USD/CHF: Expect Further Growth

2024.12.12 16:07

So the Swiss National Bank cut its base deposit rate by 50 basis points today, from 1.00% to 0.50%, surprising the markets, which had expected a 0.25% cut.

The accompanying statement from the Central Bank said that the bank’s management “will continue to closely monitor the situation and, if necessary, adjust monetary policy to ensure that inflation remains within a range consistent with price stability in the medium term.” “The outlook for Switzerland, as for the global economy, is subject to considerable uncertainty,” and the main risk is “developments abroad,” the statement also noted.

At the same time, the SNB’s management did not rule out further policy easing and intervention in foreign exchange trading in order to lower the franc. It is known to be a traditional safe-haven asset and is in demand in such situations of uncertainty.

Having received a negative impulse from the results of the SNB meeting that ended on Thursday, the franc continues to weaken, and the pair continues to grow.

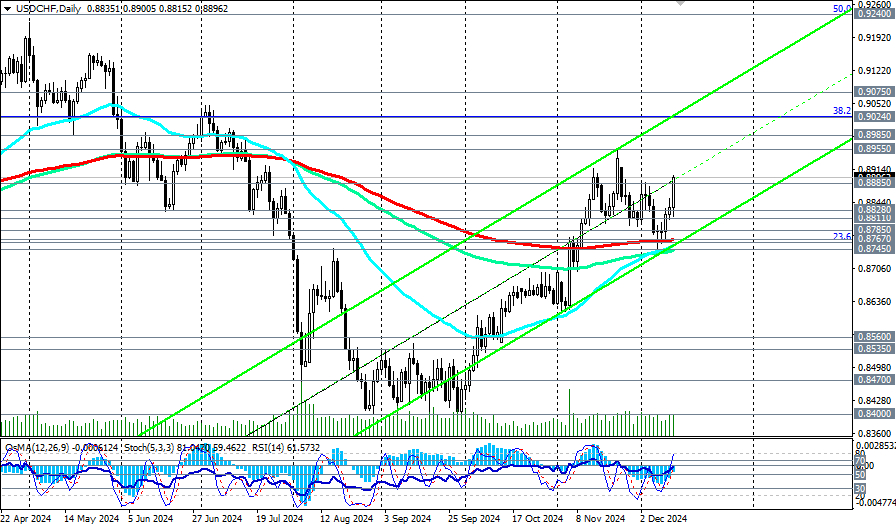

Overall, above the key support levels of 0.8767 (200-period moving average and the lower line of the ascending channel on the daily chart), 0.8745 USD/CHF is trading in the medium-term bull market zone, which makes long positions relevant in the medium term, we noted in our fundamental analysis today and suggested that “after a confirmed breakout of 0.8885, 0.8900, further growth should be expected.”

Our assumption remains valid – we expect further growth. Growth targets are resistance levels of 0.8955, 0.9000, 0.9024 (Fibonacci level of 38.2% correction in the wave of decline from 1.0145 to the minimum of the wave at 0.8330, reached in December 2023, and the upper border of the ascending channel on the daily chart), 0.9075, 0.9100.

In an alternative scenario, the price will fall into the medium-term bearish market zone located below the support levels of 0.8767, 0.8745, which will return the relevance of short positions to the USD/CHF pair.

The first signal here could be a breakout of support levels of 0.8885, 0.8853 (EMA200 on the 15-minute chart).