USD/JPY: Japanese Yen Testing Resistance as Interest Rate Support Fades

2024.10.23 02:58

USD/JPY Key Points

- Despite the likely decline in Tokyo Core CPI, traders still suspect that the Bank of Japan will raise interest rates at its first meeting of the new year on January 24th

- USD/JPY has rallied more than 1,000 pips since mid-September, helped along by a surge in the 2-year yield spread between the US and Japan.

- The yield spread has essentially flatlined since the start of October, potentially weakening one of USD/JPY’s bullish catalysts

The FX market is relatively quiet in today’s session as traders look ahead to the more significant data on tap later this week, highlighted by tomorrow’s Bank of Canada meeting, Eurozone and UK PMIs on Thursday, and Tokyo CPI on Friday.

As many traders know, the Tokyo CPI has been at least as market-moving as the broader Japan-wide inflation report given it’s released a couple of weeks earlier and tends to have a close correlation with the nationwide reading. For this month, traders and economists are expecting Tokyo Core CPI reading to come in at 1.7% year-over-year, down from 2.0% last month.

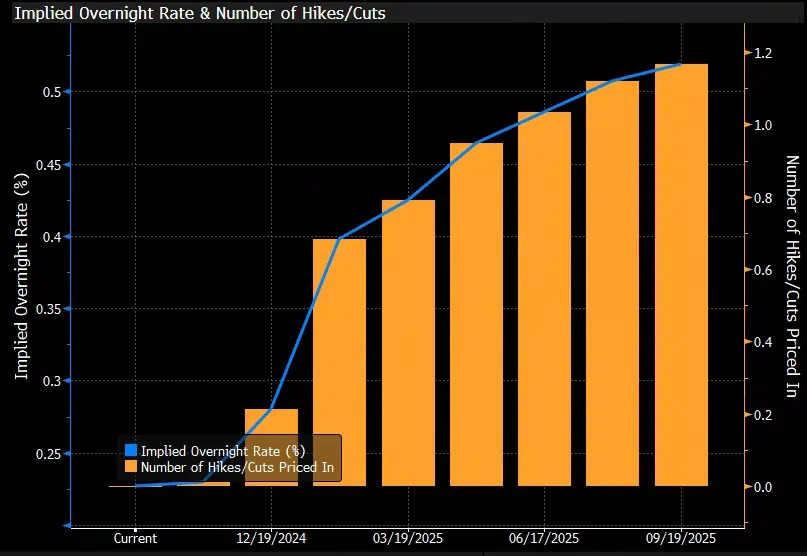

Despite the likely decline in inflation, traders still suspect that the Bank of Japan will raise interest rates at its first meeting of the new year on January 24th, though the expectations for additional increases beyond that are rapidly fading; to wit, OIS traders are expecting interest rates in Japan to sit near 0.50% at this time next year, up only about 25bps from the current 0.25% rate:

Source: Bloomberg

So, though the BOJ is still expected to raise interest rates and the US Federal Reserve is still expected to cut interest rates in the coming months, the market has pared back its expectations for both, meaning that the interest rate spread between the two countries may remain wider than assumed a few weeks ago. This dynamic, in turn, has boosted USD/JPY.

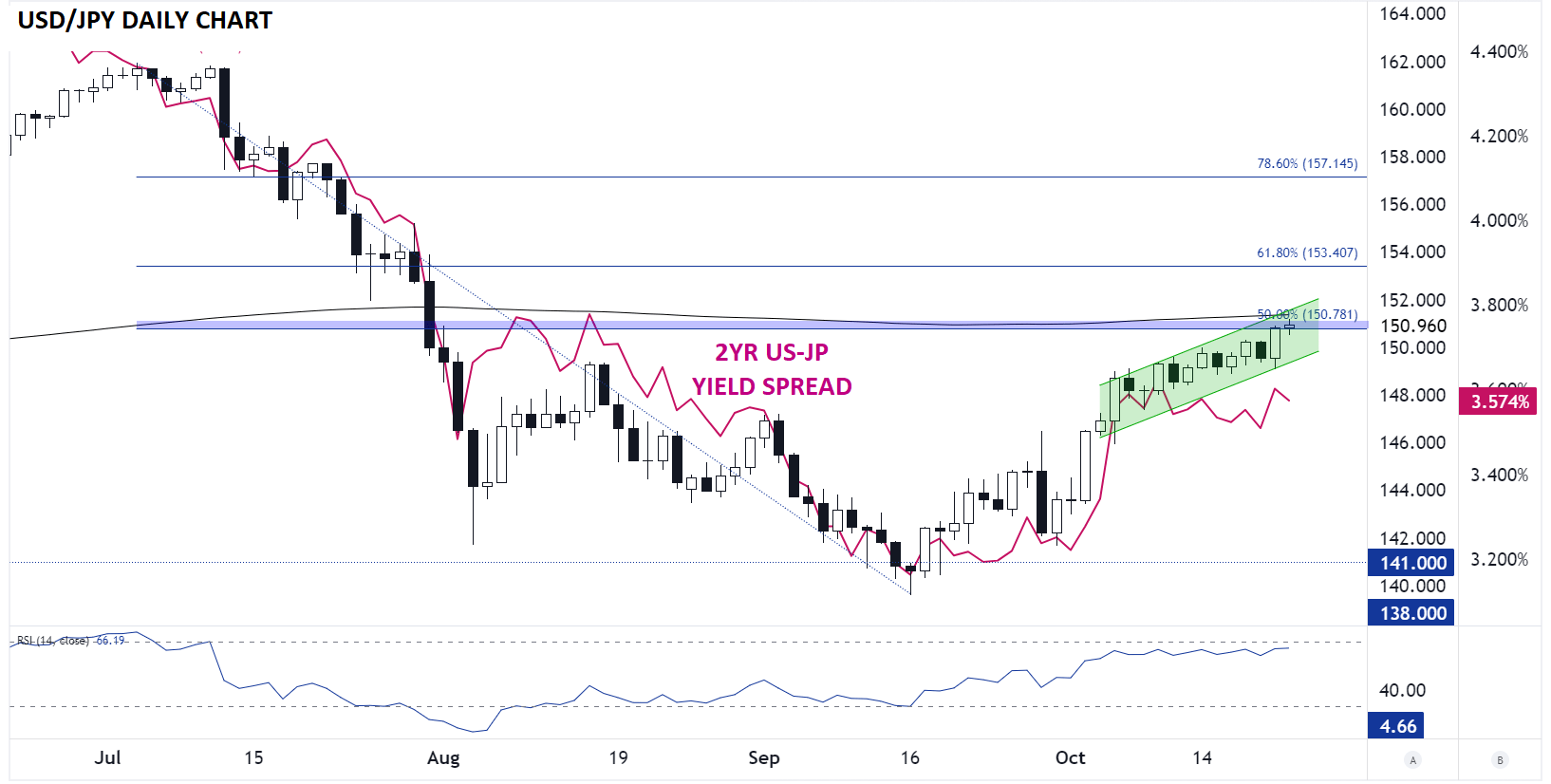

Japanese Yen Technical Analysis – USD/JPY Daily Chart

Source: TradingView, StoneX

As the chart above shows, USD/JPY has rallied more than 1,000 pips since mid-September, helped along by a surge in the spread between the US and Japan. That said, the yield spread has essentially flatlined since the start of October, potentially weakening one of USD/JPY’s bullish catalysts.

As of writing, the pair is testing resistance at the underside of its 200-day MA and the 50% Fibonacci retracement of the July-September drop in the 150.80-151.00 range. If USD/JPY bears are able to make a stand here (or if Friday’s Tokyo Core CPI reading comes in hot), the pair could break its near-term bullish channel and retrace back toward 148.00. On the other hand, a renewed widening in the spread and/or a cooler-than-anticipated Tokyo CPI reading may be enough to drive a bullish breakout in USD/JPY and set the stage for a continuation to ward 153.40 next.

Original Post