US Federal Deposit Insurance Corp to propose ‘comprehensive’ changes to regional bank living wills

2023.08.14 15:16

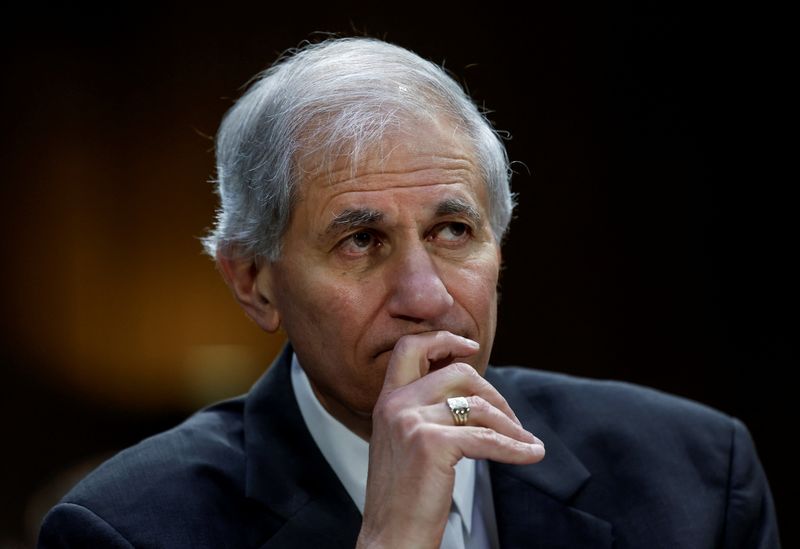

© Reuters. FILE PHOTO: Federal Deposit Insurance Corporation Chairman Martin J. Gruenberg looks on during a hearing at the Senate Banking, Housing and Urban Affairs Committee on “Recent Bank Failures and the Federal Regulatory Response” on Capitol Hill in Washington

(Reuters) -A coming regulatory proposal will overhaul how large, regional banks prepare living wills for the event of their own failures, U.S. Federal Deposit Insurance Corporation Chairman Martin Gruenberg said Monday.

The announcement comes as U.S. regulators continue their efforts to strengthen oversight of the banking system, particularly in light of a string of collapses in March that included three of the largest in U.S. history.

“To that end, the FDIC plans to issue a notice of proposed rulemaking in the near future that will be a comprehensive restatement of the rule for notice and comment,” Gruenberg said in prepared remarks.

Banks are currently required to submit plans to regulators detailing how they would wind up their businesses should they fail. Gruenberg said Monday that the coming changes would make this planning “significantly more effective.”

The FDIC will call for plans that give the regulator more options when overseeing a failed bank’s receivership, Gruenberg added, noting that FDIC’s “living will” requirements are separate from those currently required for large bank holding companies under 2010 Wall Street reforms.

“The proposed rule would require a bank to provide a strategy that is not dependent on an over-the-weekend sale,” Gruenberg said.