USD/JPY Navigates Potential Downside Correction

2025.02.05 04:59

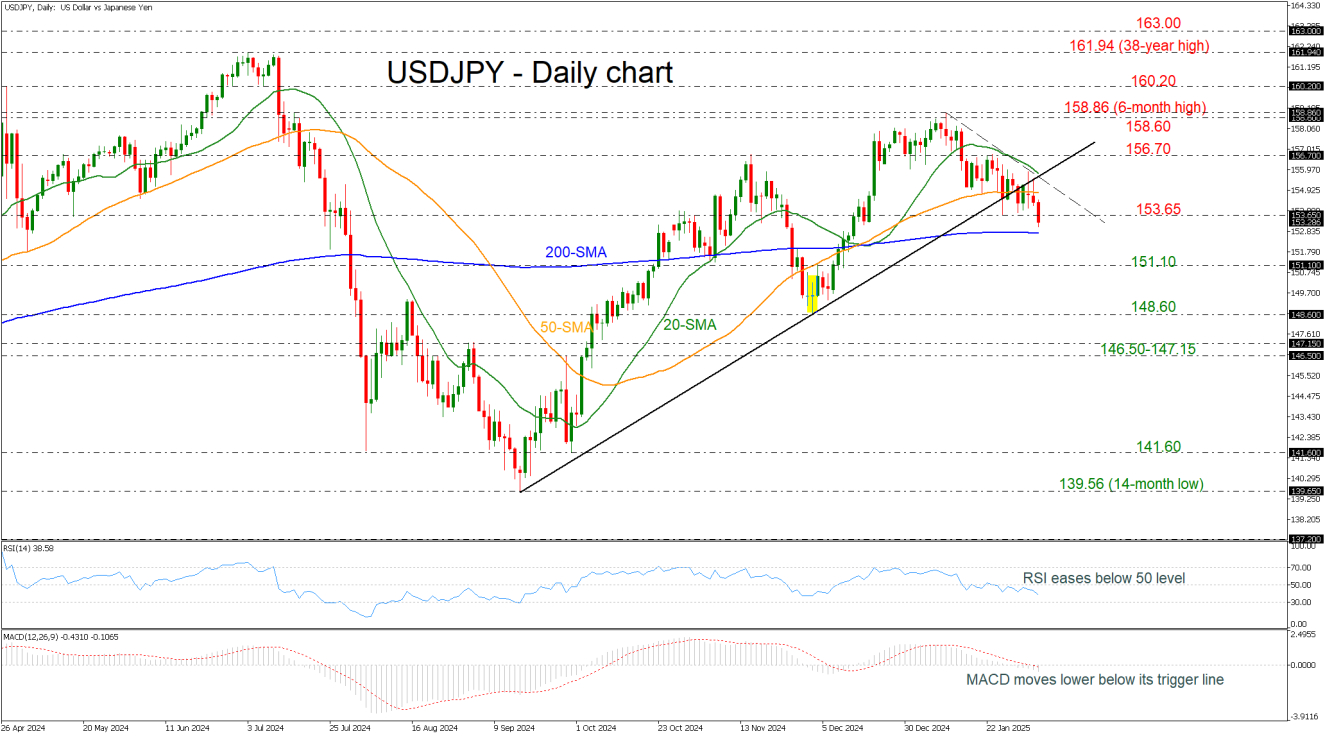

- Critical level for support at 200-day SMA

- RSI and MACD move south

is diving considerably below the long-term uptrend line and the 153.65 key level. The 20- and 50-day simple moving averages (SMAs) are pointing downwards with the technical oscillators endorsing the negative view. The RSI is also pointing downwards below the 50 territory, while the MACD is extending its bearish structure beneath its trigger and zero lines.

Immediate support comes from the critical flat 200-day SMA at 152.75, and any steeper decreases could turn the outlook into a more negative one, hitting the 151.10 level and the 148.60 hurdle.

On the other hand, a rebound off the 200-day SMA could drive investors back to the 153.65 initial resistance ahead of the 50-day SMA at 154.85. Even higher, the near-term downtrend line and the 20-day SMA at 155.70 may prove to be real struggles for the bulls. In case of more upside pressures, the 156.70 resistance as well as the 158.60-158.86 restrictive region may change the picture to neutral.

In brief, USD/JPY may be at the beginning of a downside correction; however, the 200-day SMA could be the decisive line that traders should watch out for.