US Dollar Slips After JOLTs Dips Below 8 Million, Yen Strengthens

2024.09.05 05:38

- US Dollar Index (DXY) weakens as JOLTS job openings drop to a 3.5-year low of 7.673 million.

- Japanese Yen strengthens amid recessionary fears and hawkish comments from BoJ Governor Ueda.

- Recession fears persist. Will Friday’s jobs data finally alleviate these concerns?

The (DXY) struggled to keep its recent momentum going following a slew of US data releases. Most notably the JOLTS job openings in the US, which dropped to a 3-and-a-half-year low, coming in at 7.673 million.

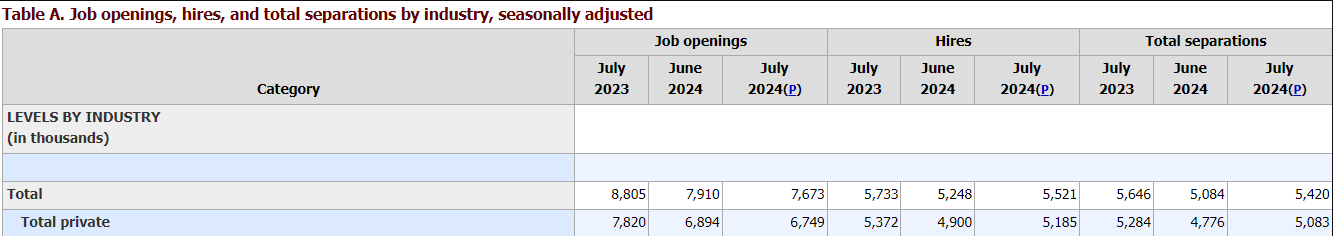

The number of job openings in the US fell by 237,000 in July 2024 from a downwardly revised 7.910 million in June, reaching the lowest level since January 2021 and below market forecasts of 8.10 million.

Source: Bureau of Labor Statistics

The number of job openings decreased in health care and social assistance (-187,000); state and local government, excluding education (-101,000); and transportation, warehousing, and utilities (-88,000), but increased in professional and business services (+178,000) and in federal government (+28,000).

Meanwhile, both the number of hires and total separations changed slightly, to 5.5 million and 5.4 million, respectively. Within separations, the number of job quits decreased to 3.277 million, the lowest level since September 2020, from a downwardly revised 3.214 million in June.

The data saw market participants increase their bets regarding a 50 bps cut by the Federal Reserve. In the immediate aftermath market participants were pricing in just over 50% chance which has since settled at 43%, up from yesterday’s 38%.

I still think a 50 bps cut is a long shot, not to mention that Federal Reserve Policymakers have reiterated their reluctance to start the cycle with a 50 bps cut. I think what is more important than the NFP print on Friday will be the unemployment rate. A significant uptick in the unemployment rate may give Fed policymakers a headache and could sway them toward a 50 bps cut.

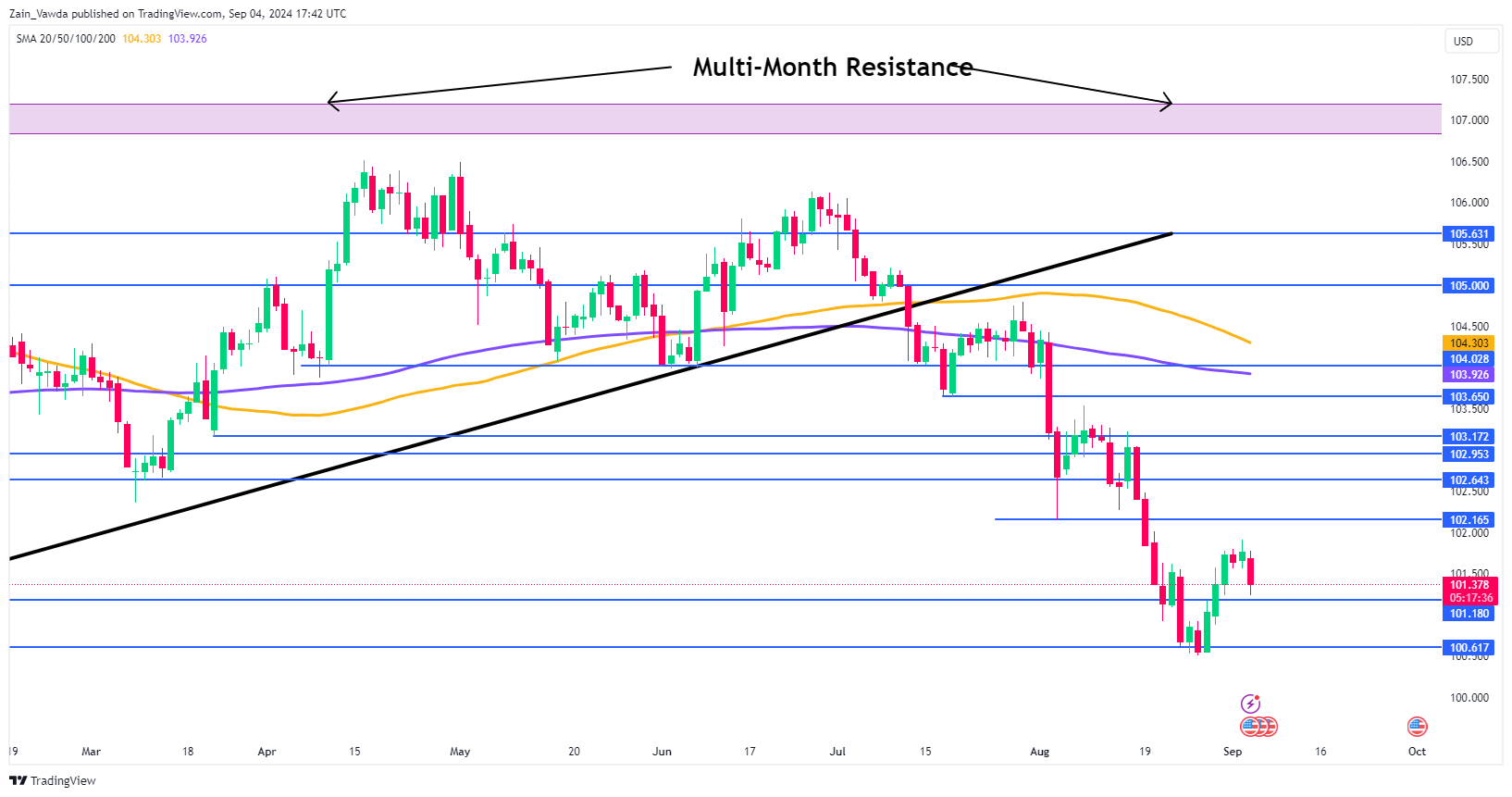

Looking at the US Dollar Index chart below and the index is back at support around 101.20. This is critical for the DXY with a break below this level opening up a retest of the recent lows around 100.50.

US Dollar Index Chart, September 4, 2024

Source: TradingView

Support

- 101.20

- 100.50

- 100.00 (key psychological level)

Resistance

Japanese Yen Gains on Haven Bids

The Yen has benefitted of late from the recessionary and demand fears and capitalized once more today, with slipping further below the 145.00 handle. Hawkish comments from BoJ Governor Ueda also lent support to the Yen.

The is no longer attracting haven bids as it did earlier in the year while Gold prices have also come under pressure of late. The precious metal in particular is a surprise as discussed in an article earlier in the day.

USD/JPY Technical Analysis

From a technical standpoint, USD/JPY has broken back below the 145.00 as early week optimism around the US Dollar has faded. The emergence of recessionary fears weighing on the dollar, while the Yen is attracting safe-haven bids. This has formed the perfect cocktail for USD/JPY to slide once more.

The daily candle is currently testing a key level around 143.65 with a break below opening up a retest of the August 5 swing low around 141.67. Whether or not USD/JPY reaches this level or potentially the psychological 140.00 level will depend on the US Jobs and Unemployment data on Friday.

USD/JPY Chart, September 4, 2024

Source: TradingView

Support

Resistance

Most Read:

Original Post