US Dollar: Will the 7-Week Winning Streak Continue?

2023.09.05 03:41

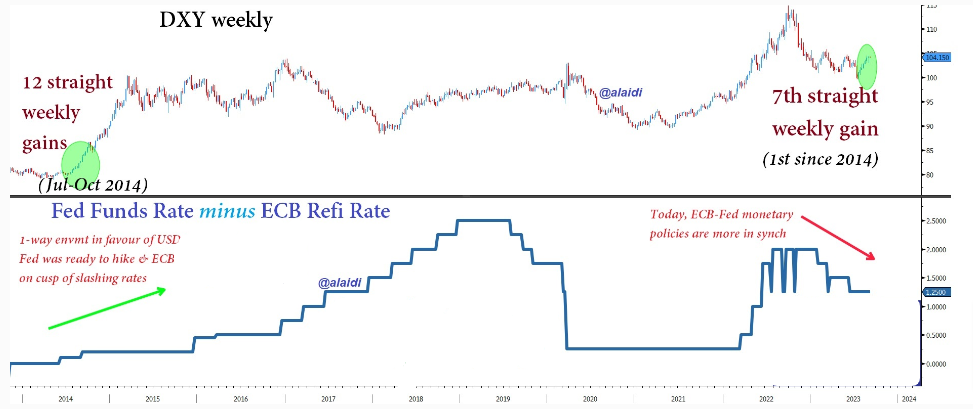

Last week, the (DXY) completed its 7th consecutive weekly gain. It was the longest string of uninterrupted weekly gains since autumn 2014. I mentioned 2 weeks ago that 2014 involved a phase of contrasting monetary policies, whereby the Fed was the only central bank in tightening mode, while most other central banks (especially ECB and BoJ) were in the midst of deep policy easing.

It was the easiest and clearest path to make money in currencies: Buy USD against everything (especially and ). Today, monetary policy paths are more in synch. Fed, ECB, and BoC rate hikes are at (or near) their final innings, according to market expectations. FX moves will depend on which central bank will face surprising upside in inflation; or/and which central bank will cut first.

So why the extreme ascent in DXY?

Some of it is due to the strong rise in US bond yields relative to all G10 nations (except for the UK), and the rest is due to the tumble in the . Most seasoned currency traders will observe that (USD vs. offshore Chinese yuan) is increasingly correlated with other USD pairs. This has created some rare divergences between DXY (57% influenced by EUR) and the USD/CNH pair. Said differently–it is USD/Commodities vs. USD/Europe-UK.

If you’re still reading this post all the way to this line (without suffering a case of short attention span), then you’re probably also aware that most bank strategists/economists continue to expect NO Fed hike this month while reducing the odds of a November hike to below 36%.

All of these odds are worthless without knowing the outcome of the crucial August CPI (due on Sep 13th).

I plan to issue the latest inter-metals count (, , , , and ) to our WhatsApp Broadcast Group to help us assess, whether a fresh break-out in bond yields (above 4.45%) will trigger the next source of damage in indexes. This is paramount, especially as DXY bears are shaking, with EUR/USD breaking its 200-DMA and USD/JPY making such a fierce intraday comeback on Friday alongside yields.