Utility Stocks’ Price Action Suggests U.S. Equities Could Struggle

2023.04.05 03:32

Gosh, it’s been a minute since we have looked at Utilities (NYSE:).

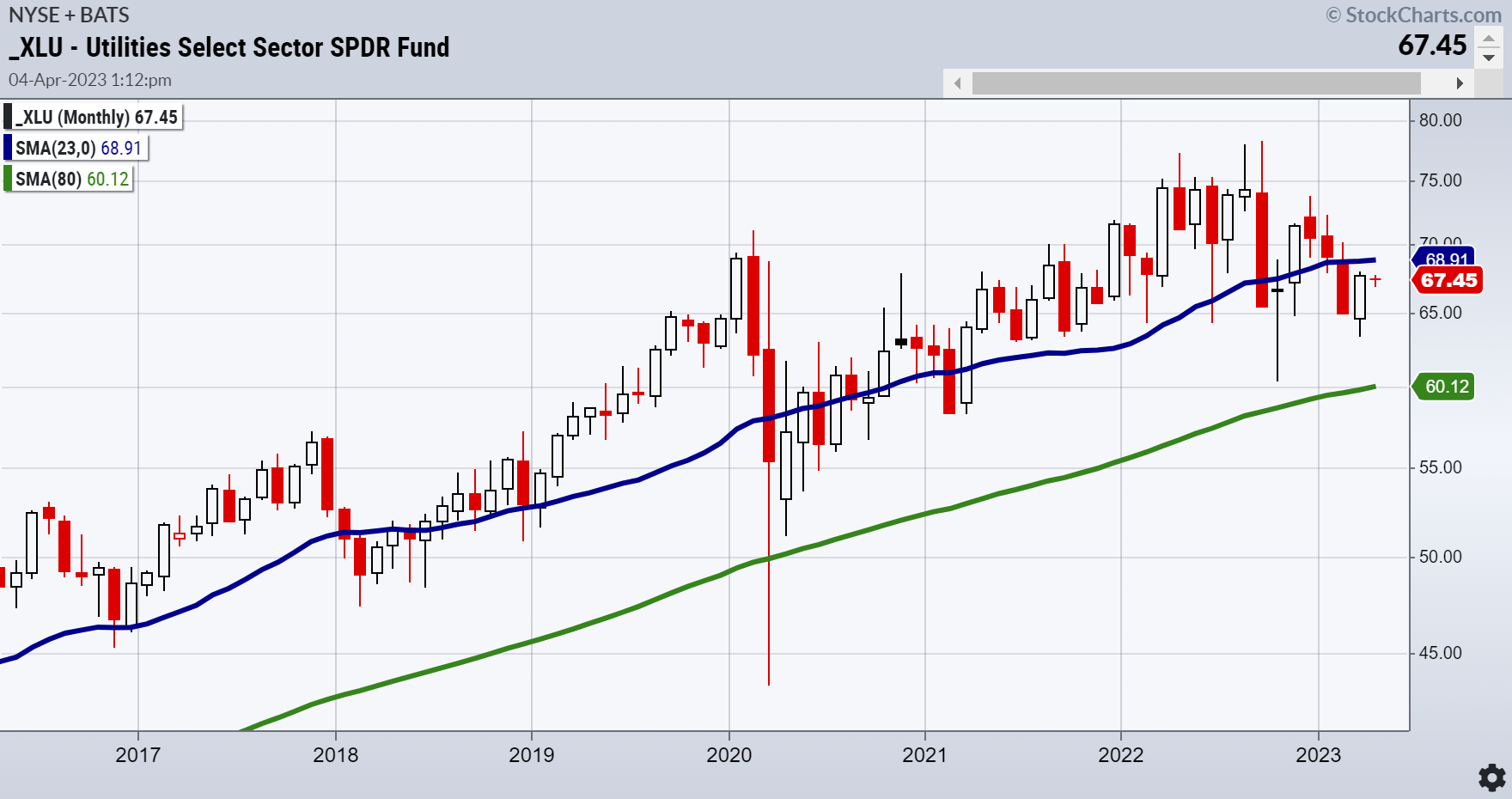

With rising interest rates, in March 2023, utilities fell near the October 2022 lows. Currently, XLU is changing phases from Bearish to Recuperation.

In my book, I say,

“When Uncle Utes Shows up Drunk at the Door, It’s Time to Pay Attention.”

So, is it time to pay attention?

In the last year, Utilities have been largely ignored as a flight to safety. Higher interest rates are the main culprit.

Also, in the cyclical nature of trading sectors, Utes simply fell out of favor.

However, with flying (see March 19th ), rates and the dollar falling, and tech stocks extremely crowded, we thought it a good time to take a fresh look.

The 50-day moving average provides support and a super low-risk point. Should that level fail or the price close back under 66.75, the trade is done for now.

On our Leadership Triple Play indicator, XLU continues to underperform the benchmark. Should that change, it would be noteworthy.

The red-dotted lines on our Real Motion momentum indicator show momentum improving and diverging as they are further above the 50-DMA than the price.

While we have been reporting on the 23-month moving average in the and how none have cleared it yet, XLU’s 23-month MA looks a bit different.

XLU only failed the 23-month MA 2 months ago. That suggests utilities are neither in expansion nor contraction.

Rather, they are trading more on the expectations for rates than on the direction of the indexes.

Along with the phase change to Recuperation, we are watching for a monthly close over 69.00.

A monthly close over that level would suggest a bigger move for Utes and a more difficult time period for equities.

ETF Summary

- (SPY) 405 support and 410 pivotal

- Russell 2000 (IWM) 170 support- 180 resistance still

- Dow (DIA) Confirmed bullish phase provided it holds 331

- Nasdaq (QQQ) 325 the 23-month moving average-huge resistance

- Regional banks (KRE) Weak get weaker-41.28 March 24 low

- Semiconductors (SMH) 255 key support 270 resistance

- Transportation (IYT) 223 pivotal-this sector needs to hold

- Biotechnology (IBB) 125-130 new range

- Retail (XRT) 60-64 current range to watch