US Stocks Show Resilience – Can They Continue to Lead Global Market?

2024.07.29 10:29

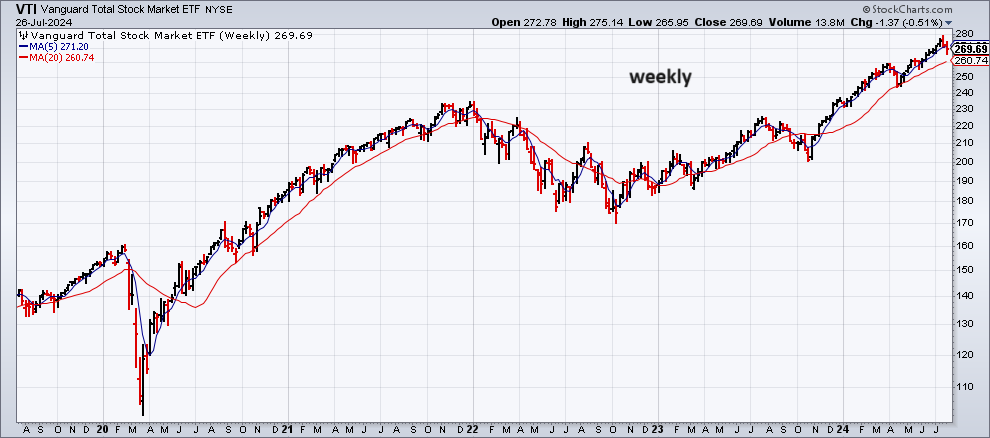

US equities fell for a second week in trading through Friday, July 26, based on the . The slide marks the first back-to-back weekly decline since April.

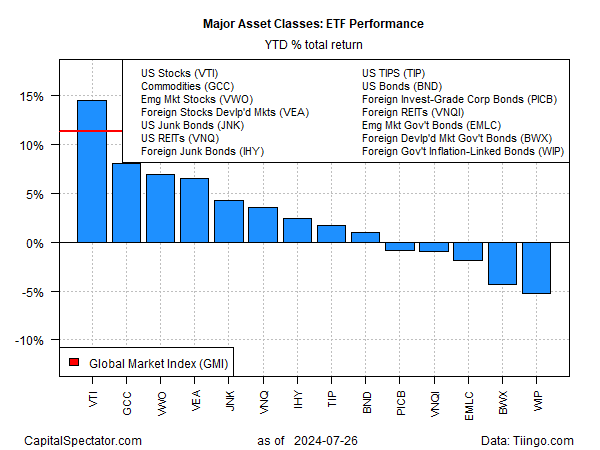

No one knows at this point whether this is noise or the start of an extended downturn. But one thing is clear: US stocks continue to lead markets this year by a wide margin, based on a set of ETFs representing the .

American shares () are up 14.5% year to date. That’s a sizable premium over the rest of the field. The second-best performer in 2024: commodities (), with an 8.9% rise.

Several asset classes are underwater this year. The deepest shade of red ink is found in global inflation-indexed government bonds ex-US () via a 5.2% loss.

Meanwhile, an ETF-based version of the Global Markets Index (GMI.F), an investable, unmanaged benchmark that holds all the major asset classes in market-value weights, is outperforming everything except US stocks this year with an 11.3% rise so far in 2024.

Investors will be looking for clues this week to decide if the resilience in US shares is cracking. Reviewing the price trend for VTI on a weekly basis suggests that the latest downturn is a garden-variety correction. Will the week ahead paint a different profile?

A possible catalyst that could influence market sentiment in the days ahead: for July (Fri., Aug. 2). The Labor Department’s estimate is expected to show that hiring eased to 180,000, based on Econoday.com’s consensus point forecast.

Assuming that’s correct, the gain would mark a pace of hiring that’s below average (relative to the past 12 months), but not low enough to raise recession fears for the immediate future.

On the other hand, a rise of 180,000 for payrolls would probably keep optimism alive that the Federal Reserve will cut interest rates in September as a down payment on trying to keep the current economic expansion alive.

At the same time, of a rate cut will, in theory, provide a degree of support for equities.

“They want to be very gradual in how they pull back,” says Gennadiy Goldberg, head of US rates strategy at TD Securities.

“But if the labor market actually looks like it’s slowing down,” policymakers may decide that “they should be moving a little bit quicker than they otherwise would.”