Verizon Looks Like The New AT&T — And That’s Not Good

2022.10.24 16:56

[ad_1]

- For a decade, VZ outperformed its closest peer T

- But on an absolute basis, the stock disappointed; AT&T’s misadventures simply made Verizon look better in comparison

- With AT&T apparently back on track, Verizon faces real challenges

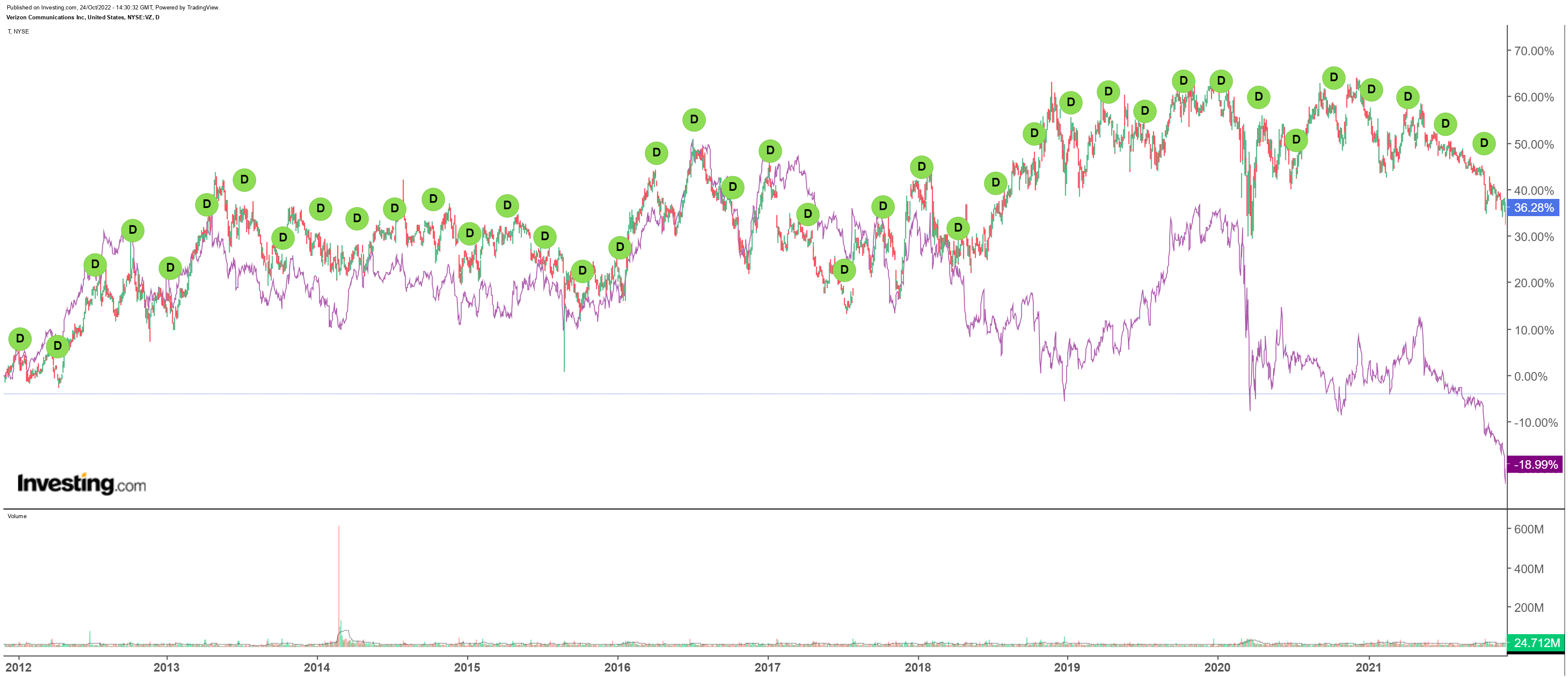

Coming into this year, shares of Verizon Communications (NYSE:) had consistently outperformed rival AT&T Inc (NYSE:). That hardly seemed like a surprise. Verizon was the better company, with stronger performance in wireless subscriber growth, a less indebted balance sheet and better management. Though T had a higher dividend, VZ posted far stronger price appreciation:

Verizon and AT&T Long-Term Combined Chart

Verizon and AT&T Long-Term Combined Chart

Heading into 2022, total returns for VZ outpaced those of its main rival over every time period. Across a decade, VZ, including dividends, returned 103% against 72% for T. Five-year total return performance showed a stark divide: VZ up 22%, T actually down 13%.

But while VZ was the stronger pick on a relative basis, it was hardly a strong pick on its own. That 10-year performance on paper sounds solid, representing annualized returns of 7.3%. But over the same period, the gained 359%. T-Mobile (NASDAQ:) — with no dividends — gained almost 900%.

Verizon did outperform AT&T — but, in large part, because AT&T was a mess. It had made a number of questionable acquisitions, buying a declining business in DirecTV in 2015 and Time Warner three years later. Those acquisitions made AT&T the most indebted corporation in the world, yet came nowhere close to achieving their promised goals.

The concern for Verizon at the moment is that AT&T seems to finally have gotten its act together. If that continues, even with VZ down 32% so far this year, it gets difficult to make much of a bull case for the stock.

A Rough Quarter

On its face, Verizon’s looks reasonably solid, at least against Wall Street expectations. Both revenue and earnings per share topped consensus. Full-year guidance was a bit light, which given the Q3 beat implies reasonable disappointment against prior expectations for Q4.

Still, overall, the quarter does not appear that bad. Goldman Sachs called the quarter “mixed.” And, in terms of the headlines, that seems like a reasonable description.

But looking closer, cracks start to appear. Adjusted earnings per share declined 7% year over year. Retail postpaid churn jumped quite a bit, to 1.17% from 0.94% the quarter before. As a result, Verizon lost 189,000 wireless retail postpaid phone subscribers.

That’s perhaps the key figure in the quarter. AT&T added 708,000 subscribers in its Q3. That continues a concerning year-to-date trend for Verizon. Over the first three quarters of 2022, Verizon has lost nearly 700,000 postpaid phone subscribers; AT&T has added 2.21 million.

The other concern is why Verizon lost its subscribers. By management’s own admission, it was because it raised pricing.

Without the ability to pass on price, Verizon is unable to manage the impact of inflation on its own costs. Indeed, we saw that trend in Q3: in the consumer business, adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) margins declined to 40.9% from 45.0% the year before.

A Declining Business?

Those two issues in Q3 highlight the core risk here. Verizon suddenly looks like a leveraged, declining business.

In other words, it looks exactly like AT&T has for much of the past decade. AT&T shows that the combination of debt and weak, or negative, growth offsets any potential contribution from a dividend. So do the likes of General Electric (NYSE:), Kraft Heinz (NASDAQ:) and many, many others over the past decade.

This year at least, Verizon is a declining business. The company guided for overall adjusted EBITDA to be down modestly. Projected adjusted EPS of $5.10 to $5.25 is below 2021’s $5.39, and at the midpoint suggests just 2.8% annualized growth from 2010’s $4.90.

To be sure, a single year’s performance does not mean Verizon is set to decline for good. The company is seeing growth in its fixed wireless product for home Internet. Results in the business segment look reasonably strong.

But fixed wireless has its own concerns about price competition, a key reason why legacy broadband operators like Comcast (NASDAQ:) and Charter Communications (NASDAQ:) have seen their share prices plunge. Business strength is necessary, but it’s the consumer business that drives the overwhelming majority of Verizon revenue.

In that context, a bet on Verizon here can’t rest on the thesis that the company has a high dividend yield. That kind of thesis has failed over and over again in recent years — even accounting for the recent bounce in T after its strong report.

Rather, the thesis here has to be, at least in part, that Verizon can return to market share growth and regain its leadership in wireless. As the 10-year performance of its own rival shows, when a high yield and lower market share collide, it’s the market share that really matters.

Disclaimer: As of this writing, Vince Martin has no positions in any securities mentioned.

[ad_2]

Source link