USD/NZD: What Does the Future Hold After RBNZ Holds Steady?

2024.07.10 08:48

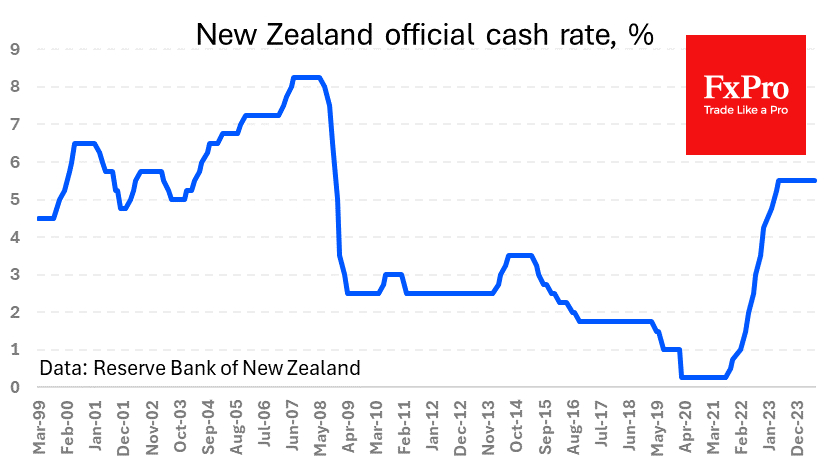

The Reserve Bank of kept its benchmark interest rate at 5.5% for the eighth consecutive meeting, which was in line with analyst expectations.

However, the central bank’s comments were softer than expected, dragging down by around 1% to 0.6070, a low for the week.

The RBNZ expects inflation to return to the 1-3% target range in the second half of the year and hinted at the possibility of reducing the degree of monetary tightening. At its last meeting in May, the regulator was leaning towards the need for another hike.

However, it has now moved into line with the major global central banks, where markets have seen or expect 1-2 rate cuts before the end of the year.

By modern standards, this sharp policy reversal has clipped the Kiwi’s vestigial wings.

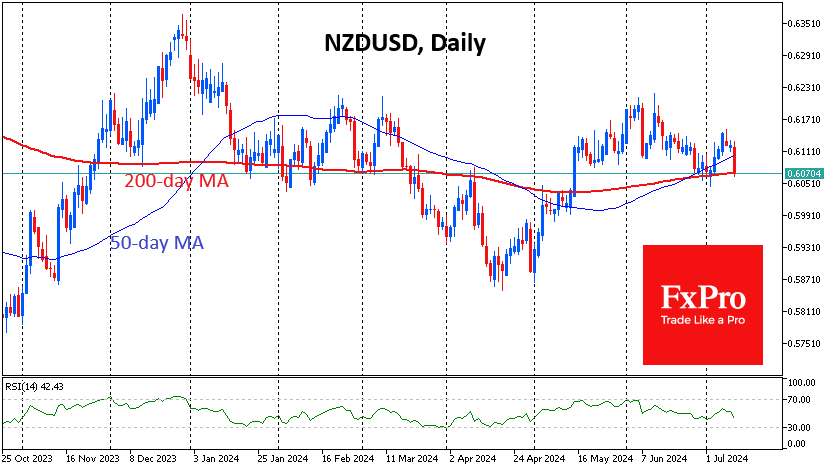

The NZD/USD reversed to the downside last Friday from a local high of 0.6150, having broken the upper boundary of the long-term descending channel in place since January 2023. This fits into a broader trend of lower highs since 2014. The recent reversal in RBNZ policy is a major fundamental factor keeping the global Kiwi trend in place.

Locally, NZD/USD is testing support in the form of the 200-day moving average after breaking above the 50-day moving average (now at 0.6100) intraday. With fundamentals driving the pair, we expect further declines towards 0.5900, a key support level over the past 12 months—over the summer months.

The pair’s dips have become increasingly shallow over the past two years, which has increased interest in the New Zealand currency’s momentum, especially near the local extremes of 0.6150 and 0.5900.

The FxPro Analyst Team