USD/JPY Coiling Ahead of CPI, Fed, and BOJ

2023.06.13 03:01

- Most major markets are consolidating ahead of this week’s big event risks, highlighted by the US CPI report and central bank meetings from the Fed, BOJ, and others.

- US CPI is likely to fall sharply on a year-over-year basis – will that give the Fed cover to skip” a rate hike on Wednesday?

- USD/JPY is coiling within a symmetrical triangle pattern, but a breakout may be imminent…

It’s a classic “calm before the storm” day in global markets as traders gear up for a whirlwind of major economic releases starting with tomorrow’s US report.

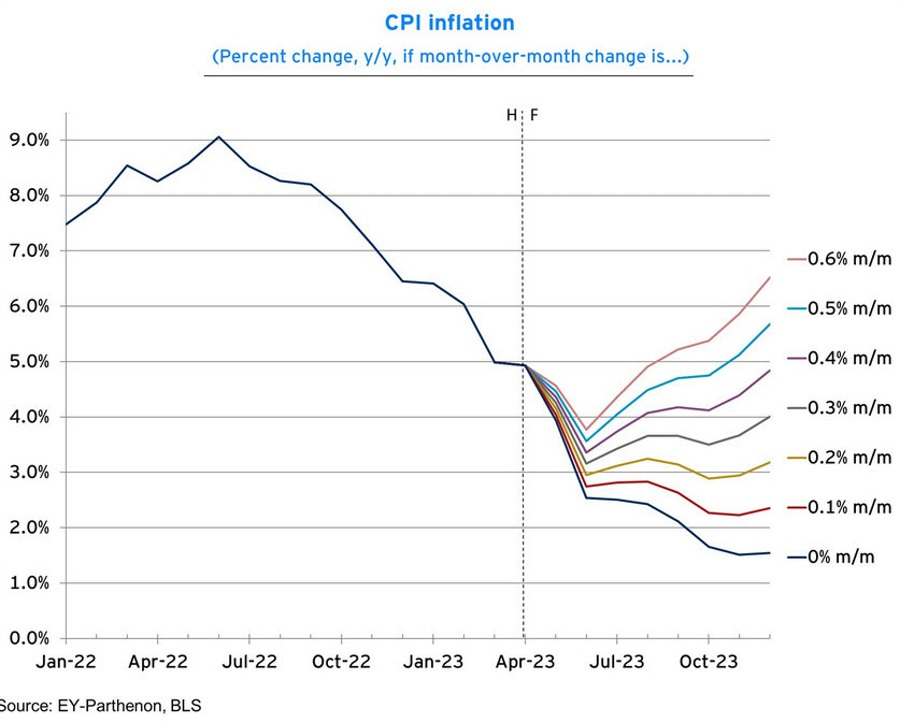

Traders and economists are expecting the key US inflation gauge to come in at 0.2% month-over-month, a reading that would bring the year-over-year rate down to 4.1% from 4.9% last month. Indeed, regardless of what the month-over-month reading is (within reason), the year-over-year rate of inflation is likely to decline precipitously over the next two months, as the chart below shows:

Source: EY-Parthenon, BLS

Essentially, we’re finally lapping the big spikes in inflation that kicked in this time last year amidst the outbreak of the Russia-Ukraine war; the 0.9% m/m reading we saw in May 2022 is expected to be replaced by a ~0.2% m/m increase tomorrow.

These so-called “base effects” are common knowledge among traders and economists but not as well-understood by the general public. The upshot is that the news headlines tomorrow will undoubtedly be trumpeting that inflation has “fallen” sharply, potentially giving the Fed political cover to “skip” a rate hike at its meeting on Wednesday if it so desires.

Meanwhile, the Bank of Japan meets at the end of the week but expectations for any immediate changes to monetary policy are subdued. New BOJ Governor Ueda noted last month that the risks of changing policy too soon were greater than the risks of being patient. That said, there is still an outside chance of a tweak to the central bank’s yield curve control program at each of the next two monetary policy meetings.

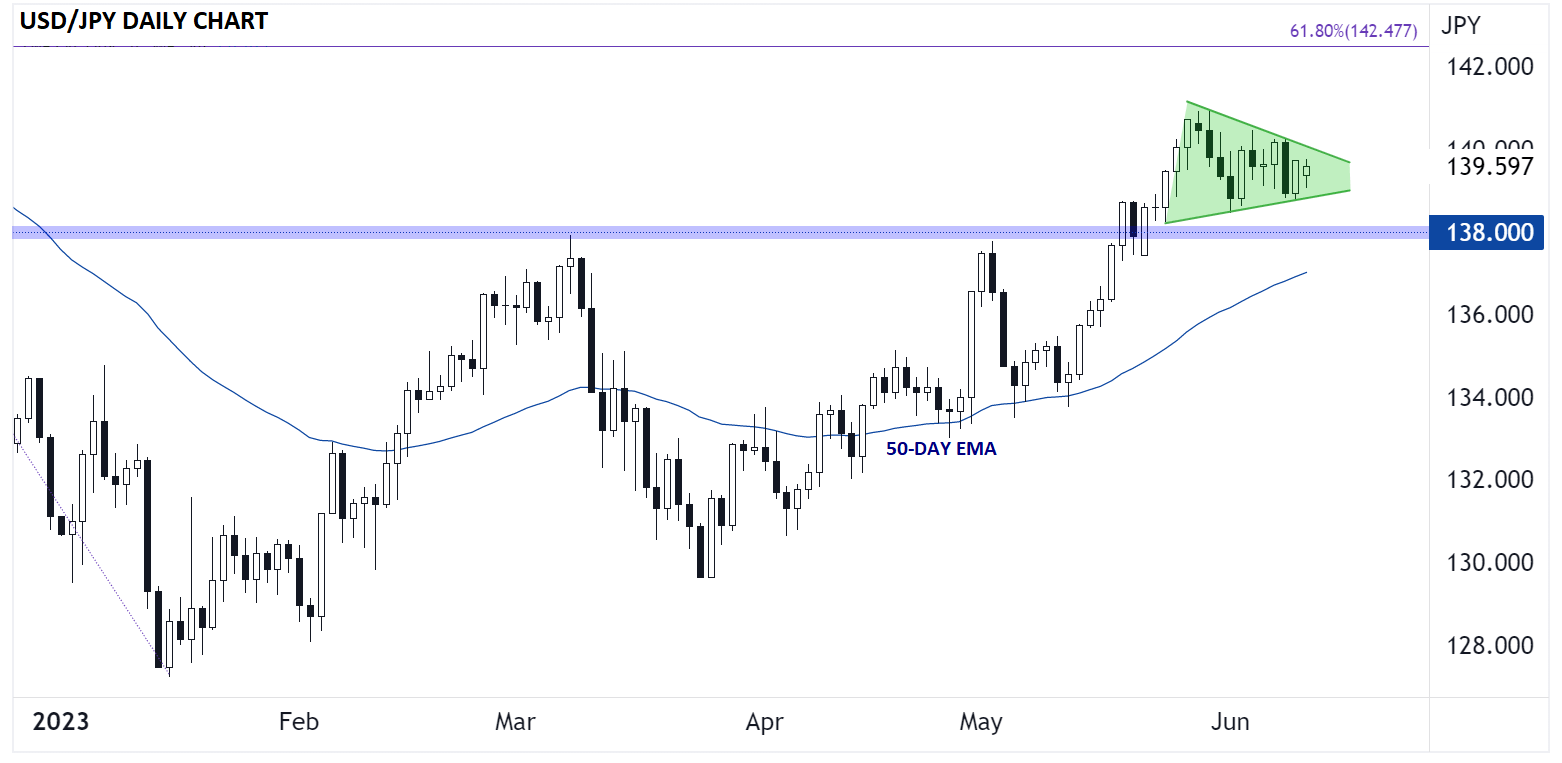

US dollar technical analysis – USD/JPY daily chart

Source: TradingView, StoneX

Looking at the chart above, has spent the last three weeks consolidating in a symmetrical triangle pattern. For the uninitiated, this pattern is formed from a series of higher lows and lower highs and is analogous to a person compressing a coiled spring: as the range continues to contract, energy builds up within the spring. When one of the pressure points is eventually removed, the spring will explode in that direction.

While it’s notoriously difficult to predict the direction of the breakout in advance, the strong bullish trend leading into the triangle suggests the odds may be tilted to the upside, especially if US inflation comes in hotter than expected. In that scenario, USD/JPY could rally out its triangle pattern toward the year-to-date high near 141.00, followed by the 61.8% Fibonacci retracement of the 2022-2023 drop around 142.50.

Meanwhile, a cool inflation report and bearish breakdown in USD/JPY could expose previous-resistance-turned-support at 138.00 or the 50-day EMA near 137.00 next.

Original Post