US Supreme Court halts Purdue Pharma bankruptcy settlement pending review

2023.08.11 21:49

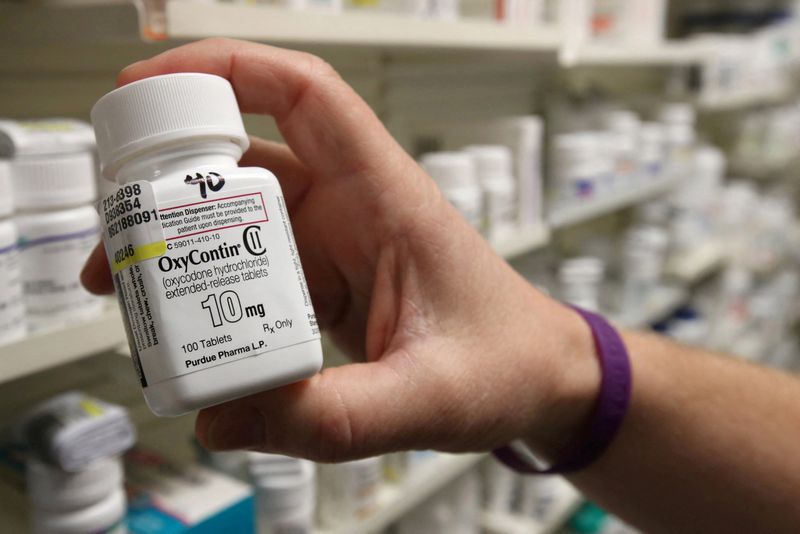

© Reuters. FILE PHOTO: A pharmacist holds a bottle OxyContin made by Purdue Pharma at a pharmacy in Provo, Utah, U.S., May 9, 2019. REUTERS/George Frey/File Photo

By John Kruzel and Andrew Chung

WASHINGTON (Reuters) -The U.S. Supreme Court on Thursday agreed to hear a challenge by President Joe Biden’s administration to the legality of OxyContin maker Purdue Pharma’s bankruptcy settlement, putting on hold a deal that would shield its wealthy Sackler family owners from lawsuits over their role in the country’s opioid epidemic.

The justices paused bankruptcy proceedings concerning Purdue and its affiliates and said they would hold oral arguments in December in the administration’s appeal of a lower court’s ruling upholding the settlement. The Supreme Court’s new term begins in October.

Purdue’s owners under the settlement would receive immunity in exchange for paying up to $6 billion to settle thousands of lawsuits filed by states, hospitals, people who had become addicted and others who have sued the Stamford, Connecticut-based company over its misleading marketing of the powerful pain medication OxyContin.

In a statement, Purdue said it was disappointed that the U.S. Trustee, the Justice Department’s bankruptcy watchdog that filed the challenge at the Supreme Court, has been able to “single-handedly delay billions of dollars in value that should be put to use for victim compensation, opioid crisis abatement for communities across the country and overdose rescue medicines.”

“We are confident in the legality of our nearly universally supported plan of reorganization, and optimistic that the Supreme Court will agree,” the company added.

The Justice Department declined to comment.

At issue is whether U.S. bankruptcy law allows Purdue’s restructuring to include legal protections for the members of the Sackler family, who have not filed for personal bankruptcy.

Purdue filed for Chapter 11 bankruptcy in 2019 to address its debts, nearly all of which stemmed from thousands of lawsuits alleging that OxyContin helped kickstart an opioid epidemic that has caused more than 500,000 U.S. overdose deaths over two decades.

Purdue estimates that its bankruptcy settlement, approved by a U.S. bankruptcy judge in 2021, would provide $10 billion in value to its creditors, including state and local governments, individual victims of addiction, hospitals, and others who have sued the company.

The Biden administration and eight states challenged the settlement, but all of the states dropped their opposition after the Sacklers agreed to contribute more to the settlement fund.

In May, the 2nd Circuit upheld the settlement, concluding that federal bankruptcy law allows legal protections for non-bankrupt parties like the Sacklers in extraordinary circumstances.

The 2nd Circuit ruled that the legal claims against Purdue were inextricably linked to claims against its owners, and that allowing lawsuits to continue targeting the Sacklers would undermine Purdue’s efforts to reach a bankruptcy settlement.

Members of the Sackler family have denied wrongdoing but expressed regret that OxyContin “unexpectedly became part of an opioid crisis.” They said in May that the bankruptcy settlement would provide “substantial resources for people and communities in need.”

In a court filing, the administration told the Supreme Court that Purdue’s settlement is an abuse of bankruptcy protections meant for debtors in “financial distress,” not people like the Sacklers. According to the administration, Sackler family members withdrew $11 billion from Purdue before agreeing to contribute $6 billion to its opioid settlement.

Many other stakeholders have responded in opposition to the administration’s request to halt the settlement.

A group comprising more than 60,000 people who have filed personal injury claims stemming from their exposure to Purdue opioid products told the Supreme Court they support the settlement, including legal immunity for members of the Sackler family.

“Regardless of how one feels about the role of the Sackler family in the creation and escalation of the opioid crisis,” the group told the justices, “the fact remains that the billions of dollars in abatement and victim compensation funds hinge on confirmation and consummation of the existing plan.”