USD/JPY Bears Eye Break Below Key 142 Level With Fed Cut, BoJ Hike in Play

2024.09.10 04:19

Since early July, the currency pair has remained in a broader downtrend, despite the slight increase recently. We’ve recently observed a slowdown around the demand zone above the key support level at 142.

This shift stems from two key factors: the Bank of Japan’s recent interest rate hike and the rate cuts by the Federal Reserve, which have weakened the somewhat.

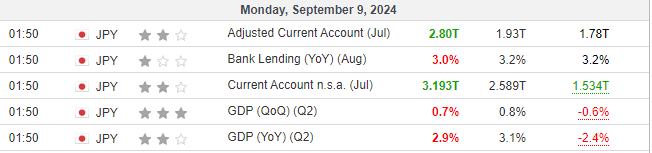

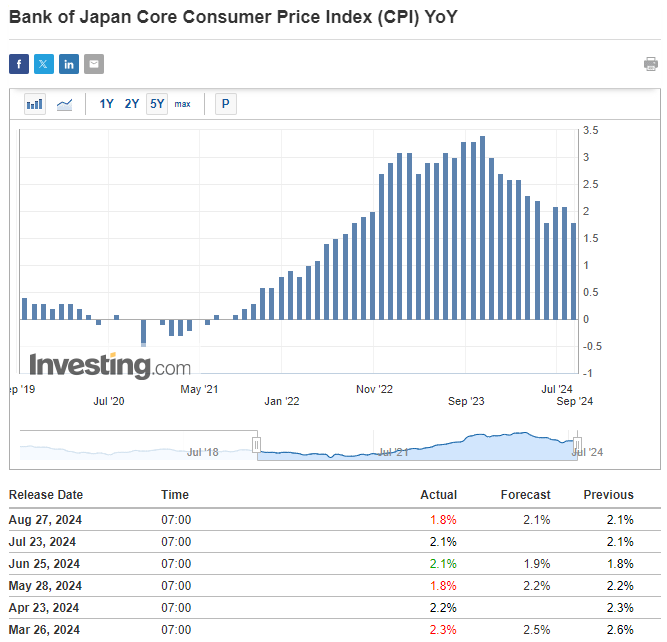

Despite this, recent data from Japan raises questions about whether the Bank of Japan will continue with its tightening policy or hesitate due to weaker-than-expected data in household spending, inflation, and economic growth.

Economists Expect a Hike by BoJ This Year

Recent data from Japan has cast doubt on whether the Bank of Japan will pursue further rate hikes. Although GDP figures were slightly below forecasts, economists still anticipate a rate hike at the Bank’s December meeting.

Looking ahead to 2025, key macroeconomic indicators like inflation and consumer spending will play a crucial role. Recent data, similar to GDP readings, came in weaker than expected, continuing a broader downward trend.

Should this trend persist, additional rate hikes may become less likely. Historical patterns, such as those observed between 2006-08, suggest that the Bank of Japan could shift to monetary easing if conditions necessitate.

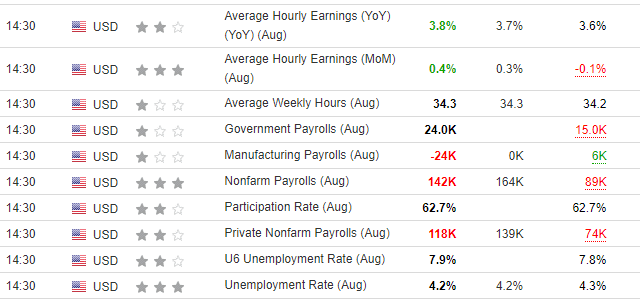

CPI, Labor Market Data to Determine Size of Rate Cut in US

On Friday, the US labor market data showed less volatility compared to the previous month. These neutral figures are expected to play a decisive role in the Federal Reserve’s upcoming interest rate .

The consensus suggests that the Fed will likely implement a 25 basis point cut, with further reductions expected if inflation remains stable through the end of the year. This could exert additional downward pressure on the US dollar.

Will USD/JPY Continue to Decline?

After a brief rebound in the demand zone around 142 yen per dollar, the USD/JPY pair is once again testing this area. Buyers remain active, but if their efforts continue to weaken, we could see a breakout and further decline.

Should the bearish trend continue, the next target for sellers would be the support level around 138 yen per dollar. Keep an eye on upcoming US inflation data, as it may provide the catalyst for a more pronounced move.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.