USD/JPY: Is a Short-Term Pullback Imminent Despite the Slide?

2024.12.04 03:27

- USD/JPY continues its decline, with a fresh low around 148.797.

- Bank of Japan (BoJ) Governor Ueda’s hawkish rhetoric suggests a potential rate hike sooner than later.

- Technical analysis indicates a potential short-term pullback towards 150.00, despite the overall downward trend.

Most Read:

has continued its decline today having displayed some resilience with a brief pullback in part of the Asian and early European sessions. This optimism has since dissipated with the pair printing a fresh low around the 148.797 handle.

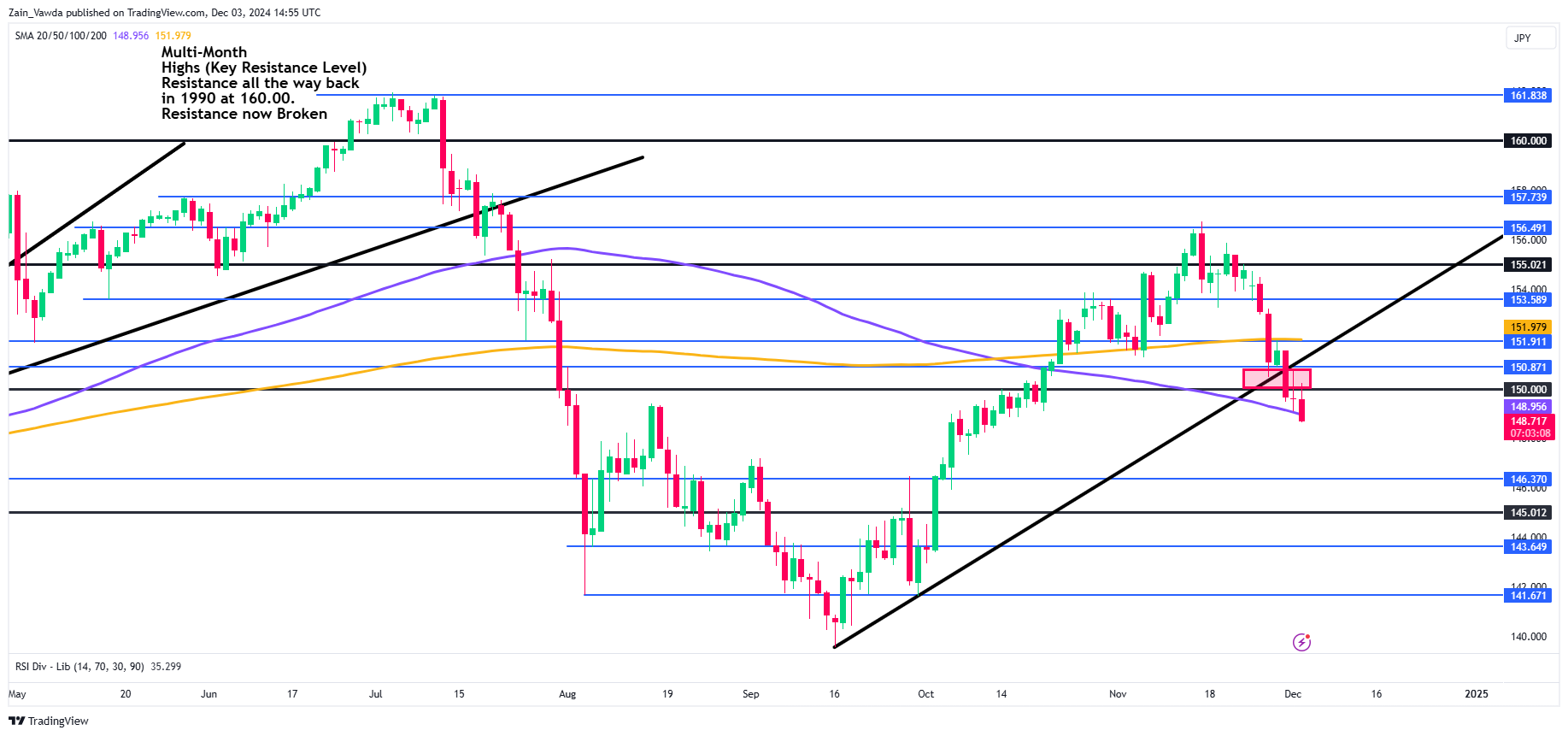

The technical picture for the Yen has been an intriguing one with the possibility of a break or bounce of the psychological 150.00 handle discussed last week Key levels were laid out in the article titled USD/JPY Price Outlook – Yen Extends Gains as Key Confluence Level Approaches, which has since played out pretty much as expected.

Bank of Japan (BoJ) Rate Hike Optimism Grows

There has long been a push for the to normalize policy and something which current Governor Ueda was brought in for. However, the Governor has been resolute since taking office that he will only act when he is happy with wage growth data in Japan. The Governor had been adamant that wage growth needed to outpace inflation before significant rate hikes.

Recent data including and are on the right track. The most important for Governor Ueda has been wage growth which has been rising as well with Prime Minister Ishiba and unions pushing for a 5-6% pay hike in next year’s wage talks. Governor Ueda meanwhile over the weekend continued his hawkish rhetoric that the BoJ is likely to hike rates sooner than later.

Immediate risks to the USD/JPY come from US jobs data this week. The data will have an impact on the probability of a December rate hike and thus needs to be monitored.

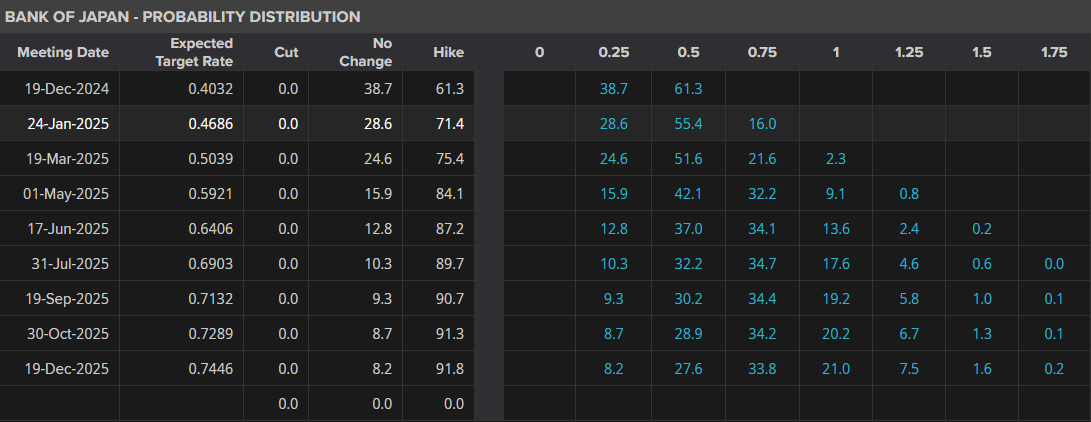

Probabilities of a BoJ Rate Hike

Source: LSEG

Technical Analysis USD/JPY

From a technical standpoint, USD/JPY is currently trading below the 100-day MA but a daily candle close below the MA will be key. There are concerns that a potential short-term pullback toward 150.00 may materialize.

The last two days have proven that bullish interest remains with a push higher on both days before selling pressure prevailed. Could this be a warning that a short-term pullback may be incoming?

The RSI remains above the oversold region as well which will give sellers another vote of confidence. However, a daily candle close above the 100-day MA might give sellers a brief pause and potentially wait for a pullback before getting involved.

What could work in favor of USD/JPY is seasonality. The is historically poor in December as market participants usually pivot to more riskier assets like US equities. There is also the possibility of portfolio rebalancing ahead of 2025.

USD/JPY Chart, December 3, 2024

Source: TradingView

Support

Resistance

Original Post