USD/JPY Crashes on BoJ’s Surprise Tweak

2022.12.20 06:30

[ad_1]

crashed to a four-month low of 132.26 in the wake of an unexpected hawkish tweak in the BoJ’s yield curve control early on Tuesday.

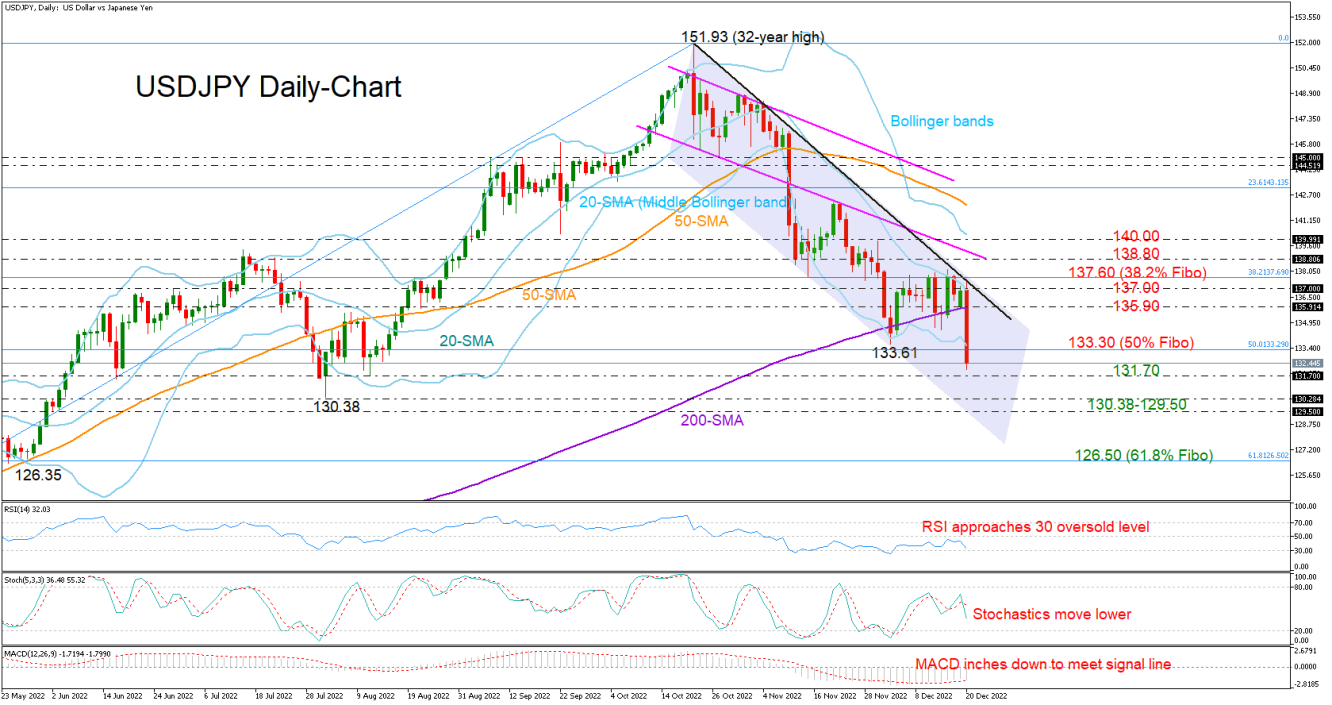

From a technical perspective, the bearish action was the outcome of the rejection near the key descending trendline and the 20-day simple moving average (SMA) at 137.00. With the price tumbling below the 200-day SMA for the first time in almost a year, traders will wait and see whether selling pressures will persist in the coming sessions.

The stochastics and the RSI have yet to confirm oversold conditions, signaling further depreciation in the market. Yet, with the price flirting with the lower Bollinger band, this initial sell-off may not last for long, especially as the crucial floor of 131.70 remains in sight. Failure to bounce here could worsen the bearish wave, shifting the spotlight to the August low of 130.38 and then to the 129.50 barrier. Moving lower, the pair may head for the 61.8% Fibonacci retracement of the March-October uptrend at 126.50. Note that May’s decline stopped around the same location.

Alternatively, a bounce back above the 50% Fibonacci of 133.29 could motivate an upside correction towards the 200-day SMA at 135.90. If the bulls win the battle with the resistance trendline at 137.00 and snap the 38.2% Fibonacci of 137.70 too, the recovery may continue towards the channel’s broken lower trendline seen at 138.80. The 140.00 mark could be the next target.

In brief, the short-term outlook for USDJPY has further darkened following the latest freefall in the price. We cannot rule out some stabilization, though a meaningful rally could be a tough job as several obstacles lay ahead.

[ad_2]

Source link