USD/CAD: Path of Least Resistance Remains to the Downside Ahead of BoC, Jobs Data

2024.09.03 10:00

The faces a big test this week, for not only do we have significantly important data from the US, but there’s also a rate across the northern border in Canada.

Meanwhile, we will also have the August employment report to look forward to from Canada on Friday. Incidentally, the Canadian will be released on the same day and time as the US report.

This should mean elevated uncertainty and volatility for the USD/CAD pair.

US Dollar Drifts Ahead of Key Events

The is set for a pivotal week with several major economic reports coming up, particularly the August jobs report.

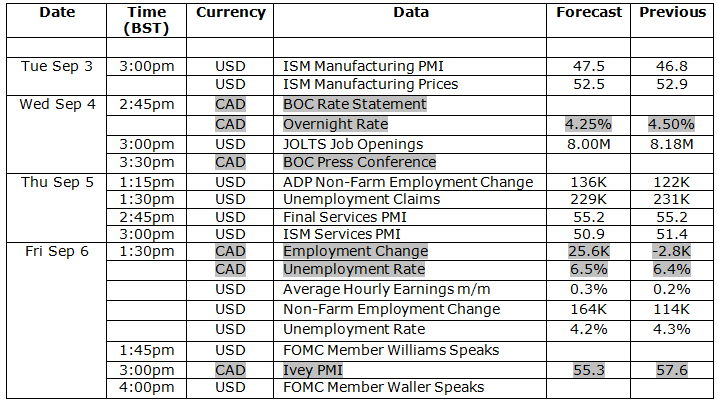

Following yesterday’s US Labor Day break, the rest of the week will bring a slew of important data releases: on Wednesday, and a series of updates on Thursday, including employment figures, , and data. The main event will be Friday’s August jobs report.

This jobs report will play a key role in deciding whether the dollar’s recent two-month decline continues or if it stabilizes.

A weaker jobs report would likely drive the dollar lower. However, if Friday’s report aligns with expectations—predicting about 165,000 new jobs and a decrease in the from 4.3% to 4.2% – it would probably strengthen the case for a 25-basis point rate cut by the Fed on September 18, and the dollar might show a muted response.

On the other hand, if job growth falls short—around 100,000 new jobs—and the unemployment rate ticks up, the dollar could face further weakness, putting pressure on the USD/CAD as the market anticipates a larger 50 basis point rate cut from the Fed. For now, the Dollar Index is holding steady.

It Is All About the Pace of Rate Cuts for September

Jerome Powell hinted at the possibility of several rate cuts during his speech at Jackson Hole a couple of weeks ago, noting that inflation had dropped “significantly” and that “the labor market is no longer overheated.”

With a rate cut in September essentially a done deal, the speed of further cuts will depend on upcoming data. This puts even more focus on the forthcoming employment report from the US.

Canadian Dollar Also Set for a Big Test

While the main focus will rightly be on the US data for a vast majority of traders, we will also have some important macro events to look forward to from Canada this week – as highlighted on the economic calendar, containing only US and Canadian data.

The Bank of Canada is expected to cut rates by a further 25 basis points at its meeting on Wednesday, following two cuts in June and July. The central bank had held the terminal rate of its hiking cycle at 5% for ten months before the June cut.

At its last meeting in July, the BoC’s Governing Council pointed out that the surplus supply in the Canadian economy has helped to ease inflation recently, justifying a shift towards looser monetary policy, especially as the Canadian labor market has started to show signs of cooling. Two months of surprise contraction in jobs (-1.4K in July and -2.8K in August), means there is now even more reason for the BoC to cut.

Meanwhile, the latest jobs report will be published on Friday. Unless we see a third month of negative jobs growth, this is something that could help fuel a fresh rally in the Canadian dollar, despite the BOC’s expected rate cut.

USD/CAD Technical Analysis and Trade Ideas

Following that big reversal pattern created at the start of August, when rates temporarily broke above the November 2023 high of 1.3900 and failed to hold there, the resulting sell-off has been a swift one.

By the end of the month, the USD/CAD had reached a low of 1.3441, shedding some 500+ pips from the month’s high (1.3947).

But after such a sharp decline and ahead of key major macro events, it is hardly surprising that the USD/CAD is now staging what looks like a short-covering rebound. However, it remains to be seen if we are going to see a more pronounced recovery.

A potential re-test of the broken 1.3570-1.3600 area might offer resistance. This zone was previously a major support area, where we also have both the 21- and 200-day moving averages converge. If we get a pop into this area on the back of any of this week’s macro events, I would then expect a swift rejection and another move lower.

The path of least resistance on the USD/CAD pair will remain bearish until and unless we go back above that 1.3570-1.3600 resistance area, or we form a major bullish reversal signal at lower levels first.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Read my articles at City Index