USD/JPY Stays Within Caution Zone

2023.03.08 10:22

USD/JPY jumped into the green territory during the early US trading hours on Tuesday after the Fed chief Jerome Powell told Senate lawmakers that a return to bigger rate hikes is likely.

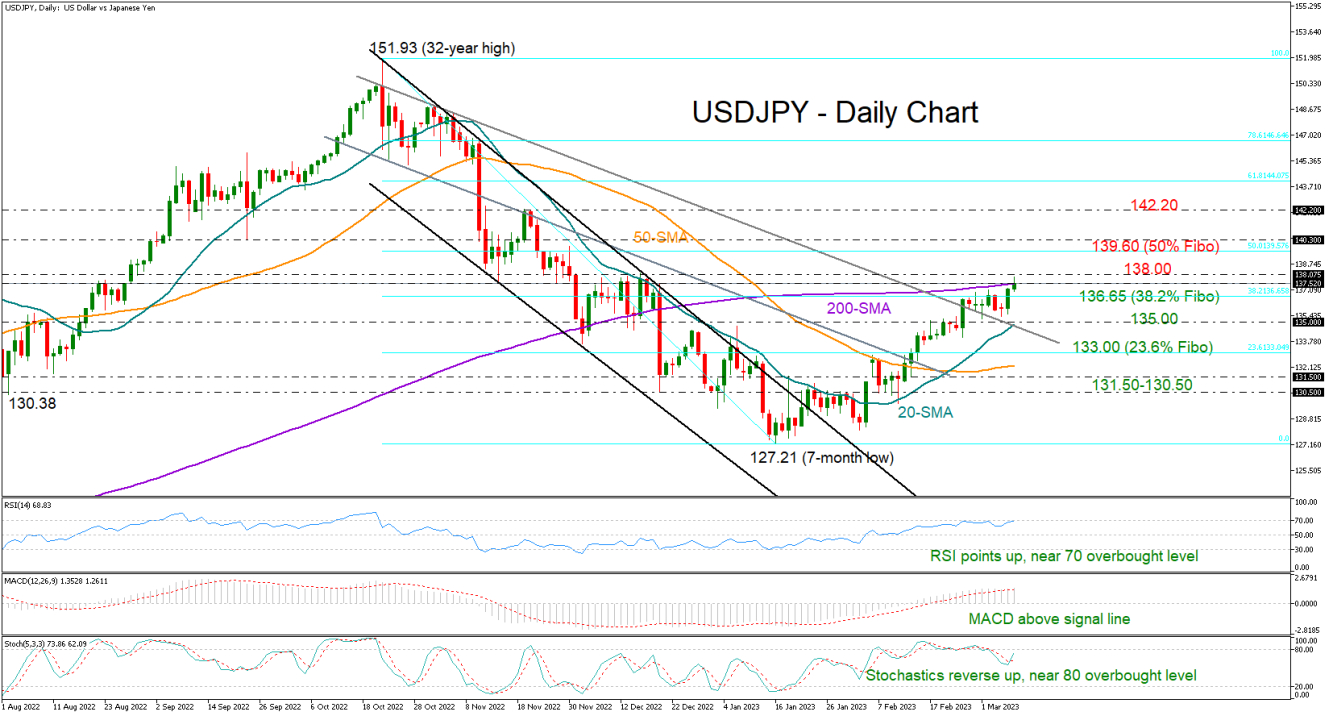

The pair closed moderately above the 38.2% Fibonacci retracement of the 151.93-127.21 downleg, which had been limiting bullish actions over the past couple of sessions around 136.65. But the bulls will also need to win the battle against the 200-day simple moving average (SMA) and the 138.00 round level in order to speed up to the next Fibonacci level of 139.60. Slightly higher, the 140.30 region may attract some attention before all eyes turn to the 142.20 barrier.

The bullish intersection between the 20- and 50-day SMAs is promoting the rally from January’s seven-month low, while the positive slope in the RSI and the Stochastic oscillator is also endorsing the aforementioned bullish scenario. Yet the indicators are currently only a short distance below their overbought levels, suggesting that upside pressures may fade soon.

Should the price pull below 136.65, the 20-day SMA could immediately come to the rescue around 135.00. The 23.6% Fibonacci zone of 133.00 could be the next target, while lower, the pair may attempt to pivot within the frequently tested support area of 131.50-130.50.

In brief, USDJPY is looking cautiously bullish as the pair is trading within a constraining territory. A decisive close above 138.00 could further bolster buying appetite.