Utilities Lead the Charge as Lower Rate Prospects Ignite Yield-Sensitive Sectors

2024.09.11 08:23

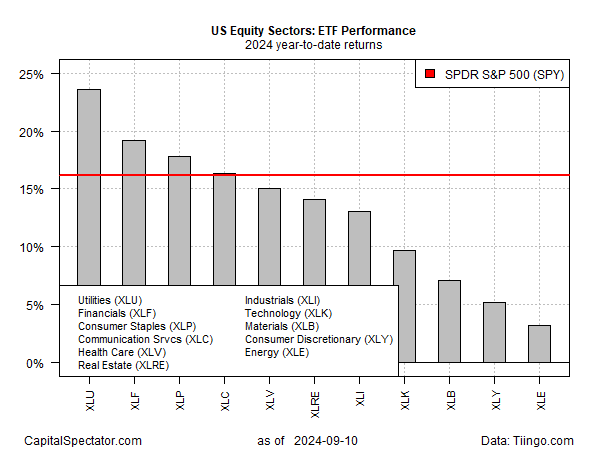

Market sentiment has recently shifted to prioritize defensive equity sectors. The attitude adjustment has lifted utilities shares, which are now outperforming the rest of the field as the top performer, based on a set of sector ETFs through Tuesday’s close (Sep. 10).

The (XLU) is up a sizzling 23.6% year to date. That’s well ahead of the broad market’s 16.2% rise, based on the SPDR S&P 500 ETF (NYSE:). XLU’s rally this year is also comfortably above the second-best sector performer: financials (), which is posting a strong 19.2% advance. The bottom performer is energy () with a comparatively weak 3.2% increase for 2024.

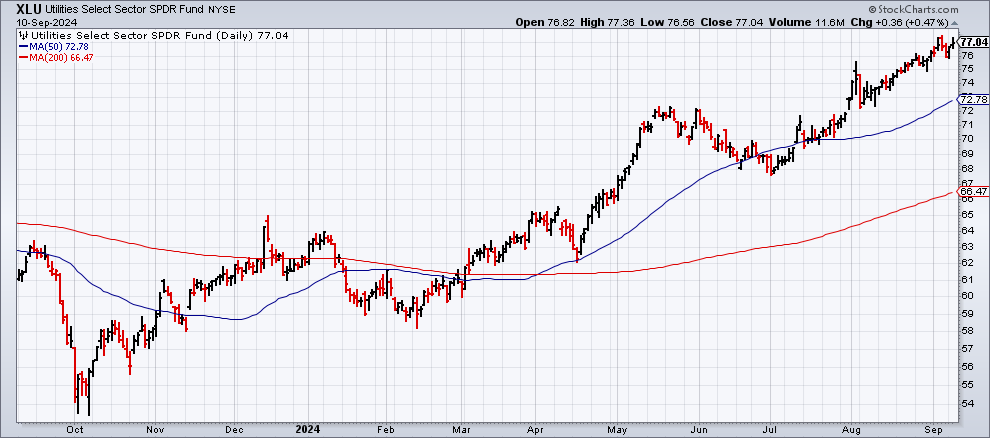

The utilities sector has been on a mostly non-stop bull run since early July. A key animating feature: growing confidence by the crowd that the will start cutting interest rates at next week’s FOMC policy meeting (Sep. 18). Fed funds futures are currently pricing in 71% probability for a 25-basis-points reduction and a 29% probability for a larger 50-basis-points cut.

The prospect of lower interest rates has lit a fire under yield-sensitive sectors such as utilities. If risk-free government bond yields are falling, as they have been in recent months, the allure increases for payout rates for utilities and other sectors prized for relatively high dividends yields.

Another beneficiary of expectations for lower government bond yields is real estate investment trusts. The (XLRE) has also been on a tear recently and closed yesterday at the highest level in roughly 2-1/2 years. As with utilities, REITs are prized for relatively high payout rates and so the slide in Treasury yields is benefiting this sector too.

There are limits, of course, to an interest-rate fueled rally. As prices of utilities and REITs run hot, the trailing yields fall. Exactly when these markets normalize for the softer interest-rate outlook is unclear, but stark value opportunities of recent history are no longer conspicuous.

What is clear is that the sector rotation game is in high gear these days. The so-called boring utilities and REITs sectors were no match for red-hot stocks earlier in the year – received wisdom that, for now, has been turned on its head.