USD/JPY Eyes 154.74 Level Amid Possible Intervention

2024.07.15 05:35

The showed significant strength against the US dollar late last week, with the pair currently stabilizing around 157.86. This marks the lowest level for the currency pair in nearly a month.

The yen’s recent surge is attributed to widespread market speculation regarding potential interventions by Japanese authorities. Analysts believe that Japan may have conducted two separate interventions to bolster the yen, although these could also involve large-scale position closings on exchanges, known as “stop triggers.”

Reports indicate that the Bank of Japan may have expended between 3.37 and 3.57 trillion yen ($21.18 to $22.00 billion) last Thursday alone, with Friday’s expenditures yet to be confirmed. This marks a short interval since the last currency intervention by the BOJ.

Additionally, the BOJ’s recent inquiries into bank exchange rates could have preemptively influenced market movements, sometimes seen as a precursor to formal interventions.

USD/JPY Technical Analysis

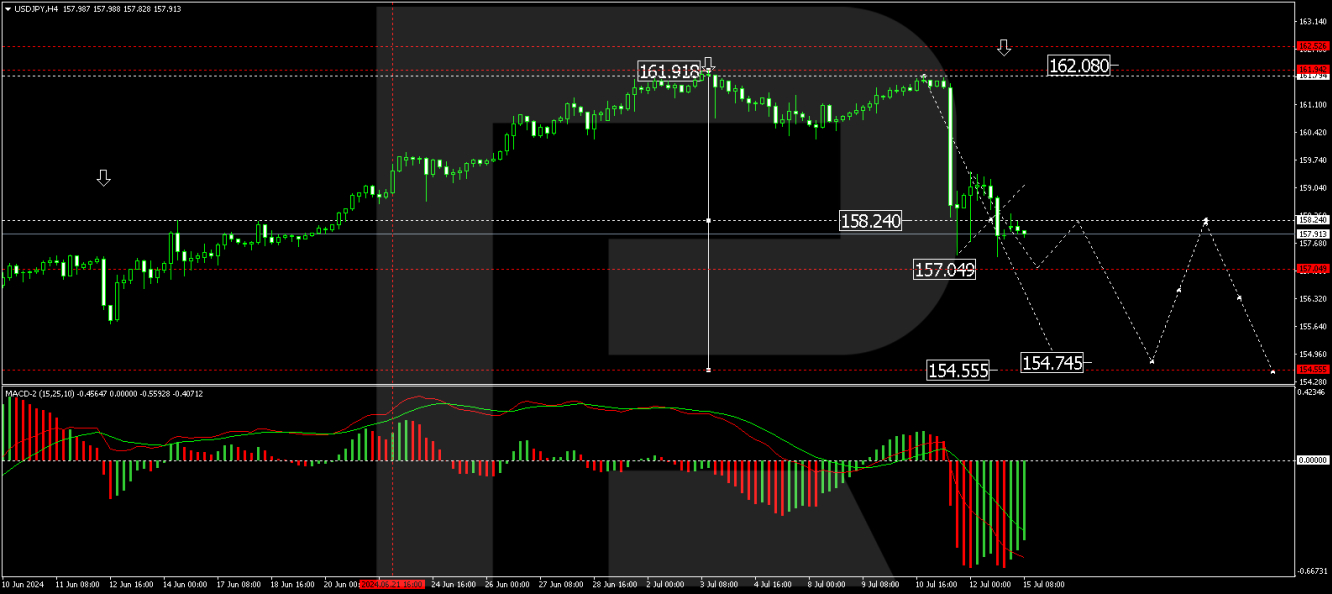

The USD/JPY pair is navigating a consolidation phase around the 158.24 level. We anticipate a potential decline to 157.05, followed by a rebound to 158.76. A subsequent drop to 154.74 is expected, which could prompt a corrective movement back to 158.24. The MACD indicator supports this bearish outlook, with its signal line positioned below zero and indicating a downward trajectory.

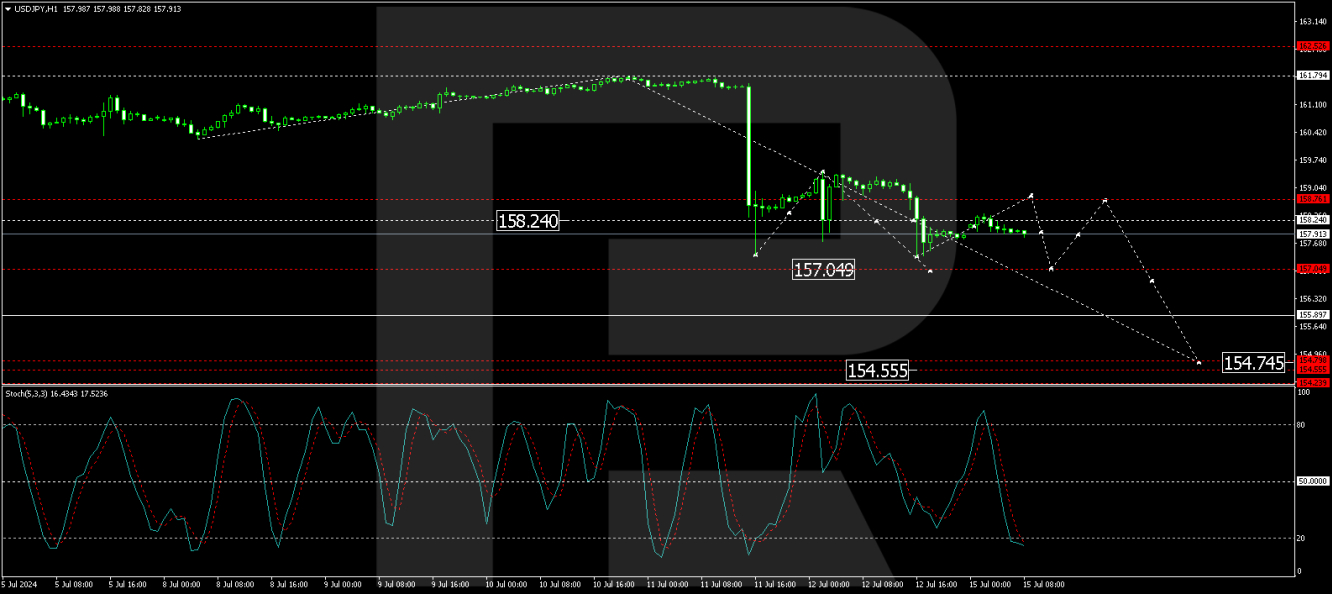

On the H1 chart, the USD/JPY is forming a downward wave towards 157.04. Upon reaching this level, a rise to at least 158.24 may occur, followed by another decline to 154.74. This bearish pattern is corroborated by the stochastic oscillator, with the signal line preparing to ascend from below 20 to around 50, suggesting potential brief recoveries amid overall downward momentum.

Market participants will closely monitor upcoming releases and statements from the Japanese government and the BOJ for confirmation of these interventions and further insights into future monetary policy actions.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.