Vitalik Buterin Mocks Bitcoin ‘Stock-To-Flow’ Model Amid Price Slump

2022.06.22 16:01

Vitalik Buterin has become the latest notable industry figure to voice their opinion on the invalidated Bitcoin stock-to-flow model.

Key Takeaways

- Vitalik Buterin took to Twitter today to criticize the infamous stock-to-flow Bitcoin model popularized by the pseudonymous investor PlanB.

- The model famously predicted that Bitcoin would hit a price of $100,000 by December 2021, inviting criticism after it was invalidated by the market.

- Buterin pointed out that if PlanB’s model was applied to Ethereum following its “Merge” upgrade, its price would be a surreal number that doesn’t “exist” in nature.

Ethereum inventor Vitalik Buterin has described the infamous Bitcoin stock-to-flow model as “harmful,” saying that flawed financial models “deserve all the mockery they get.”

Vitalik Buterin Slates PlanB’s Stock-to-Flow Model

Vitalik Buterin has taken shots at the Bitcoin stock-to-flow model that gained popularity over the course of the 2021 bull run.

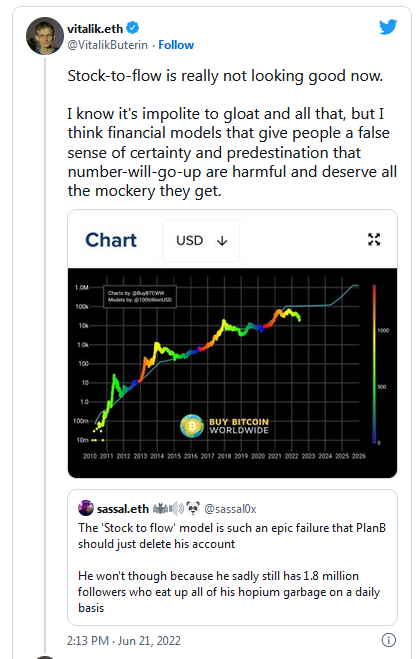

Vitalik Buterin Tweet

Vitalik Buterin Tweet

The Ethereum co-founder took to Twitter today to criticize the infamous, now invalidated model popularized by the pseudonymous Dutch investor PlanB. “Stock-to-flow is really not looking good now,” he said, adding that “financial models that give people a false sense of certainty and predestination that number-will-go-up are harmful and deserve all the mockery they get.” In voicing his criticism, Buterin was quote tweeting the independent Ethereum educator and founder of podcast, Anthony Sassano, who said that PlanB’s model was “such an epic failure” that they should consider deleting their account.

The stock-to-flow model famously predicted that Bitcoin would hit $100,000 by December 2021 and attracted attention as the asset led a rally across the crypto market. It was first conceived by PlanB in a March 2019 blog post titled “Modeling Bitcoin Value with Scarcity (S2F).” The article outlined a new way of valuing Bitcoin and predicting its price based on the relationship between the asset’s stock and flow, whereby the stock is the total size of the existing stockpiles or reserves of the asset, while the flow signifies the yearly production or coin issuance. Claiming that there was a statistically significant relationship between Bitcoin’s stock-to-flow ratio and its market price, the model forecasted Bitcoin’s price at $55,000 following its May 2020 halving event, and $100,000 by December 2021. “I will call s2f invalidated if we have not reached 100K by Dec this year, we can not stay at current levels for the rest of the year,” PlanB tweeted in June 2021, only to backtrack on his claim after Bitcoin failed to reach the forecasted target.

Stock-to-Flow Model Invalidated

Many notable industry figures have criticized PlanB and the stock-to-flow model in the past. Some have argued that it fails to account for price-influencing factors such as demand, while others have said that it is not backed by empirical evidence or scientific logic. In mocking the model’s flawed assumptions, Buterin highlighted in a follow-up tweet that if the model was applied to Ethereum following its “Merge” to Proof-of-Stake, the stock-to-flow ratio would be negative 55, meaning it would take around 55 years to burn all Ethereum in existence. This would give Ethereum a price of -47610 – 101177*i—a surreal number that doesn’t “exist” in nature.

PlanB responded to Buterin’s initial post on Twitter, calling out leaders who “fall victim to blaming others and playing the victim.”

The latest criticism of the stock-to-flow model comes as Bitcoin suffers from its eighth month of sluggish price action. The top crypto is currently trading for around $21,000, around five times below PlanB’s forecasted price target for June 2022.