USD/JPY Rally Faces Key Test as US Job Openings Data Approaches

2024.10.29 10:37

- USD/JPY nears 154 as US Treasury yields push higher

- Bias remains to buy dips over selling rallies, although the price action is starting to look tired

- US JOLTS survey provides first major hurdle to the US economic exceptionalism narrative

The preference remains to buy over selling rallies, although beware near-term reversal risks as major economic data, month-end flows and the US election provide ample excuse for profit-taking after a sizeable move higher.

US Rate Futures Point to Higher Treasury Yields

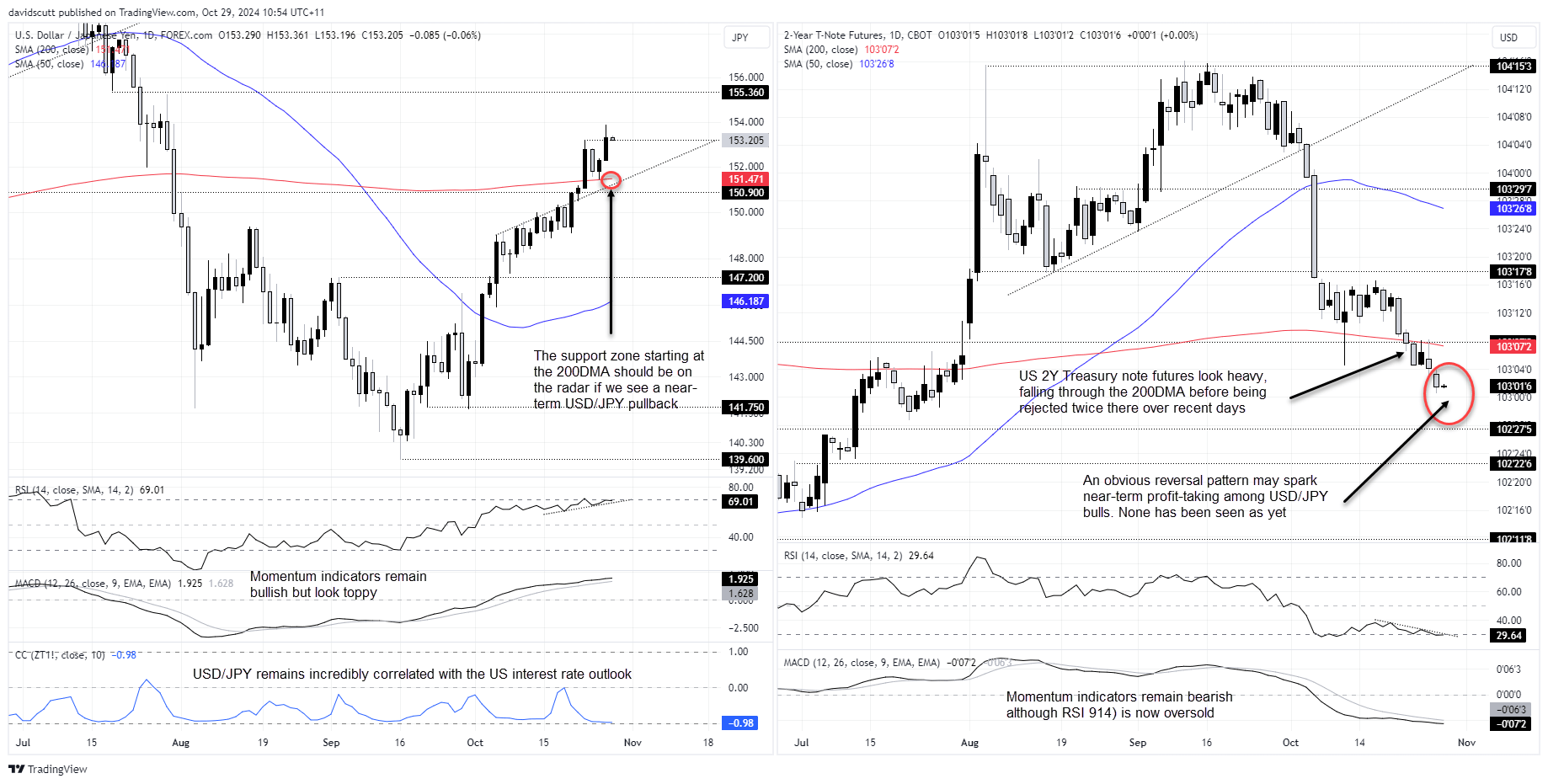

USD/JPY remains a play on the US interest rate outlook, sitting with an incredibly strong correlation with futures of -0.98 over the past fortnight. When short-dated US debt futures have moved in a particular direction, USD/JPY has almost always done the opposite, mirroring US Treasury yields.

USD/JPY surged to multi-month highs on Monday, responding not only to political developments in Japan that may lead to more expansionary fiscal and monetary policy being implemented but also continued gains in US Treasury yields.

With no obvious reversal pattern in US 2-year note futures in the right-hand chart below, the preference remains to buy USD/JPY dips, especially with momentum indicators such as RSI (14) and MACD continuing to provide bullish signals on price momentum.

Source: TradingView

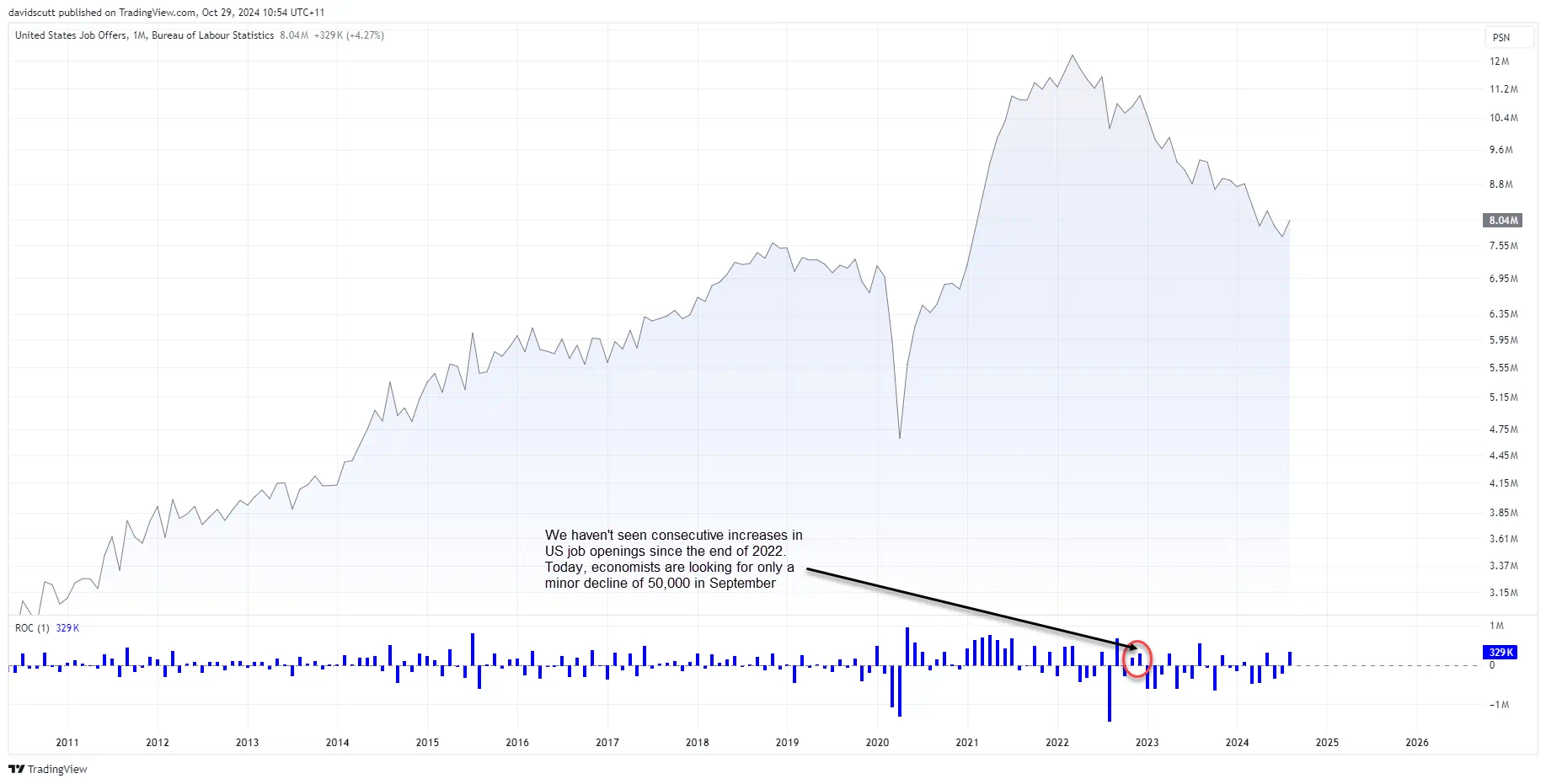

However, I’m not rushing in to add around these levels with the first of the week’s major US economic data releases on the way, the survey for September. After a surprise bounce in August, markets are looking for only a minor decline in openings of 50,000 to 7.99 million.

Notably, this survey tends to bounce around wildly month-to-month, and we haven’t seen back-to-back increases since late 2022. That hints at the potential for a downside surprise that could spark downside for US Treasury yields and USD/JPY which have both run very hard over recent weeks.

Source: TradingView

USD/JPY Levels and Setups

Near-term, support may be found at 153.19, the high established on Wednesday last week. Below, the 200-day moving average and former uptrend resistance are located within 20 pips of each other from 151.47.

If the price were to fall below 153.19 and hold there, one trade setup would be to sell with a tight stop above the level for protection targeting a return to the 200DMA.

Alternatively, if the price holds at 153.19, you could flip the trade around, buying with a tight stop below for protection. The initial target would be Monday’s high of 153.89. If that were to break, the next target could be 155.36, a minor level that acted as both support and resistance earlier this year.

Original Post