USD/JPY Calm as Inflation Rises Higher

2022.11.18 08:56

[ad_1]

The has edged higher on Friday and is trading at 139.90 in the European session.

Japan’s Core CPI Beats Forecast

Inflation continues to creep up in Japan. accelerated to 3.6% in October, up from 3.0% in September and edging above the consensus of 3.5%. These levels pale in comparison to what we’re seeing in the US, the UK and elsewhere, but Japan hasn’t seen these levels of inflation in 40 years. The country has a deflationary mindset, which leads firms to absorb higher costs for fear of losing customers. However, as inflation continues to move higher, that trend is changing and consumers are feeling the pain of higher prices.

Despite rising inflation and a weak yen, the Bank of Japan is resolute in maintaining its ultra-loose policy in order to support the weak economy. The BoJ has been an outlier as it has capped interest rates while the global trend has been to raise rates, arguing that cost-push inflation is only temporary. BoJ Governor Kuroda has said that inflation should peak after hitting 3%. Kuroda might want to consult with Jerome Powell or Christine Lagarde about making assumptions about inflation peaks, as they found out to their chagrin that inflation was much stickier than they had anticipated.

Fed Continues Tightening Talk

Ever since the last US report sent the equity markets soaring and the US dollar sliding, the Fed has circled the wagons and telegraphed a hawkish message to the markets. The latest salvo came from Fed member Bullard, who urged the Fed to raise rates to 5%-5.25% at a minimum. Bullard also presented a hawkish scenario in which the funds rate would climb all the way to 7%, a message investors clearly didn’t want to hear. Retail sales and unemployment claims were better than expected, another indication that the US economy remains resilient handle further rate hikes. The Fed’s coordinated message and the solid data have quelled the stock market rally and boosted the US dollar.

USD/JPY Technical

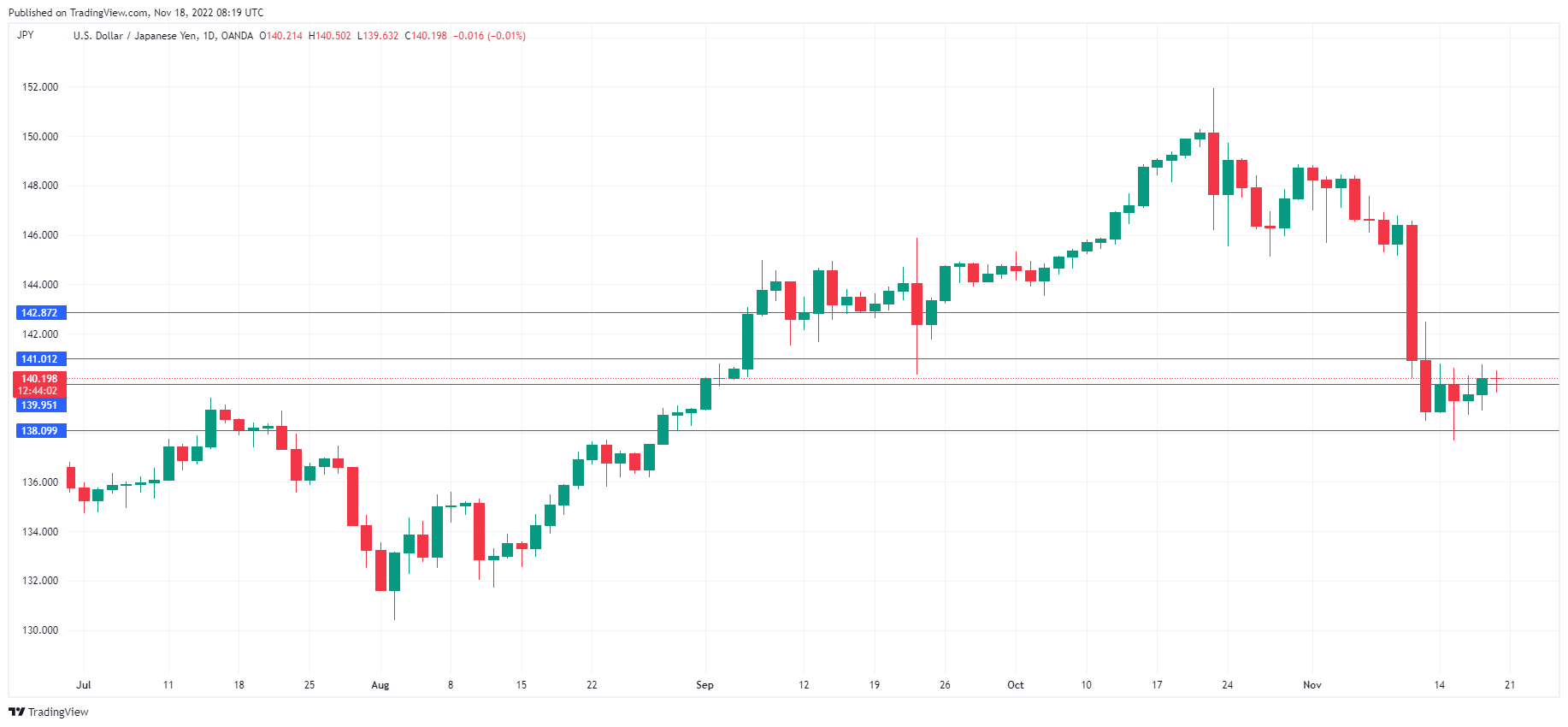

- USD/JPY is testing support at 139.95. Below, there is support at 138.09

- There is resistance at 141.01 and 142.87

[ad_2]

Source link