USD/JPY Bears Push Lower – 147 Target in Focus as Downtrend Gains Momentum

2024.12.03 05:55

- USD/JPY approaches critical 149 support as BOJ hints at a rate hike.

- A weaker-than-expected jobs report could fuel further declines in USD/JPY.

- Traders should brace for volatility with upcoming BOJ and Fed decisions.

- Unlock Cyber Monday savings! Get 60% off InvestingPro and access top features like ProPicks AI, Fair Value, and the Top Stock Screener for just $6/month. Claim your deal now!

traders face a pivotal moment as the pair approaches the 149 support level, with pressures mounting from both sides of the Pacific.

A hawkish Bank of Japan (BOJ) and a strengthening are fueling moves in the currency pair, and based on the technicals, another move lower isn’t out of the question.

As the ’s December 19 meeting looms, just a day after the ‘s policy decision, the market is poised for significant volatility.

BOJ Signals a Hawkish Shift

Bank of Japan Governor Kazuo Ueda’s recent remarks have signaled that a long-awaited interest rate hike could be on the horizon.

Over the weekend, Ueda hinted at improving domestic economic conditions, bolstering the case for a policy shift. Markets are now pricing in a 60% probability of a December rate hike, adding momentum to the yen.

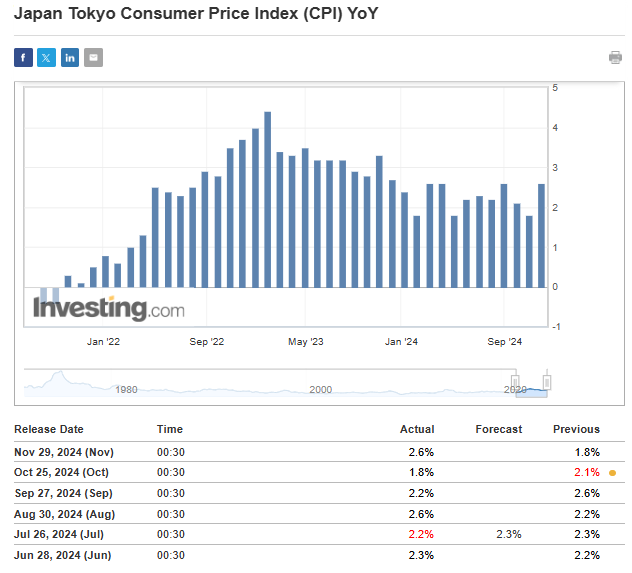

, a key driver for BOJ policy, remains above the 2% year-over-year target, showing no signs of a sustained pullback—a factor likely to weigh heavily on the central bank’s decision.

Despite this hawkish tilt, the BOJ remains cautious. A premature move could disrupt Japan’s economic recovery, especially if U.S. monetary policy takes an unexpected turn.

Should the Federal Reserve hold rates steady, the BOJ may feel emboldened to act. However, any misstep could reignite USD/JPY’s upward trend, particularly if yield differentials widen.

Traders should also consider the yen’s role as a safe haven. Escalating geopolitical risks, especially surrounding the ongoing war in Ukraine, could trigger yen-buying.

This dynamic adds a layer of complexity as global uncertainty grows.

All Eyes on U.S. Labor Market Data

As the new month begins, attention shifts to U.S. labor market reports. Forecasts suggest stability, a reassuring signal for the Federal Reserve as it navigates its policy path.

For USD/JPY, weaker-than-expected U.S. could amplify the pair’s downward momentum, potentially breaking the 149 support level and targeting 147.

Technical Outlook: Can Bulls Regain Control?

USD/JPY has entered a corrective phase, currently testing the critical 149 support zone. While buyers have managed to slow the decline, their response has been tepid.

A decisive break below 149 could open the door to further losses, with 147 as the next target. Conversely, a reversal above 153 would negate the bearish scenario, signaling a return to bullish momentum.

As the BOJ and Federal Reserve prepare to make their moves, traders should remain vigilant. Key data points and geopolitical developments will likely dictate the pair’s next major move.

Don’t Miss Out on 60% Off This Cyber Monday—Here’s Why You Should Act Fast:

- ProPicks AI Has Been Beating the Market Since November 2023

- Fair Value Shows You What Stocks Are Really Worth

- The Market’s Best Stock Screener, Right at Your Fingertips

Save 60% now—this deal ends soon!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.