USD/JPY: Yen Steady, BoJ Releases Summary of Opinions

2023.12.27 06:59

- BoJ Summary of Opinion highlights split over shift in policy

The continues to have a quiet week. In the European session, USD/JPY is trading at 142.54, up 0.12%.

The Bank of Japan’s summary of opinions from the December meeting was released earlier today. That meeting was somewhat of a disappointment to the markets, as there were expectations of a move after senior BoJ members hinted prior to the meeting that the Bank was looking to lift interest rates out of negative territory. In the end, the BoJ stayed put and maintained policy settings.

The summary highlighted the split amongst board members regarding the exit from ultra-loose monetary policy. One member stated that the timing of normalizing policy was “getting closer” but another member said that the BoJ could wait until after wage talks next spring.

The internal debate revolves around the key question as to when inflation will become sustainable at the 2% target. Governor Ueda has argued that wage growth must increase before inflation is sustainable and that the current high rate of inflation is due to cost-push factors. This means that national wage talks in April will play a key role in determining the BoJ’s rate policy. The takeaway from the summary is that an exit from ultra-loose policy is a question of when rather than if, and that there are differences of opinion within the central bank as to the timing of a shift in policy.

We have seen that tweaks to the yield curve control program have triggered sharp movement from the yen, and it’s a safe bet that a shift in policy would send the yen flying higher. BoJ policy meetings have become market-moving events and every comment from a senior BoJ official has the potential to shake up the currency markets. The BoJ holds its next meeting on January 22-23.

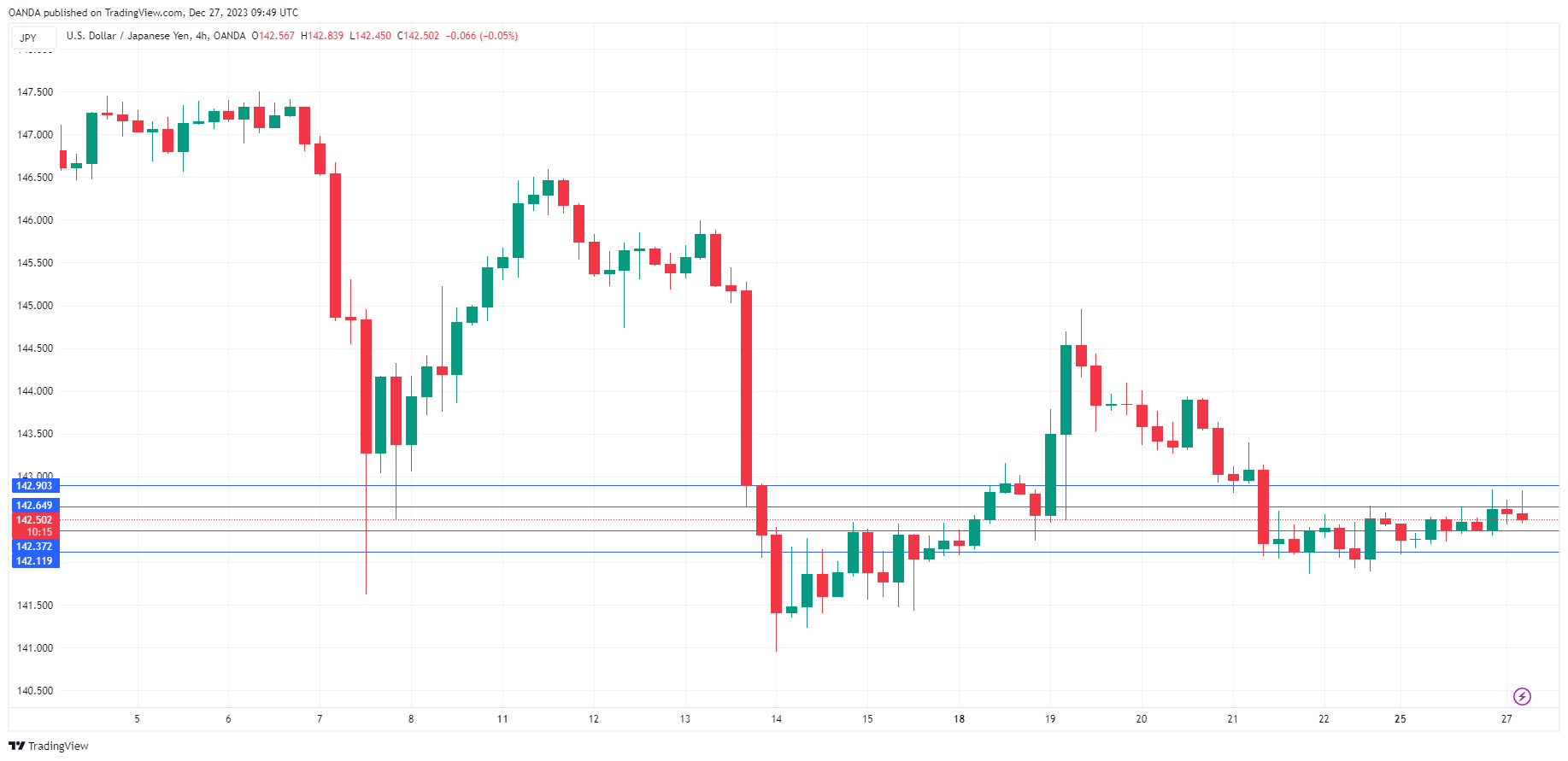

USD/JPY Technical

- USD/JPY is putting pressure on resistance at 142.55. Above, there is resistance at 142.78

- There is support at 142.34 and 142.11

Original Post