USD/CAD challenges symmetrical triangle’s base

2023.06.09 05:49

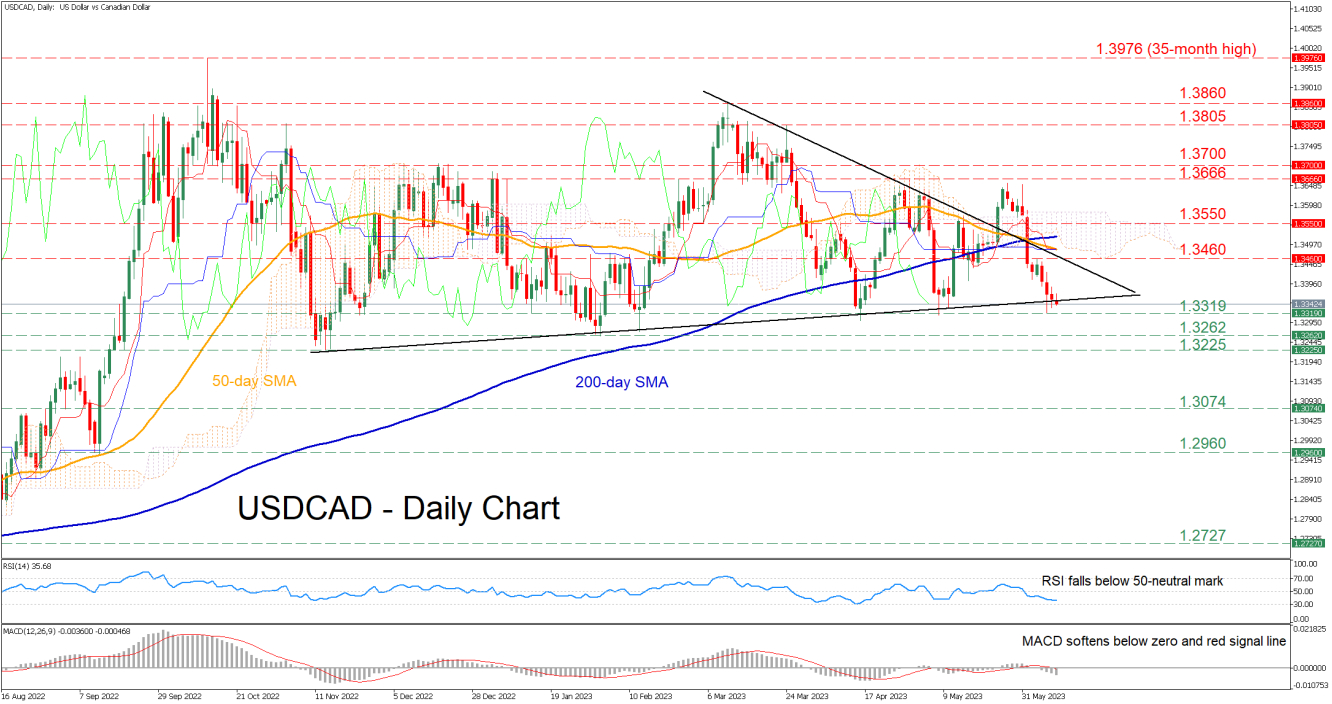

USDCAD has been generating a structure of lower highs but higher lows after peaking at the 2023 high of 1.3860 in mid-March. Even though the price broke below the base of the symmetrical triangle pattern following the unanticipated rate hike by the BoC, it failed to decisively close below it and post a lower low.

The momentum indicators currently suggest that near-term risks remain tilted to the downside. Specifically, the RSI descends below the 50-neutral mark, while the MACD is softening below both zero and its red signal line.

Should the decline resume, initial support could be met at the June bottom of 1.3319. Piercing that wall, the pair could retreat towards the 2023 low of 1.3262. Further declines could then come to a halt at the November 2022 support of 1.3225.

On the flipside, if the price bounces off the base of the symmetrical triangle, the bulls might aim for the recent resistance of 1.3460. A break above that zone could trigger an advance towards the 1.3550 resistance. Even higher, the April peak of 1.3666 could prove to be a tough one for the price to overcome.

In brief, USDCAD attempted to break its symmetrical triangle to the downside for the first time in the past two months, but the latter continues to hold its ground. Should the price manage to close below this barrier, the recent downtrend is likely to accelerate.