US oil executive censure puts spotlight on shale-OPEC meetings

2024.05.02 15:50

By Sabrina Valle

HOUSTON (Reuters) – A U.S. regulator’s censure of a top U.S. oil executive over private meetings with the Organization of the Petroleum Exporting Countries (OPEC) group of oil producers has put a spotlight on dinners attended by dozens of shale executives.

The U.S. Federal Trade Commission (FTC) on Thursday barred former Pioneer Natural Resources (NYSE:) CEO Scott Sheffield from joining the board of Exxon Mobil (NYSE:), which is acquiring Pioneer for $60 billion in stock.

The FTC accused the 72-year-old executive of leading a coordinated effort with other U.S. oil firms and with OPEC “to keep production artificially low” and increase oil companies’ profits.

In its complaint, the FTC pointed to meetings that shale and OPEC officials held over several years, including a series of private dinners at a Houston energy conference.

Executives who attended previously had described to Reuters the meetings as discussing oil demand, spare production capacity and shareholder requirements.

Pioneer said Sheffield had acted in the best interests of the oil industry, its investors, and said his actions helped lift U.S. oil production and exports.

“The FTC’s complaint reflects a fundamental misunderstanding of the U.S. and global oil markets and misreads the nature and intent of Mr. Sheffield’s actions,” the company said, defending its former chief as “a leading and internationally respected industry authority.”

The first shale-OPEC dinner, in March 2017, was organized by then-OPEC Secretary General Mohammed Barkindo after OPEC had failed in a price war to halt U.S. shale’s rapid market share gains and wanted to understand how the industry operated, the FTC said.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

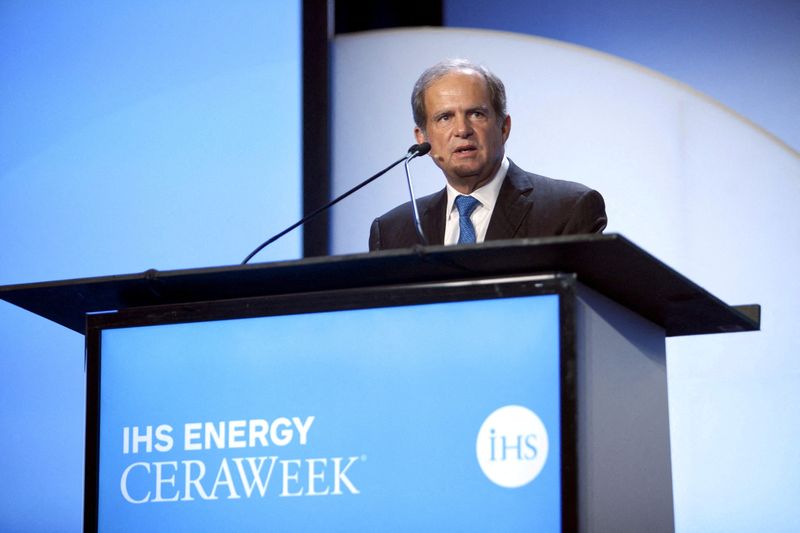

Subsequent dinners at the CERAWeek energy conference in Houston brought OPEC together with shale executives including Hess (NYSE:) CEO John Hess, Occidental Petroleum (NYSE:) CEO Vicki Hollub, Devon Energy (NYSE:) CEO Rick Muncrief, and Chesapeake Energy (NYSE:) chief Domenic Dell (NYSE:)’Osso, among others.

Spokespeople for the companies did not respond to requests for comment.

“I’m seeing a series of meetings where OPEC is reaching out and spending more time with US independents than I have seen over my entire career,” Sheffield said in 2017, according to the FTC complaint.

OPEC members had been perplexed by how quickly U.S. companies had recovered from losses during an OPEC-initiated price war between 2014 through 2016 that had led to dozens of U.S. energy bankruptcies.

But the shale industry quickly bounced back with heavy investments and led the U.S. to become the world’s largest oil producer in a few years. It produced a record 12.9 million barrels per day last year.

In 2017, OPEC cut its production, reducing a market glut that reduced global prices, and handed a victory to U.S. producers. The glut returned in 2020 after demand plummeted on COVID-19 shutdowns.

Sheffield was vocal about his desire to move away from the boom-bust cycles that plagued the U.S. oil business, and became an outspoken advocate for prioritizing shareholder returns over production gains.

He spoke about his contacts with Saudi Aramco (TADAWUL:) officials and other members of the shale dinners attended OPEC meetings in Vienna. In a March 2023 Reuters interview, Sheffield said Pioneer had twice hosted Saudi officials and explained the company’s operations and business practices to them.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

“They can get the same information from most service companies,” he said. “But they like to talk to producers… we have so much data.”