USD/JPY Adjusts Amid Mixed Signals from Japan’s Economic Data

2024.10.18 07:38

is experiencing a correction phase following two days of gains, as mixed economic signals emerge from Japan. Despite ongoing expectations for monetary tightening by the Bank of Japan (BoJ), the yen faces downward pressure from a slowdown in domestic inflation, which could potentially dampen the urgency for immediate rate hikes.

In September, Japan’s consumer prices increased by 2.5% year-on-year, marking a decrease from the 3.0% inflation rate recorded in August. This slowdown is the first since March and represents the lowest inflation level since April of this year. The core inflation index, a key metric for the BoJ, rose by 2.4%, down from 2.8% in August, yet has remained above the BoJ’s target of 2.0% for 30 consecutive months. Notably, inflation excluding food and energy was recorded at 2.1% in September, a slight increase from 2.0% in August.

Recent comments from BoJ board member Seiji Adachi suggest a preference for moderate rate adjustments, reflecting concerns over global economic uncertainty and the domestic pace of wage increases. Additionally, the yen’s persistent weakness has drawn attention from Japan’s Chief Monetary Representative Atsushi Mimura, who reiterated the government’s focus on monitoring exchange rate fluctuations and its stance against excessive volatility.

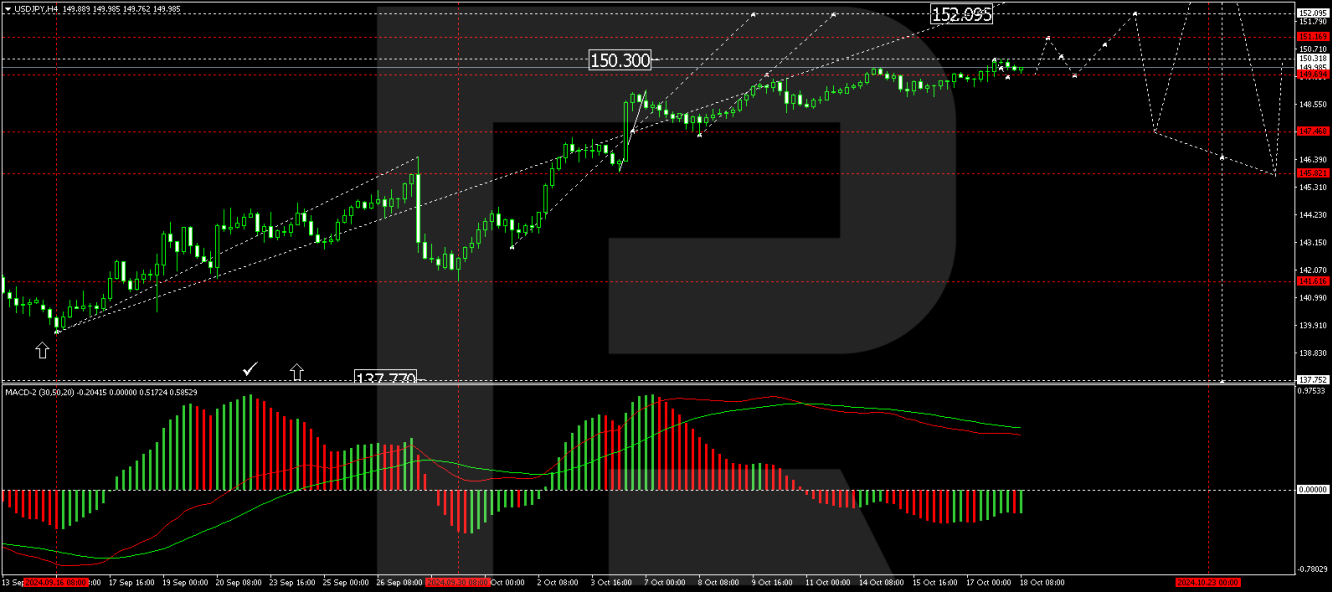

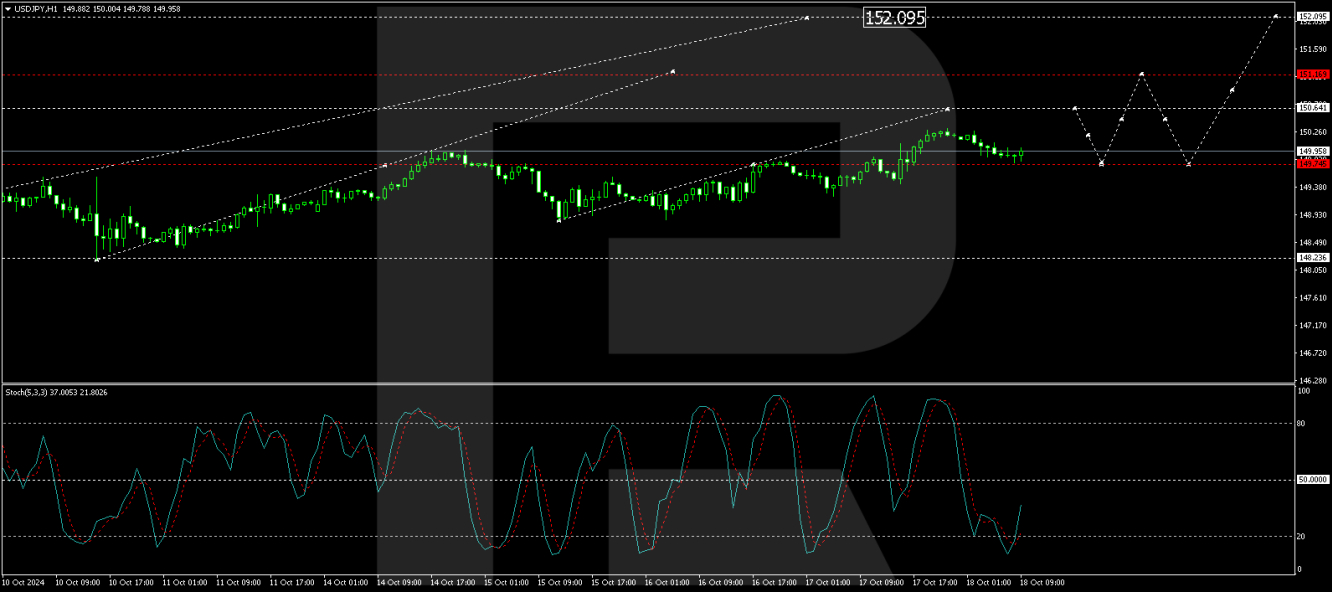

USD/JPY technical analysis

The USD/JPY pair recently achieved a peak at 150.30 and is now forming a decline towards 149.75, testing this level from above. Looking ahead, we anticipate a potential resurgence towards 151.15. A successful breach of this level could open the way to 152.09. Conversely, a drop below 149.70 could trigger a further correction down to 147.70. The MACD indicator supports this potential upward trajectory, with the signal line positioned above zero and poised to reach new highs.

On the hourly chart, USD/JPY has established a consolidation range between 149.75 and 150.30. The current market dynamics suggest a correction towards 149.75. Following this correction, the likelihood of a rebound to 150.65 appears feasible, setting the stage for an extended rise to 151.15. This bullish outlook is corroborated by the Stochastic oscillator, with its signal line advancing from 20 towards 80, indicating a strengthening momentum for upward movement.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.