Walmart Upcoming Earnings: How Will Tech Initiatives Shape Results?

2024.11.18 12:00

Walmart Inc (NYSE:) is a technology-powered omnichannel retailer. The Company is engaged in the operation of retail and wholesale stores and clubs, as well as e-commerce websites and mobile applications, located throughout the United States, Africa, Canada, Central America, Chile, China, India, and Mexico. The Walmart U.S. segment operates as a merchandiser of consumer products, operating under the Walmart, WalMart, and Walmart Neighborhood Market brands, as well as walmart.com and other eCommerce brands.

WMT Q3 2024 reports earnings at 7:01 AM ET TUESDAY, Nov 19, 2024

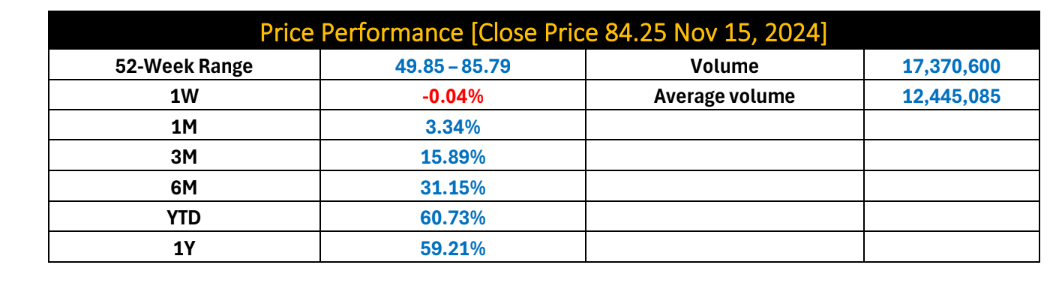

Price Performance:

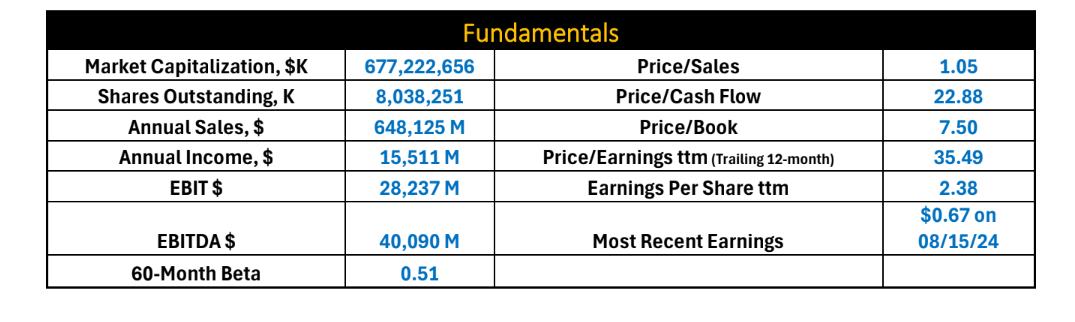

Fundamentals:

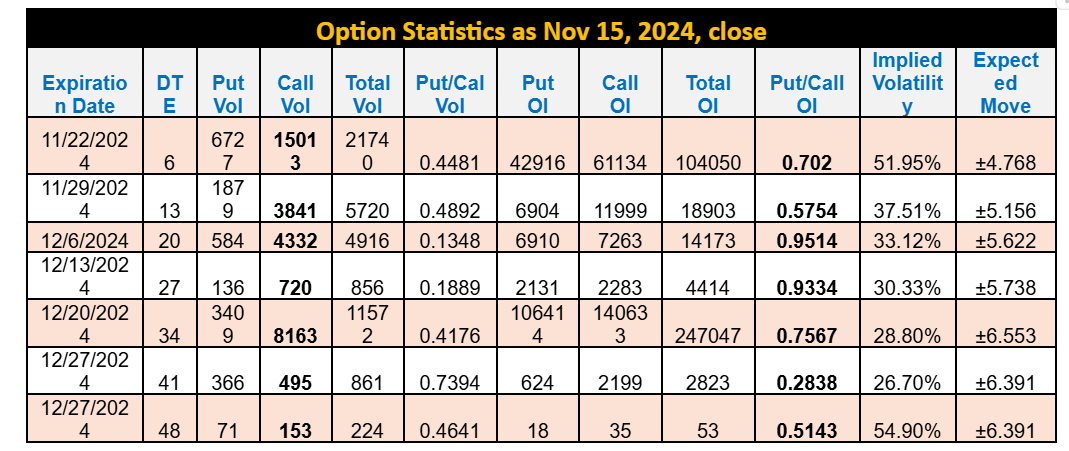

Option Statistics:

Put/Call ratio for Nov. 22 expiry is 0.702% more calls than puts which suggests the following three scenarios:

-

Any sharp rally will face liquidations of Calls pre or post earnings.

-

Earning miss or lower guidance could trigger a sell-off Tuesday.

-

Earning and guidance in line or better than estimates trigger a short-live rally.

Key Highlights:

-

Walmart stock is trading 61% higher YTD, reflecting the strength of its diversified business.

-

Robust E-Commerce Initiatives continues to produce positive outcomes.

-

Consumers can get drugs delivered with their grocery orders; service will be available in 49 states by the end of January.

-

Walmart’s Antidote to locked-up products. Some staff can use mobile devices to unlock display cases. Technology could be offered to Walmart+ loyalty members.

Technical Analysis Perspective:

-

WMT rally from May 2022 is in a parabolic Arc pattern, showing a strong trend in progress.

-

Monthly prices are rising inside a rising channel, challenging resistance between 88/90.

-

A rejection of this channel resistance eyes a drop to 78/77 the middle line of the channel.

-

A parabolic pattern has a tendency of reversing sharply with any negative catalyst.

-

Monthly Relative Strength model is hovering around the extreme levels at 85% in November.

-

The highest RSI reading has been between 88% (1998/99), 86% (1991) and 94% (1983).

-

WMT RSI may remain higher for a while, however, it is showing a warning sign suggesting that this is not a time to buy.

WMT Monthly Chart

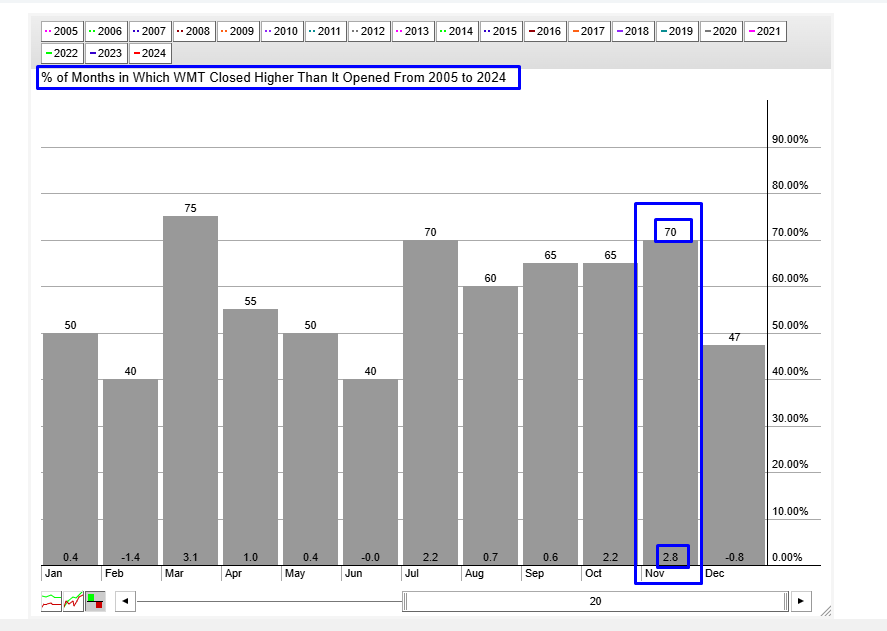

AMAT Seasonality Chart

-

WMT 19 years seasonality suggests that it closes 2.8% higher in November 70% of the time.

-

So far in November stock is up about 3.

-

95% from its opening price.

Conclusion:

Technical setups suggest that the stock is at extreme levels; warning that this is not a time to buy. A prudent strategy will be to wait and see.

Fundamentally the stock appears to be overvalued as per a few analysts.