USD/CAD Slips as NFP Falls, Canada Adds Jobs

2023.07.10 11:01

- US nonfarm payrolls decline

- Canada adds 60,000 jobs

- Bank of Canada expected to raise rates on Wednesday

The Canadian dollar is trading quietly at the start of the week. In the North American session, is trading at 1.3286, up 0.07%. On Friday, the Canadian dollar gained 0.68% on the back of soft and strong Canadian jobs report.

US nonfarm payrolls decline

There was plenty of drama ahead of Friday’s |nonfarm payrolls. The consensus estimate for June stood at 225,000 and this was close to the actual reading of 209,000 but much lower than the downwardly revised reading of 306,000 in May.

So why the excitement? The reason was the Employment report prior to nonfarm payrolls. ADP is not considered a reliable precursor to NFP, but the markets couldn’t ignore the massive ADP reading of 497,000. This prompted speculation of a banner NFP which would force the Fed to keep tightening. In the end, nonfarm payrolls performed as expected, renewing speculation that the Fed may soon wind up its rate-hike cycle if there are additional signs of the US economy cooling down.

Canada also released the June employment report on Friday, with job growth showing strong gains. The economy produced 59,900 jobs, smashing the consensus estimate of 20,000 and bouncing back from the May reading of -17,300. Even more impressive, the economy created a massive 109,600 full-time jobs, as part-time employment fell by 49,800. At the same time, there were indications that the economy is cooling – the unemployment rate climbed to 5.4%, up from 5.2% and wage growth slowed to 4.2%, down from 5.1% in May.

The numbers show a mixed employment report, raising the question of what will be the Bank of Canada’s takeaway from the job numbers ahead of Wednesday’s rate announcement. The BoC has stopped providing forward guidance about its rate plans, instead saying that rate decisions would be based on economic data, particularly inflation and employment numbers. The BoC is expected to raise rates by 0.25% at the Wednesday meeting, which would bring the cash rate to 5.0%.

USD/CAD Technical

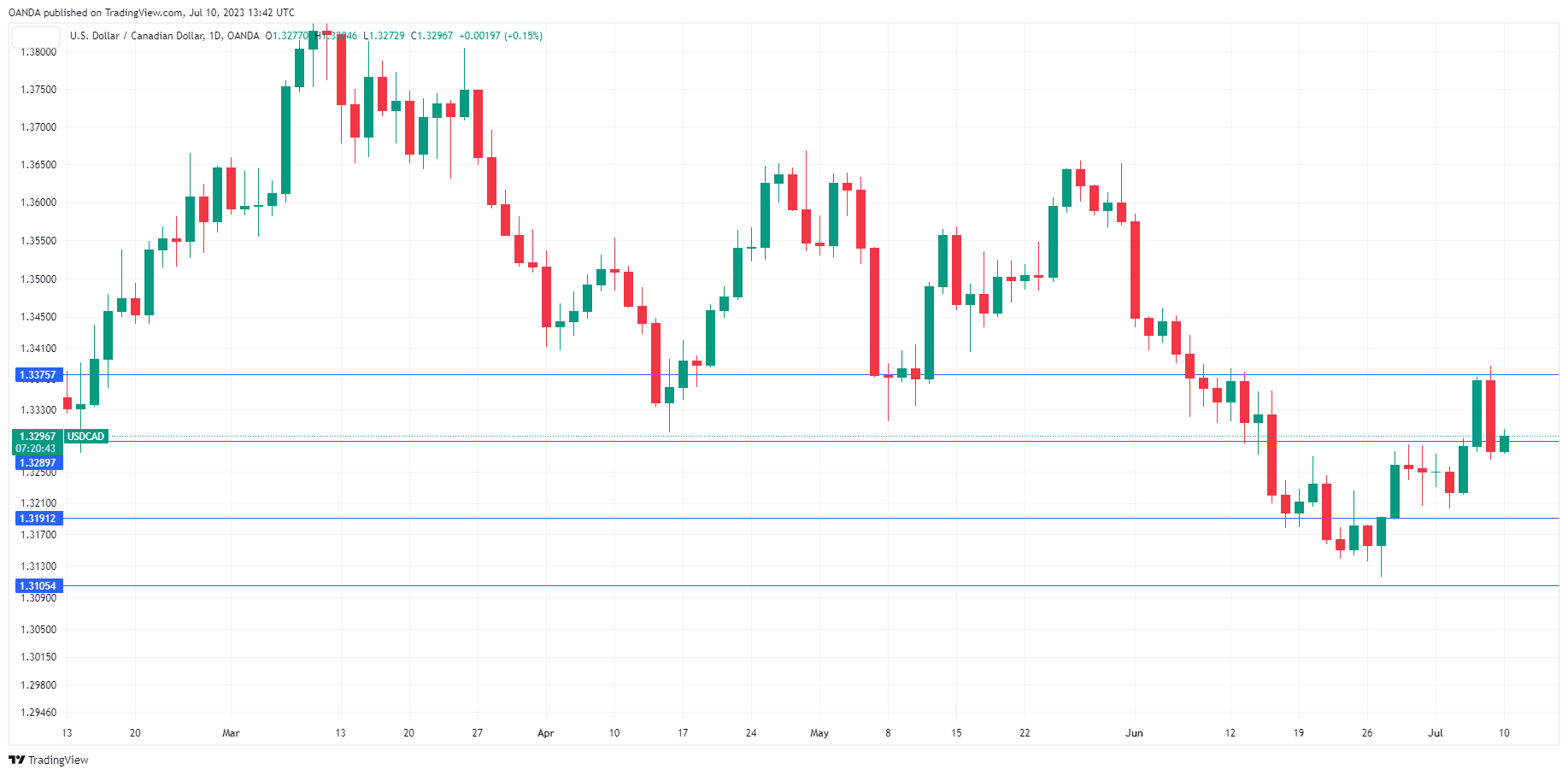

- USD/CAD is testing resistance at 1.3289. Next, there is resistance at 1.3375

- 1.3191 and 1.3105 are providing support

Original Post