USD/JPY: Key Trading Levels to Monitor Ahead of Powell’s Address

2024.08.22 10:48

The pair has weakened to 145.72, marking a two-week low as the yen strengthens against a backdrop of a weakening US dollar.

This decline is primarily driven by market expectations surrounding the US Federal Reserve’s actions. The minutes from the Fed’s last meeting, released recently, revealed a consensus among monetary policymakers for an impending interest rate reduction. Some members advocate for immediate action, fueling speculation about an imminent easing of monetary policy. This anticipation exerts downward pressure on the USD.

Further focus is on Fed Chairman Jerome Powell’s forthcoming speech at the Jackson Hole symposium, scheduled for Friday. The financial community eagerly awaits his comments, which could provide clearer indications of the Fed’s policy trajectory heading into the remainder of the year.

In Japan, significant events include a speech by Bank of Japan Governor Kazuo Ueda to the parliament, where he is expected to discuss the implications of the recent interest rate hike. Additionally, Japan’s inflation data due for release on Friday will be crucial in assessing the domestic economic environment and could influence BoJ’s future policy decisions.

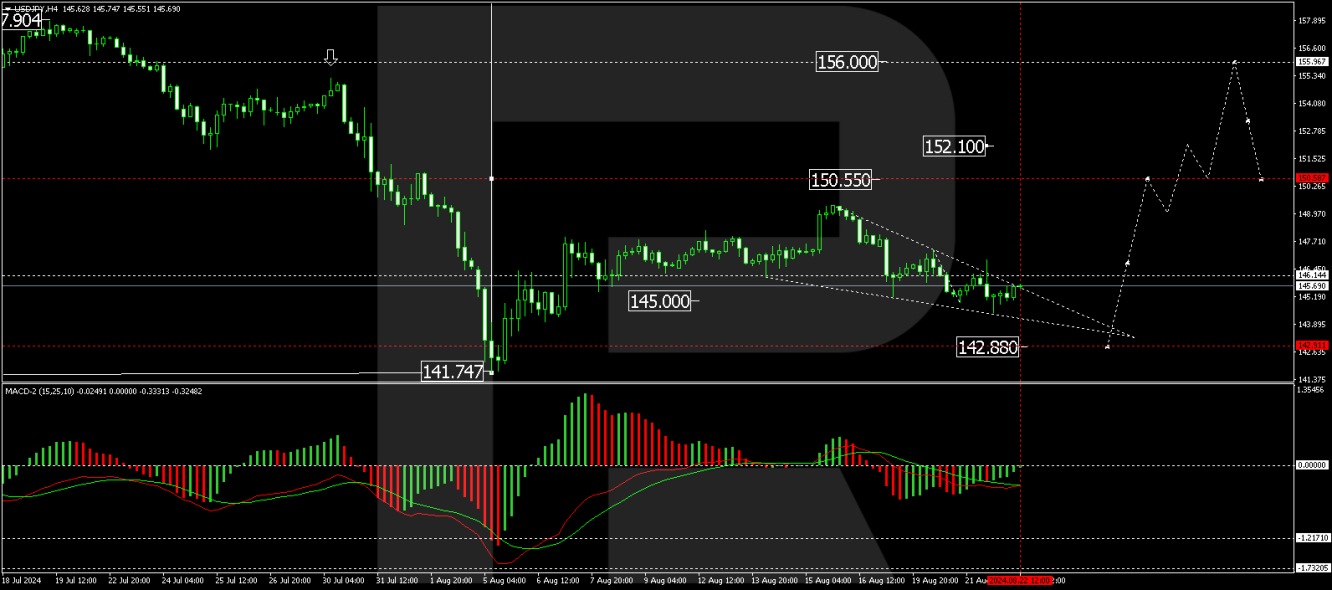

Technical analysis of USD/JPY

The USD/JPY is currently exhibiting a consolidation pattern around the 146.15 level. A downward breakout targeting 142.88 is anticipated, which is seen as a key corrective level. Post-correction, the market might initiate a new growth phase aiming for 150.55, potentially extending to 156.00 if the upper threshold is breached. The MACD indicator supports a bullish outlook long-term, with the signal line positioned below zero but trending upwards.

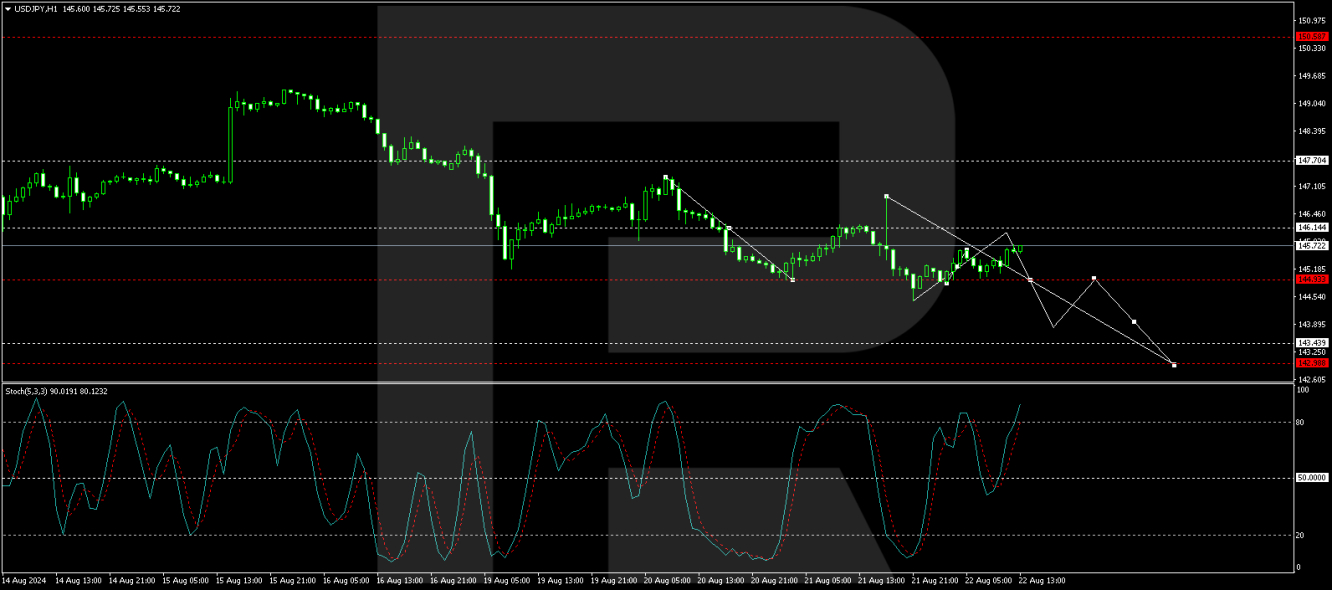

On the hourly chart, USD/JPY is progressing through a correction phase with a target set at a minimum of 143.00. Following this corrective phase, expectations lean towards a resurgence in price, potentially reaching 147.70, and if momentum sustains, aiming further for 150.55. The Stochastic oscillator underscores this view, with its signal line poised below 80, suggesting a downward movement towards 20 before a probable rebound.

Investors and traders are advised to monitor these developments closely, as outcomes from these events could significantly sway market dynamics and the trajectory of the USD/JPY pair in the near term.

By RoboForex Analytical Department

Disclaimer: Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.