USD/JPY Slips as Fed Flips Fully Data Dependent

2023.07.27 03:25

- The Fed raised interest rates by 25bps to the 5.25-5.50% range as expected.

- Powell emphasized the importance of future inflation data in his press conference, leaving the door open for another rate hike this year if it reaccelerates.

- The market is viewing the statement as modestly less hawkish than expected in the initial reaction, with the dollar falling and stocks rallying.

Fed Interest Rate Decision and Statement

In Monday’s Fed meeting preview report, I noted that the Fed’s to raise interest rates by 25bps to the 5.25-5.50% range was essentially 100%, and Jerome Powell and Company delivered in an 11-0 vote.

Traders who were looking for useful updates from the Fed’s monetary policy statement were disappointed: Beyond updating the language to reflect the interest rate hike and updated date, the only “change” was that the central bank characterized economic activity as expanding at a “moderate” pace instead of a “modest” pace.

Fed Chairman Powell’s Press Conference

With the interest rate “decision” and monetary policy statement providing little in the way of fireworks, Fed Chairman Powell’s was the lone remaining catalyst for potential volatility. Mr. Powell is still speaking as we go to press, but thus far, markets see his comments as slightly dovish at the margin, albeit leaving the door open for additional rate hikes if inflation reaccelerates.

Headlines from Chairman Powell’s Press Conference follow [emphasis mine]:

- THE FOMC IS TO TAKE A DATA-DEPENDENT APPROACH ON FUTURE HIKES

- THE FULL EFFECTS OF TIGHTENING ARE YET TO BE FELT

- GROWTH IN CONSUMER SPENDING HAS SLOWED FROM EARLIER IN THE YEAR

- THERE IS CONTINUING SIGNS OF LABOR SUPPLY AND DEMAND COMING INTO BETTER BALANCE

- LABOR MARKET REMAINS VERY TIGHT

- PROCESS OF GETTING INFLATION TO 2% HAS A LONG WAY TO GO

- WE’RE HIGHLY ATTENTIVE TO RISKS INFLATION POSES TO BOTH SIDES OF THE MANDATE.

- THE FOMC WILL TAKE CUMULATIVE TIGHTENING AND LAGS INTO ACCOUNT

- REDUCING INFLATION LIKELY TO MEAN BELOW-TREND GROWTH

- WE HAVEN’T MADE A DECISION TO GO EVERY OTHER MEETING

- THE INTERMEETING DATA CAME IN BROADLY IN LINE WITH EXPECTATIONS.

- IT’S POSSIBLE WE’D RAISE IN SEPTEMBER IF DATA WARRANTS IT

- FED’S POWELL: WE BELIEVE MONETARY POLICY IS RESTRICTIVE

- WE WILL BE LOOKING TO SEE IF SIGNAL FROM THE JUNE CPI IS REPLICATED

- CORE INFLATION IS STILL PRETTY ELEVATED

- CORE INFLATION IS A BETTER SIGNAL OF WHERE HEADLINE GOING

- THIS IS NOT AN ENVIRONMENT WHERE THE FOMC SHOULD PROVIDE LOTS OF FORWARD GUIDANCE

- WE ARE NOT TAKING MOVING AT CONSECUTIVE MEETINGS OFF THE TABLE

- WE CAN AFFORD TO BE A LITTLE PATIENT.

- THE NORMALIZATION OF SUPPLY CONDITIONS PLAYING IMPORTANT ROLE IN GOODS DISINFLATION.

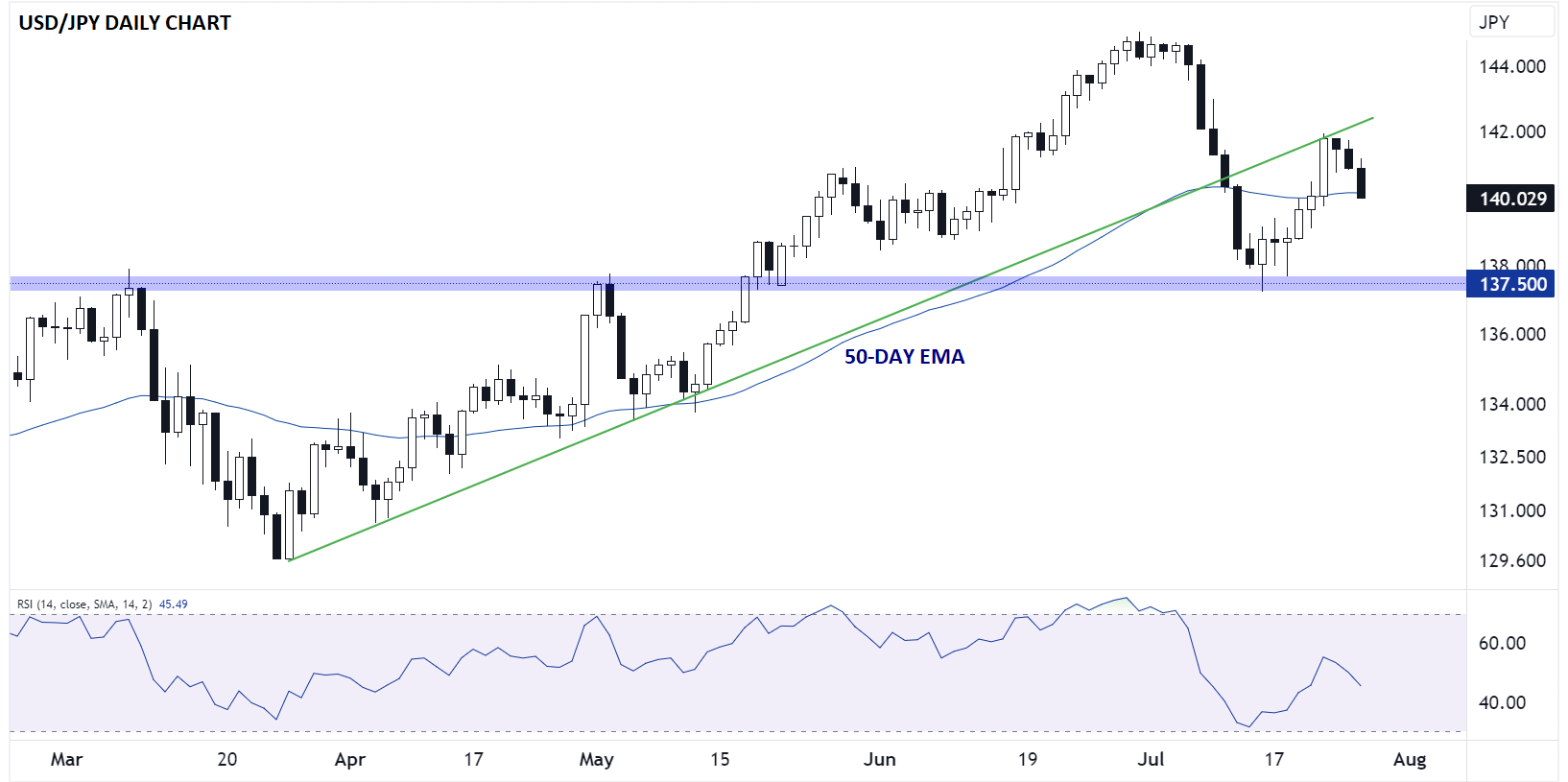

Fed Market Reaction – USD/JPY Daily Chart

Source: TradingView, StoneX

As noted above, traders are viewing the Fed meeting as incrementally less hawkish than expected, driving the US dollar lower, major indices higher, and 2-year treasury yields down slightly. Keying in on , rates are falling for the 3 straight days to testing the 50-day EMA after stalling at the underside of their previous bullish trend line late last week.

Moving forward, continued weakness from here (note the BOJ meets on Friday and has more potential for a surprise than the Fed) could open the door for a drop toward previous-resistance-turned-support at 137.50 next. Meanwhile, buyers would want to see a move back above the broken bullish trend line at 142.50 to restore the bullish bias.

Original Post