US Dollar Strength About to Peak? Keep an Eye on 10-Year Yields for Clues

2024.12.26 06:54

are always among the most important determinants of currency exchange rates, but over the past two years they have dominated. We cite the following two charts as evidence.

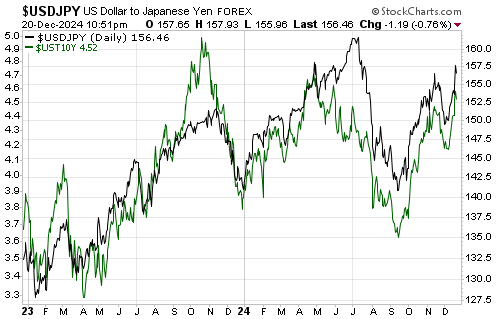

The first chart compares the exchange rate (the black line) with the yield on the (the green line). This chart only illustrates the strong positive correlation between these two markets over the past two years, but the relationship has existed and has been tracked at TSI — normally via a chart that compares the Yen with the price of the 10-year T-Note — for much longer.

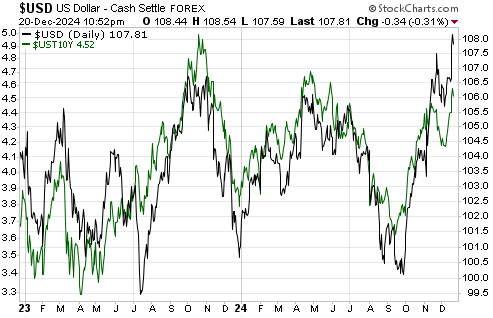

The second chart compares the (the black line) with the yield on the US 10-year T-Note (the green line).

These charts show that over the past two years the has strengthened against other fiat currencies whenever the US 10-year T-Note yield has risen and weakened against other fiat currencies whenever the US 10-year T-Note yield has fallen. The relationship operates on a trend basis rather than a daily or weekly basis, although it was evident last Friday when a slightly lower-than-forecast Index prompted a dip in the T-Note yield, which, in turn, prompted a pullback in the US dollar’s exchange rate.

The overarching message being sent by the above charts is that for the to continue strengthening, the US 10-year T-Note yield will have to continue trending upward. This is unlikely, because we probably are now seeing a sentiment peak related to the expected inflationary effects of Trump’s policies, US economic strength, US stock market outperformance and Federal Reserve ‘hawkishness’. What we haven’t seen yet are any signs in the price action that the trends of the past 2-3 months have ended.