US Stocks Q3 Fundamentals Look Fantastic, but Valuations at Dangerous Levels

2024.11.08 16:36

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. These elite companies continue to thrive, collectively reporting near-record sales and profits. Yet their valuations remain deep into dangerous bubble territory, which is always risky. Especially with American consumers drowning in debt following the ravages of serious inflation, forcing them to slow their spending.

The flagship stock index has been on fire, enjoying a fantastic 2024. This week’s big 4.7% surge on Trump’s decisive election victory extended the SPX’s year-to-date gains to 26%, and its 48th record close this year. Interestingly that’s still underperforming gold, which was up 29.0% YTD midweek despite plunging 3.0% on Trump’s win. That launched the , triggering heavy gold-futures selling.

The US stock markets are enjoying a mighty bull run, with the SPX soaring 44.0% in just over a year. The artificial-intelligence mania has been the main driver, fueling popular greed and even euphoria. Investors love this surging record-shattering run, and universally expect it to continue. They may be right, yet markets are forever cyclical with bears inevitably following bulls. And extreme overvaluations awaken bears.

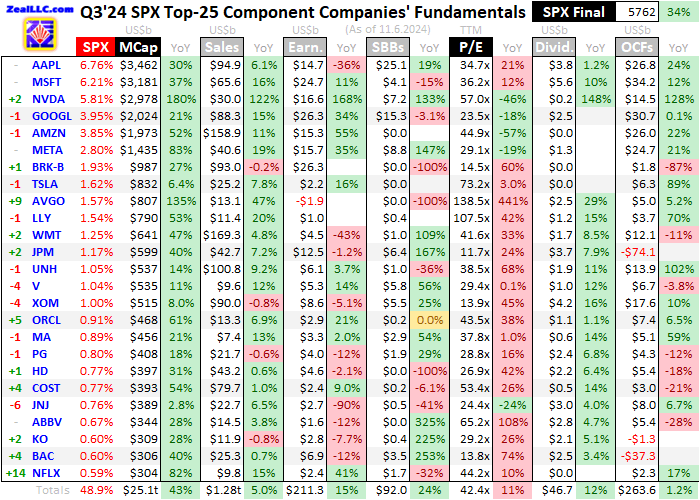

For 29 quarters in a row now, I’ve painstakingly analyzed the latest results just reported by the 25 biggest SPX components and US companies. Almost all American investors are heavily deployed in these behemoths due to fund managers crowding in. How big US stocks are collectively faring fundamentally offers clues on what markets are likely to do in coming months. This table includes key SPX-top-25-component results.

Each of these elite companies’ symbols are preceded by their SPX rankings changes over this past year, and followed by their index weightings exiting Q3’24. Next comes their quarter-end market capitalizations and year-over-year changes, revealing how these stocks performed. Looking at market caps instead of stock prices helps neutralize the distorting effects of massive stock buybacks artificially boosting prices.

Next comes a bunch of hard accounting data directly from 10-Q reports filed with the SEC. That includes each SPX-top-25 component’s quarterly sales, earnings, stock buybacks, dividends, and operating cash flows generated. Their quarter-end trailing-twelve-month price-to-earnings ratios are also shown. YoY percentage changes are included unless they’d be misleading, such as comparing positives with negatives.

Overall the big US stocks’ Q3’24 results proved fantastic, confirming why these companies are the best. But despite their continuing size-defying growth, troubling signs abound. These include extreme concentration, extreme overvaluations, and the overwhelming probability that these outsized growth rates aren’t sustainable. And the US economy slowing down as Americans struggle with debt and inflation exacerbates risks.

The sheer market dominance of these beloved American companies can’t be overstated. Their massive aggregate market capitalization of $25,069b exiting Q3 commands a staggering 48.9% of the entire S&P 500’s weighting. That’s just a little under the prior quarter’s record of 50.2%, still crazy-concentrated. The SPX top 25 are worth as much as the bottom 471 companies. These big US stocks effectively are the markets.

High concentration really ramps stock-market downside risks. The fewer stocks fund managers crowd into, the easier it is for a handful of companies to drag down the SPX after disappointing news or quarterly results. Concentrated portfolios are inherently fragile, particularly in mature bull runs after big gains force valuations to extremes. In Q3’17 when I started this research thread, the SPX top 25 were 34.8% of the total.

Fund managers’ concentrated monoculture of aggressively overweighting these same big US stocks results from the hyper-competitive nature of their business. If their fund performance consistently falls behind their peers’, investors will quickly shift their capital to better-performing funds. That leads to more-and-more money chasing fewer-and-fewer stocks, which is unsustainable but amplifies their gains while it lasts.

Overall the SPX-top-25 stocks’ total market caps soared 42.6% during the year ending Q3’24. Such huge gains can’t continue off such colossal bases. And not surprisingly this past year’s massive gains came mostly in the beloved Magnificent 7 mega-cap tech stocks. Their market caps skyrocketed an epic 49.8% YoY to $15,885b, or 31.0% of the entire S&P 500. The Next-18-largest lagged well behind, up 31.5% to $9,184b.

Astoundingly exiting Q3, Apple (NASDAQ:), Microsoft (NASDAQ:), NVIDIA (NASDAQ:), Alphabet (NASDAQ:), Amazon (NASDAQ:), Meta (NASDAQ:), and Tesla (NASDAQ:) averaged crazy-high $2,269b market caps. Such gigantic sizes make it almost impossible for these huge mid-double-digit gains to continue. The bigger any stock the more market-cap inertia it has, requiring proportionally-larger capital inflows or outflows to move. It’s far easier for a $200b company to soar 50% than a $2,000b one.

The Mag7’s overwhelming dominance of US stock markets has left them increasingly bifurcated across all key metrics. Overall the SPX top 25’s revenues grew a solid 5.0% YoY last quarter to $1,282.9b. And that was despite one key composition change, with another tech market-darling Netflix (NASDAQ:) surging to force oil super-major Chevron (NYSE:) out of these elite ranks over this past year. NFLX merely did $9.8b in sales in Q3.

CVX’s dwarfed that at $50.7b, so had it remained in the SPX top 25 these comparisons would’ve looked better. Yet all last quarter’s top-line growth came from the Mag7, where sales exploded up 15.3% YoY to a jaw-dropping $503.5b. The Next-18-largest US stocks actually saw their total revenues slip a slight 0.7% YoY to $779.5b. Again composition changes skewed this, but business is slowing for some elite companies.

And despite their undeniable brilliance, the mega-cap techs aren’t immune. Nearly 70% of the entire US economy is driven by consumer spending. That has remained robust in recent years, but only because of soaring debt levels. The Federal Reserve tracks those statistics, revealing mortgages, home-equity lines of credit, car loans, and credit-card debt keep surging up to new record highs. That’s an ominous omen.

Much of that frenzied borrowing was to maintain lifestyles through raging inflation. After March 2020’s pandemic-lockdown stock panic, the Fed absurdly mushroomed the US money supply by 115.6% or $4,807b in just 25.5 months. Relatively-far-more dollars chasing relatively-less goods and services really bid up their prices. Trump won this week because Americans are struggling with the resulting crushing inflation.

While far-higher groceries prices have been big political news, they are the tip of the iceberg. Most major expenses that have to be paid are way higher than during Trump’s first term, including mortgage payments and rent, house and car insurance, property taxes, medical insurance and bills, electricity, and the list goes on. Paying all these higher non-discretionary expenses every month leaves less spending money left.

The large majority of SPX-top-25 companies sell discretionary goods and services that Americans want but don’t necessarily need. Apple’s iPhones are essential tools to function in modern society, but is the latest model far superior to the last few years’ ones? Not really. Cash-strapped consumers could easily delay their iPhone upgrade cycles another year or two, which could start shrinking Apple’s revenues.

Microsoft essentially rents productivity software and servers to businesses. Yet if their own customers scale back purchases, their demand for MSFT services will eventually follow. Rather than paying every month for software, companies can buy it outright then use it for years. Alphabet and Amazon are also quite dependent on server rentals, their cloud businesses would suffer too if customers have to retrench.

When sales slow, one of the easiest expenses businesses can cut is advertising. Both Alphabet and Meta are overwhelmingly reliant on business ad spends. Those could wane considerably as Americans’ tight budgets and high debt loads force them to slow discretionary purchases. That’s also true of the goods-selling side of Amazon, where a likely big majority of stuff sold there is for wants rather than needs.

NVIDIA is the ringleader of this massive AI stock bubble, with its stock launching a stratospheric 179.9% higher over this past year. Other mega-cap-tech companies have scrambled to buy all the graphics-processing-unit chips NVIDIA can manage to get produced, at wildly-inflated prices compared to their manufacturing costs. Many tens of billions of dollars are being spent to ramp up AI models and capabilities.

But despite these epic investments in AI infrastructure, so far end-user demand has remained very weak. Is ChatGPT that much better than a standard Google search? Are Americans willing to pay monthly for access to large language models? While AI has really improved certain aspects of businesses like customer service, for normal people AI seems to be a solution in search of a problem. AI is neat, but not essential.

While it will slowly integrate into our lives, that will likely take many years. With the bubble valuations in all the AI leaders, investors will need to see AI fuel strong sales growth way sooner. The vast majority of these SPX-top-25 stocks including all the Mag7 aren’t immune to weaker revenues as belt-tightening Americans are forced to slow their spending. Lower sales quickly multiply to much-lower profits, a serious risk.

There are a handful of exceptions though. Walmart (NYSE:) and Costco (NASDAQ:) both benefit from this inflationary budget-busting environment. The more expensive groceries get and the less cash left over every month to buy them, the more the great deals at this leading discounter and wholesaler matter. I brave Costco once a week to buy fresh meat, fruit, vegetables, and bread for my family, and my local ones are bursting at the seams.

The big US stocks’ earnings last quarter were strong, surging a hefty 14.7% YoY to $211.3b despite not including Chevron. Again those were heavily bifurcated though, with the Mag7’s profits soaring 22.3% to $115.5b while the Next-18-largest US companies’ only grew 6.0% to $95.8b. But that overall earnings growth was really overstated by Warren Buffett’s legendary investment conglomerate, Berkshire Hathaway (NYSE:).

Accounting rules require BRK to flush its massive unrealized and realized gains and losses on investments through its income statements every quarter. This drives Buffett crazy, he has railed against this countless times over the decades. Of BRK’s massive $26.3b in profits last quarter, fully $20.5b or 78% were gains on investments. That compared to an ugly $12.8b bottom-line loss in Q3’23 after investment losses of $29.8b.

Back all that out, and Berkshire’s earnings ex-investments actually plunged 66.3% YoY to $5.8b. That is really interesting because BRK’s extensive holdings are very diverse across many industries, suggesting the US economy is slowing. If BRK’s ex-investment earnings are used in both Q3’23 and Q3’24, the overall SPX top 25’s profits actually fell a sizable 10.9% YoY to $190.8b. That’s a big problem in a stock bubble.

And Buffett and his handful of top lieutenants running Berkshire sure seem to agree these stock markets are scarily overvalued. While not included in this table, BRK’s cash balance last quarter skyrocketed 106.8% YoY to a staggering $325.2b. That accounts for 31% of the cash treasuries of the entire SPX top 25, and rivals the $464.2b warchests held by the Mag7. Why is the world’s greatest investor rushing into cash?

Either he can’t find any good deals in these expensive stock markets, or he fears a bear is looming that will maul stock prices much lower. Berkshire’s entire business is investing, and its sterling reputation also grants it unique access to countless deals outside stock markets. So BRK’s brain trust hoarding cash in record amounts rather than deploying it is ominous. Odds are the SPX’s extreme bubble valuations factor in.

Absolute stock prices don’t matter, or even market caps to some extent. A $500 stock price or $1,000b market capitalization for a company trading at 14x trailing-twelve-month earnings is way cheaper than a rival priced at $100 or $200b but sporting a far-higher 28x price-to-earnings ratio. Over the past century-and-a-half or so, fair-value for the US stock markets has run around 14x while bubbles start at double that or 28x.

Exiting Q3, these big US stocks averaged crazy-high TTM P/Es of 42.4x which is deep into dangerous bubble territory. Interestingly that was the only place that bifurcation vanished, with the Mag7 averaging 42.6x while the rest of the SPX top 25 averaged 42.4x. So at these prevailing stock prices, it would take these big US companies about 42 years to earn back those prices investors are paying. That’s a long time.

Such extreme overvaluations are only seen late in secular bulls, after huge gains fuel universal greed and euphoria. The whole mission of inevitable subsequent bears is to maul stock prices lower or sometimes sideways for long enough for underlying corporate profits to catch up with prevailing stock prices. Bears tend to run until SPX-top-25 valuations fall back under 14x, sometimes even as low as half fair-value at 7x.

While euphoric traders have forgotten about stock bears, they are serious and not to be trifled with. From March 2000 to October 2002 after the last time the SPX was this overvalued, it plunged 49.1% over 30.5 months. Later from October 2007 to March 2009, the SPX plummeted 56.8% in 17.0 months. There is plenty of modern precedent for bears gutting excessive stock prices, especially starting from bubble toppings.

And even milder minor bears are dangerous, with the last one clawing the SPX down 25.4% from early January 2022 to mid-October that same year. Before that bear, Wall Street asserted that fundamentally-strong mega-cap techs were among the safest stocks. Yet surrounding that SPX-bear span, the Mag7 market-darlings averaged brutal 54.6% losses more than doubling the SPX’s. Bubble stocks are never refuges.

As if that wasn’t menacing enough, slowing discretionary consumer spending will exacerbate bubble valuations giving any bear more fodder. If a big US stock’s revenues slump 5%, its earnings could easily drop 20%+. That means if it had a current average 42x P/E, that could surge near 53x. That makes for proportionally more downside as a bear does its gory work of realigning stock prices with underlying earnings.

Falling profits as sales come under pressure are also a major risk for massive stock buybacks. These have been the primary driver of stock-market upside over the past decade or so. Last quarter the SPX top 25’s soared 23.8% YoY to $92.0b. That’s still well under Q4’21’s record $107.3b, but in line with the past-four-quarter average of $83.5b. Cutting buybacks is the easiest way for large companies to preserve cash.

If revenues start flagging as Americans’ discretionary spending power wanes, buybacks will soon follow. Buybacks boost earnings per share, retiring existing shares leaving fewer outstanding ones to spread net income across. So the EPS growth prized by Wall Street analysts will take a major hit if buybacks slow, leaving big US stocks even more overvalued. These bear-spawning bubble valuations could get even worse.

Buybacks are far easier to cut in challenging economic times than dividends, which are sacrosanct. Last quarter the SPX top 25’s total dividends grew 12.0% YoY to $46.7b. Plenty of investors rely on those dividend streams, so the rare times companies really cut dividends their stocks usually plunge sharply. I suspect most big US companies would slash their stock buybacks to zero before they dared reduce dividends.

Operating cash flows generated last quarter by the big US stocks weren’t as strong as sales or profits. They only edged up 1.2% YoY to $263.6b for the SPX top 25. OCFs were also really bifurcated, with the Mag7’s soaring 21.6% YoY to $163.1b while the Next 18 largest’s excluding mega-banks plunged 23.6% to $100.5b. That’s more of a Chevron-booted-out thing though, reflecting a shifting SPX-top-25 composition.

That oil super-major’s OCFs ran $9.7b both a year ago in Q3’23 and in this latest Q3’24. Meanwhile Netflix’s OCFs were way smaller at $2.0b and $2.3b. So had the latter not edged out the former, the SPX top 25’s operating cash flows would’ve looked stronger. They still remained ahead of the past-four-quarter average of $242.5b. A weakening economy should grow evident in OCFs before revenues and earnings.

Despite Trump’s remarkable comeback win, these stock markets also face big political risks. One of the reasons the SPX surged so much over this past year was many big upside surprises in key economic data, led by monthly US jobs reports. Unfortunately the Biden Administration bureaucrats running those reporting agencies were chronically overstating market-moving economic data for their party’s political gains.

In recent years headline jobs numbers have mostly come in well above expectations, which gooses the stock markets. Then those big beats are soon revised away in subsequent months, after traders no longer care. There have been even-bigger annual downward revisions, the last claiming 818k fewer jobs on top of earlier monthly downward revisions in the year ending Q1’24. What if that economic-data skewing vanishes?

Maybe the Biden guys will stop making data-boosting assumptions with their party losing power. Maybe Trump will replace data-reporting agency heads with his own people. Either way, there’s a good chance economic data will better reflect economic reality as thumbs are removed from scales. Big misses in key economic data in coming months could ignite sizable selling pressure in these bubble-valued stock markets.

So how should investors prepare for an overdue bear market to normalize extreme valuations? Diversify. Large holdings in these popular big US stocks can be pared, reallocating some of that capital to cash like Buffett. Also gold and its miners’ stocks tend to thrive when stock markets weaken, and the latter remain very undervalued relative to these record prevailing gold levels. Battered gold stocks have vast upside potential.

The bottom line is the big US stocks dominating markets and investors’ portfolios just reported another fantastic quarter. Revenues hit record levels, while earnings weren’t far behind. Yet with valuations still deep into dangerous bubble territory, even fat profits were way too low to justify these lofty stock prices. That’s a real problem, portending a looming bear market to maul prices back down in line with earnings.

Even worse, these extreme valuations will likely head higher until that bear really roars. Corporate sales and profits should come under increasing pressure as cash-strapped Americans cut back on discretionary spending. Inflated necessities’ prices are consuming more of their incomes. Declining revenues will be amplified by earnings, leaving US stock markets even more bubbly. Traders need to reallocate some into gold.