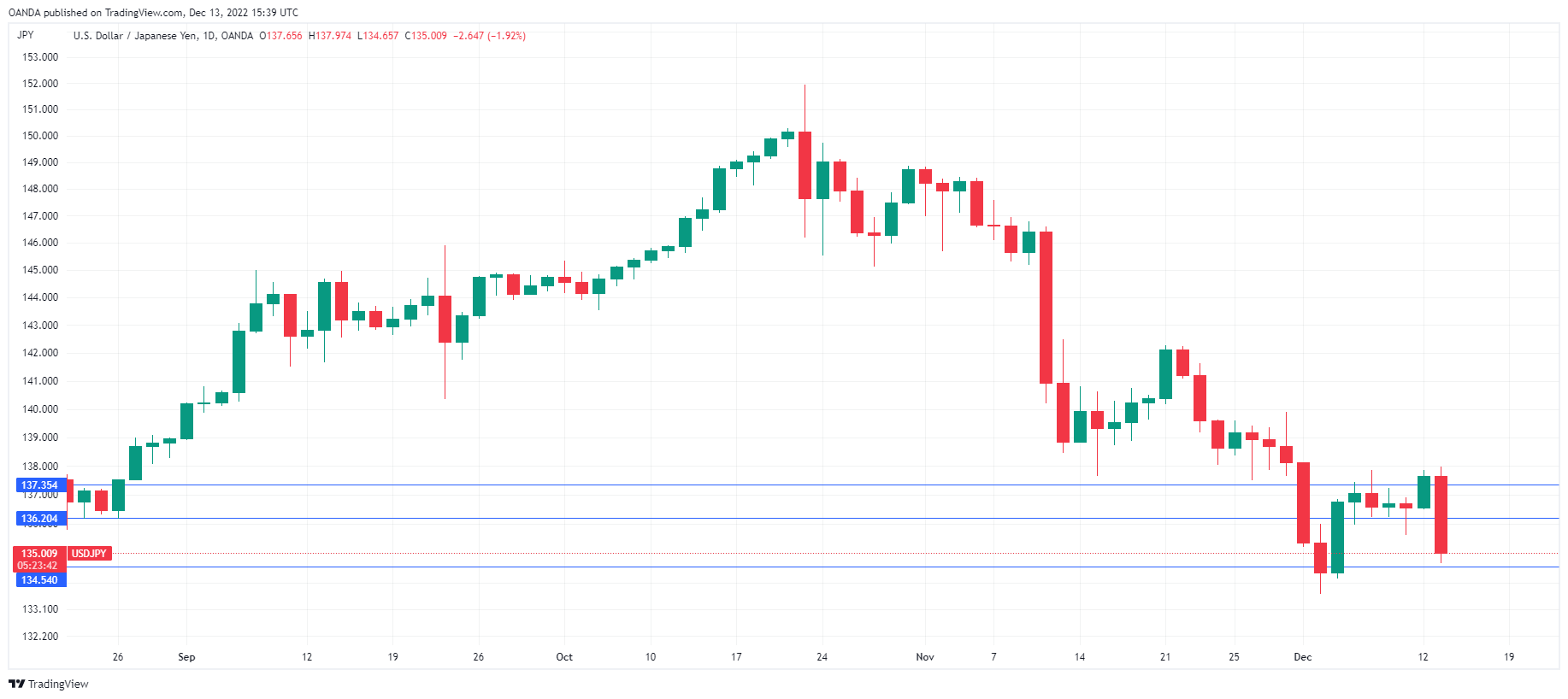

USD/JPY Tumbles Post Soft CPI

2022.12.14 03:25

[ad_1]

The Japanese yen is sharply higher on Tuesday. In the North American session, is trading at 134.97, down 1.95%.

US inflation underperforms again

The is in broad retreat after was softer than expected. The November reading dropped to 7.1% y/y, down from 7.7% in October and slightly lower than the 7.3% consensus. The trend was similar for , which dipped to 6.0%, down from 6.3% and below the consensus of 6.1%. We’ve seen this story before – equities jump, and the US dollar slides after a soft CPI report, as the markets speculate that the could make a dovish pivot in response to falling inflation.

This inflation report is even more interesting because the Fed winds up its policy meeting on Wednesday. Today’s CPI data hasn’t changed the pricing of a 50-bp hike tomorrow, which is about 80% likely. The markets will be listening carefully to the tone of Jerome Powell’s rate statement and follow-up remarks, hoping for clues about the next meeting in February. There is a strong chance that the Fed will hike by 25 bp and then take a pause – this would be significant because the rate tightening cycle would terminate at 4.75%, below the 5.00% level or higher, which many forecasts projected for the terminal rate.

In all the market enthusiasm, investors would be well to remember that even with the recent fall in inflation, it remains more than three times the Fed’s target of 2%. The battle with inflation is far from over, and we are yet to hear the Fed utter the magic phrase that “inflation has peaked.” Jerome Powell and Co. may continue to drum out a hawkish message, but the critical question is whether anyone in the market is listening.

USD/JPY Technical

- USD/JPY broke below support at 136.20 earlier. This is followed by support at 1.3453

- There is resistance at 1.3734

Original Post

[ad_2]

Source link