USD/JPY: Yen Strength Elements Emerge Ahead of BoJ Meeting Next Week

2025.01.16 07:49

- Hawkish speeches from BoJ officials coupled with a softer US core CPI print for December put an interim ceiling on US dollar strength against the yen.

- The leading 10-year yield spread of the US Treasury note against the has staged a bearish breakdown condition.

- Medium-term uptrend of USD/JPY from 16 September 2024 low is at risk of shaping a potential multi-week corrective decline sequence.

- Watch the key medium-term resistance of 158.35/80 on the USD/JPY.

Since the start of the new year, the persistent strength against the seen in the last quarter (Q4) of 2024 has started to ease.

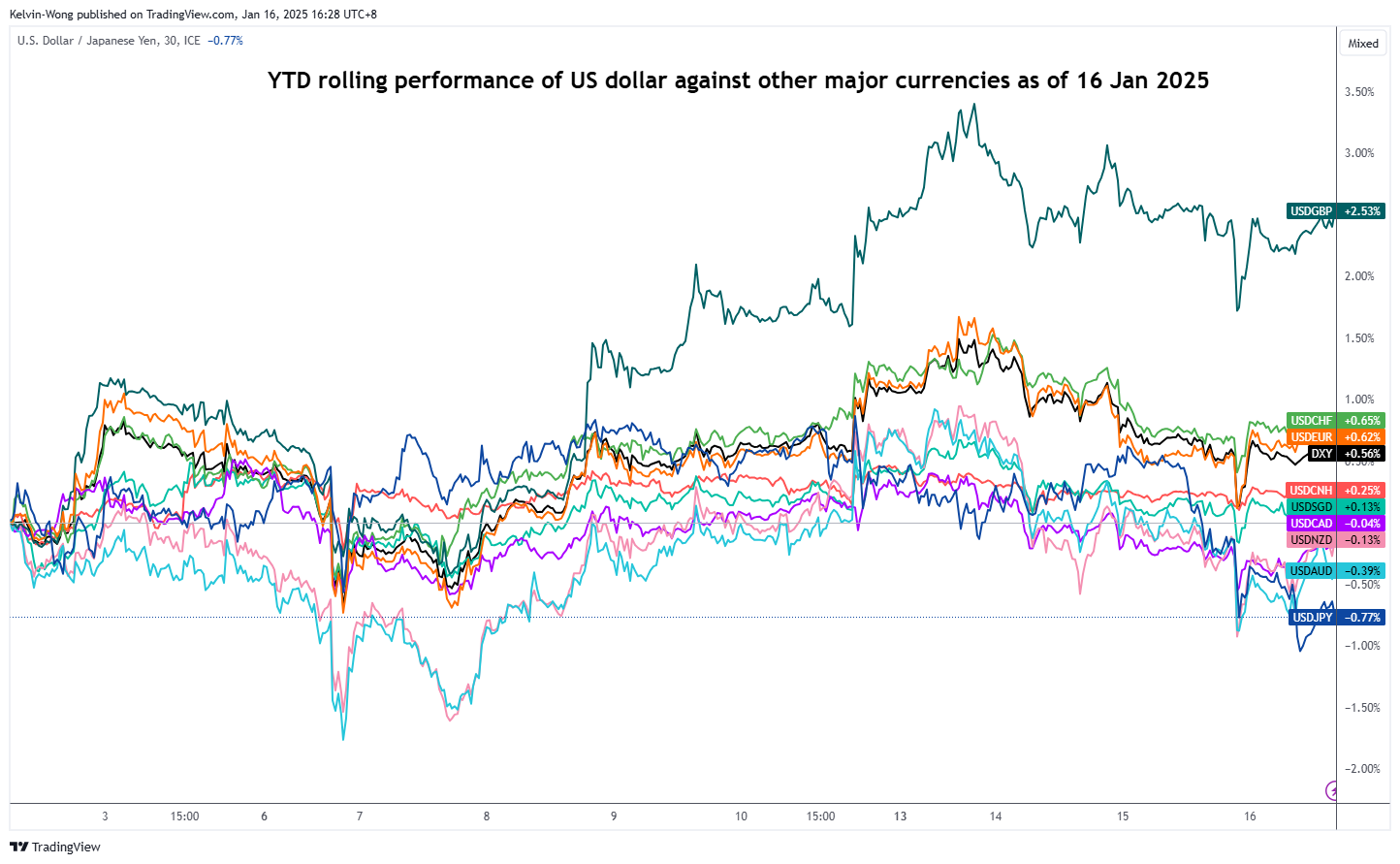

Fig 1: Year-to-date performance of the US dollar against major currencies as of 16 Jan 2025 (Source: TradingView)

Based on the year-to-date rolling performance as of Thursday, 16 January, the performance of the US dollar is the weakest against the yen versus other major developed nations’ currencies as the USD/JPY shed -0.77% (see Fig 1).

This week, speeches from the Bank of Japan (BoJ) Governor Ueda and his deputy Himino have mentioned encouraging remarks on a stronger positive outlook towards Japanese corporations raising employees’ salaries compared to December.

These positive remarks on wage growth in Japan have signaled a rate hike chance at the BoJ’s next policy meeting to be concluded on Friday, 24 January which in turn softened the USD/JPY’s prior bullish momentum coupled with a softer core US print for December that eased to 3.2% y/y from November print of 3.3% and came in slightly below expectations of 3.3%.

Longer-Term US Treasury Yield Premium Shrinkage Over JGB

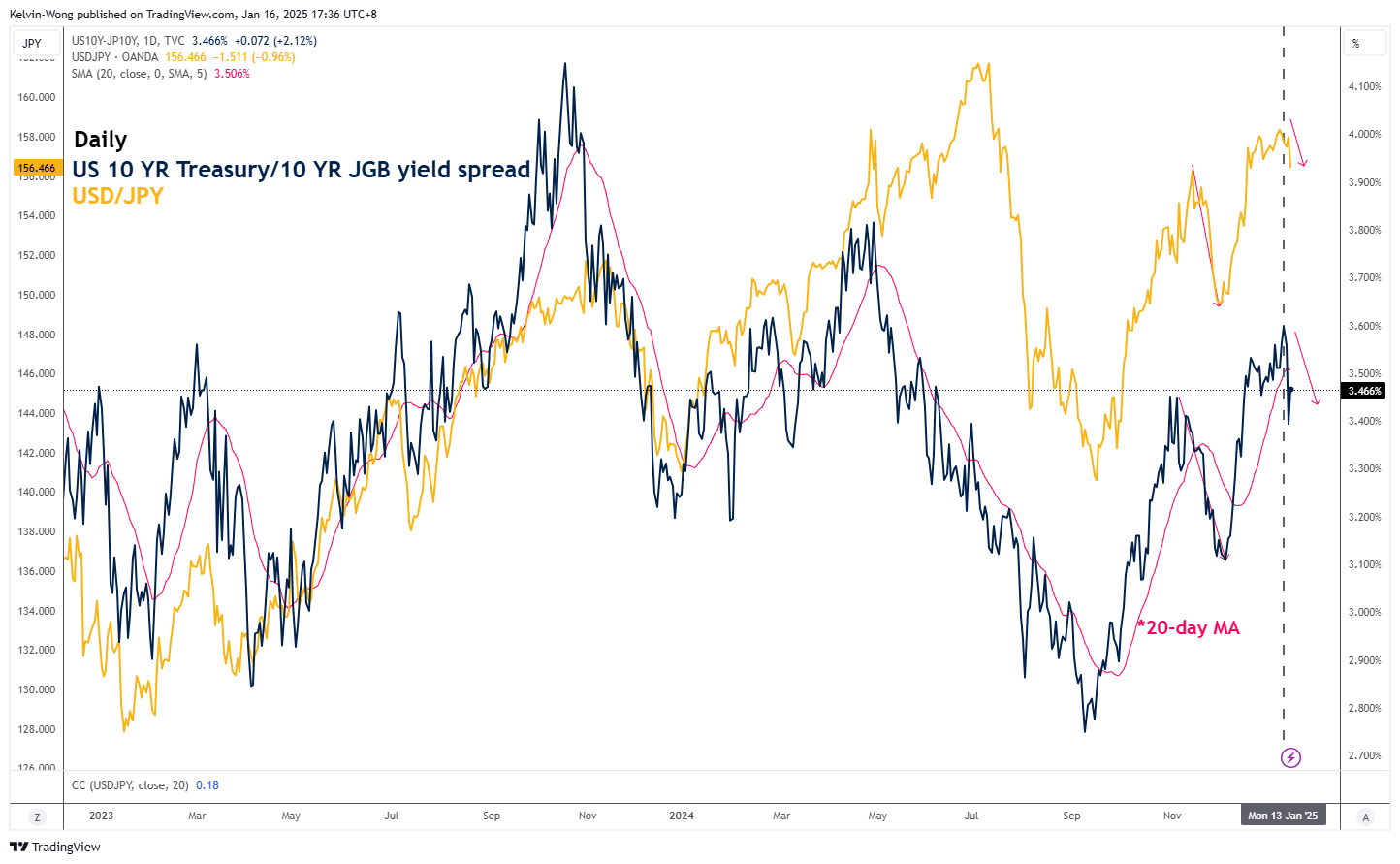

Fig 2: 10-year yield spread of US Treasury/JGB with USD/JPY as of 16 Jan 2025 (Source: TradingView)

The yield spread between the and the (JGB) has a direct correlation movement with the USD/JPY (see Fig 2).

Based on past observations, the movement of the 10-year yield spread of the US Treasury against JGB has a lead time over the USD/JPY where the yield spread inched downwards on 5 November 2024 and broke below its 20-day moving average thereafter on 20 November 2024.

This prior bearish movement of the yield spread between the 10-year US Treasury note over the JGB took precedence ahead of the USD/JPY medium-term decline of 7% from 14 November 2024 to 2 December 2024.

Right now, a similar bearish movement of the 10-year yield spread of the US Treasury against JGB has been detected from 13 January 2025 to 14 January 2025 where the US Treasury yield premium declined from 3.6% to 3.7% and broke below the 20-day moving average at this time of the writing.

Hence, if the yield spread between the 10-year US Treasury note over the JGB continues to inch lower, the USD/JPY may see further downside pressure.

Bearish Momentum Detected

Fig 3: USD/JPY medium-term & major trend phases as of 16 Jan 2025 (Source: TradingView)

The daily RSI momentum indicator of the USD/JPY has flashed on a recent bearish divergence condition at its overbought region since 8 January 2025 and just broke below the 50 level at this time of writing.

These observations suggest that the medium-term uptrend from the 16 September 2024 low of 139.58 is in jeopardy of shaping a potential multi-week corrective decline sequence.

Watch 158.35/80 key medium-term pivotal resistance and a break below 152.90 (also the 200-day moving average) may trigger the corrective decline to expose the next medium-term supports at 149.30 and 144.80 (see Fig 3).

On the other hand, a clearance above 158.80 invalidates the bearish scenario for a squeeze up to retest the 160.30/161.70 major resistance.

Original Post