US Supreme Court scrutinizes Biden college student debt relief

2023.02.28 06:55

US Supreme Court scrutinizes Biden college student debt relief

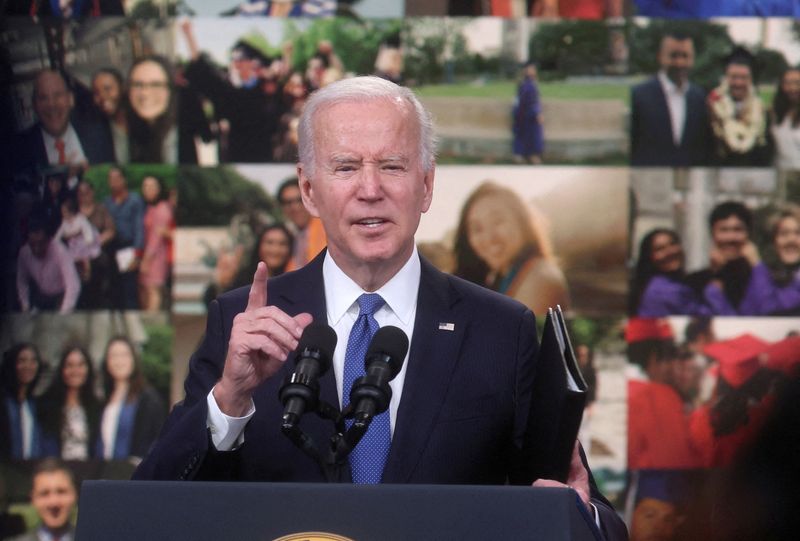

WASHINGTON (Reuters) – The fate of President Joe Biden’s plan to cancel $430 billion in student debt for some 40 million borrowers is placed in the hands of the U.S. Supreme Court on Tuesday in a case that presents another major test of executive branch authority.

The nine justices are set to hear arguments in the Biden administration’s appeal of two lower court rulings blocking the policy that he announced last August in legal challenges brought by six conservative-leaning states and two student loan borrowers opposed to the plan’s eligibility requirements.

Under the Democratic president’s plan, the U.S. government would forgive up to $10,000 in federal student debt for Americans making under $125,000 who took out loans to pay for college and other post-secondary education and $20,000 for recipients of Pell grants awarded to students from lower-income families.

The program fulfilled Biden’s 2020 campaign promise to cancel a portion of the nation’s $1.6 trillion in federal student loan debt but was criticized by Republicans and others as an overreach of his authority.

The policy, intended to ease the financial burden on debt-saddled borrowers, could face scrutiny by the court under the so-called major questions doctrine. Its 6-3 conservative majority has employed this muscular judicial approach to invalidate major Biden policies deemed lacking clear congressional authorization.

Biden’s administration has said the plan is authorized under a 2003 federal law called the Higher Education Relief Opportunities for Students Act, or HEROES Act, that allows student loan debt relief during wartime or national emergencies.

Many borrowers experienced financial strain during the COVID-19 pandemic, a declared public health emergency. Beginning in 2020, the administrations of President Donald Trump, a Republican, and Biden, a Democrat, repeatedly paused federal student loan payments and halted interest from accruing, relying upon the HEROES Act.

Biden’s administration contends that the challengers have not suffered the sort of legal injury needed to give them the proper standing to bring their lawsuits. The challengers have said Biden’s administration failed to provide an adequate legal underpinning for the program.

In the legal challenge brought by individual borrowers Myra Brown and Alexander Taylor, Texas-based U.S. District Judge Mark Pittman ruled the student loan forgiveness program lacked “clear congressional authorization.” The New Orleans-based 5th U.S. Circuit Court of Appeals declined to put Pittman’s decision on hold pending appeal.

Missouri-based U.S. District Judge Henry Autrey found the states – Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina lacked the legal standing to sue. On appeal, the St. Louis-based 8th U.S. Circuit Court of Appeals found at a minimum that Missouri likely had standing to sue and that court temporarily blocked the Biden program from taking effect while the case proceeded.

One theory of legal standing advanced by the states is that Biden plan’s would harm a Missouri-based student loan servicer – a company involved in collecting payment – which in effect would injure that state. The two individual borrowers have said the administration’s failure to allow public comment over Biden’s student debt forgiveness plan deprived them of “procedural rights” under federal law.