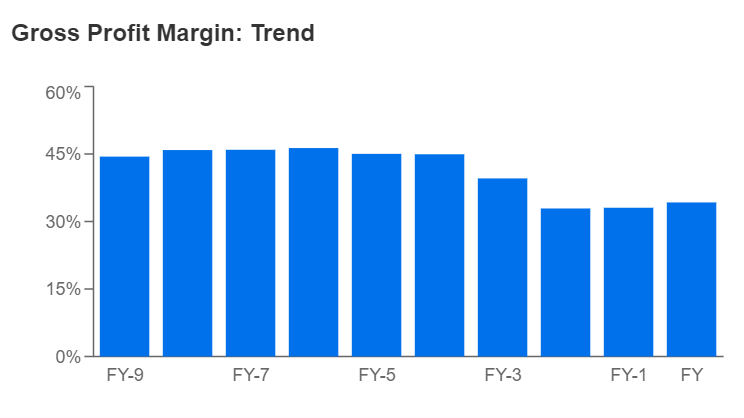

Margins are also down since the pandemic and post-pandemic period (last three years) from 45% to just above 30%, signaling that the company has been unable to adapt to the changed economic scenario despite implementing changes.

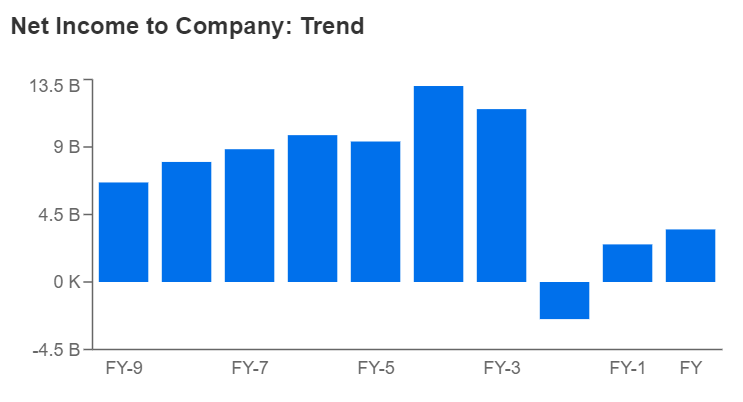

DIS Net Income to Company

DIS Net Income to Company

Source: InvestingPro

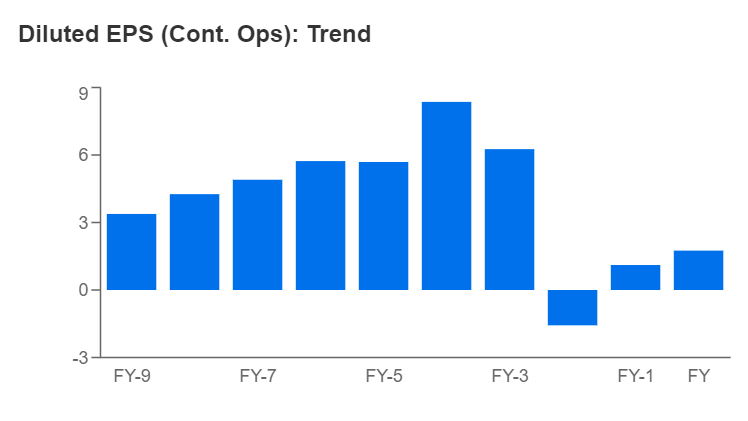

Over the past ten years, the annual growth rate of diluted earnings per share (EPSd) has been a negative 7%. This downward trend in EPSd growth has continued for the past four years, following a consistent period of steady growth.

So the question remains: Can the company return to growth at an attractive pace, or has something changed at the market level, setting off alarm bells?

Source: InvestingPro

Balance Sheet and Cash Flows

Between cash and short-term investments, the Walt Disney Company has over $11 billion, for around $29 billion in current assets. This results in a less-than-stellar short-term balance sheet compared to current liabilities (around $29 billion).

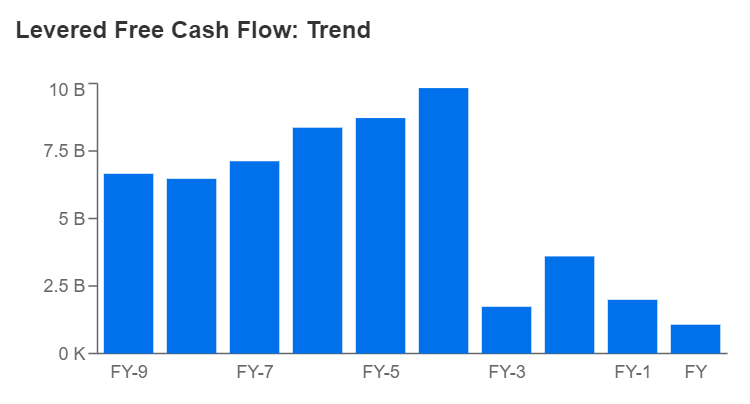

The debt-to-equity ratio is under control (0.44), which allows for a good balance on the equity side. On the cash flow side, operating cash flow and free cash flow show a declining trend over the last four years, in line with diluted EPS.

DIS Levered Free Cash Flow Trend

DIS Levered Free Cash Flow Trend

Source: InvestingPro

With an FCF of about $1 billion (the latest available), the return from FCF is about 0%, which is poor. On average, a good level of profitability is between 8-10%, so the company needs to improve on this metric.

Ratings

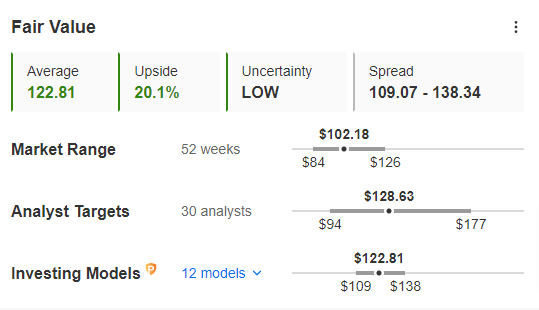

Regarding valuations, the stock is currently trading at a discount to its fair value of around $122.81 per share (based on the average of 12 different mathematical models, according to InvestingPro).

The deteriorating fundamentals are, in my view, a warning sign that needs to be carefully evaluated in the coming years, even if we take into account analysts’ estimates, which probably see a target of around $128.

DIS Fair Value

Source: InvestingPro

Since the beginning of the bear market in 2021, the share price has fallen by about 45%. This is on par with many other growth stocks and shows that the market is picking up on the deterioration in fundamentals.

Given the upcoming quarterly report and the potential for future turnarounds, I believe the current valuations pose a significant level of risk for investors.

I would caution against purchasing at these levels unless one has a very short-term investment horizon.

Find All the Info you Need on InvestingPro!

The analysis was done using InvestingPro.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or recommendation to invest as such, it is not intended to incentivize the purchase of assets in any way. I want to remind you that any type of asset is evaluated from multiple points of view and is highly risky therefore, any investment decision and the associated risk remain with the investor.