US Dollar Remains Stable for Now: What’s Next?

2023.09.04 09:37

The is holding steady, with the currency pair hovering around 1.0780 as of Monday. This follows a robust performance by the dollar last Friday, driven by newly-released U.S. employment statistics.

The U.S. unemployment rate rose slightly to 3.8%, up from 3.5%, while the average hourly wage saw a modest month-over-month increase of 0.2%, falling short of the anticipated 0.3% hike. However, non-farm payrolls exceeded expectations by adding 187,000 jobs.

Given these mixed signals, the Federal Reserve may view the current labor market conditions with caution. The central bank could attribute the job market’s volatility to the effects of elevated interest rates, among other factors. If these economic indicators continue to show weakness, it could imply greater susceptibility to high interest rates, suggesting that further rate hikes may be on the horizon.

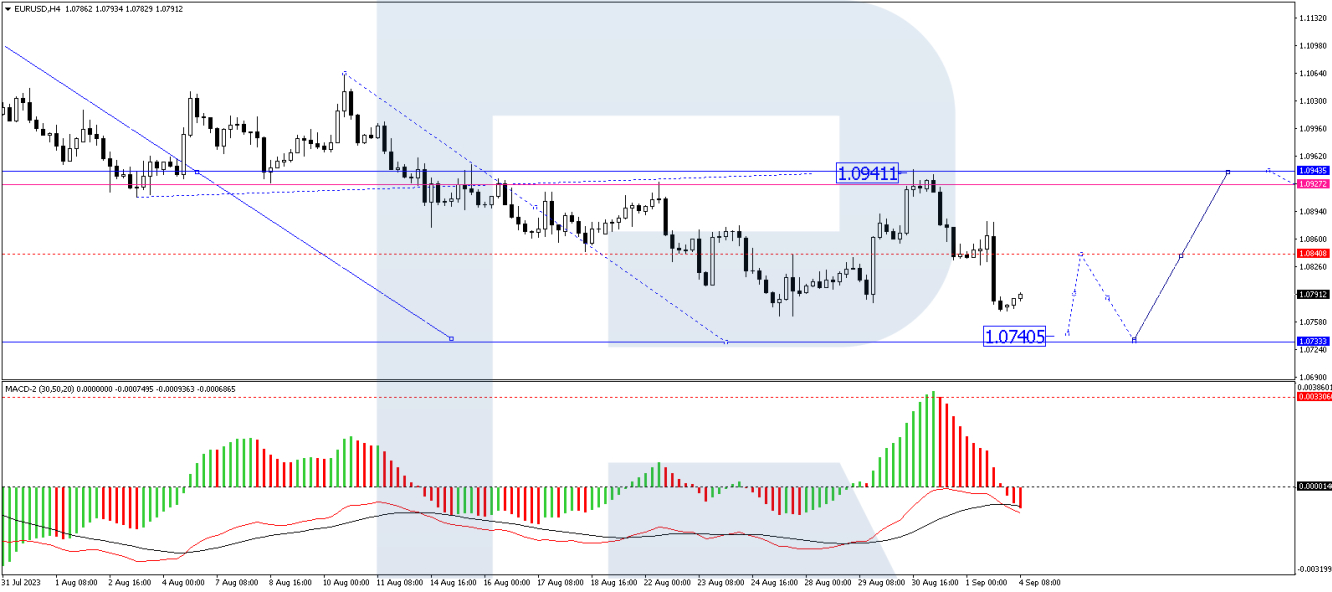

Technical Analysis of EUR/USD Currency Pair

On the 4-hour chart, EUR/USD prices have concluded a corrective phase at 1.0941 and have commenced a downward trend targeting 1.0740. In the short term, the market may witness an upward adjustment to 1.0810, which would then be followed by a resumption of the declining trend toward the local target of 1.0740. This outlook is technically supported by the Moving Average Convergence Divergence (MACD) indicator, whose signal line is positioned below the zero threshold and is oriented downward.

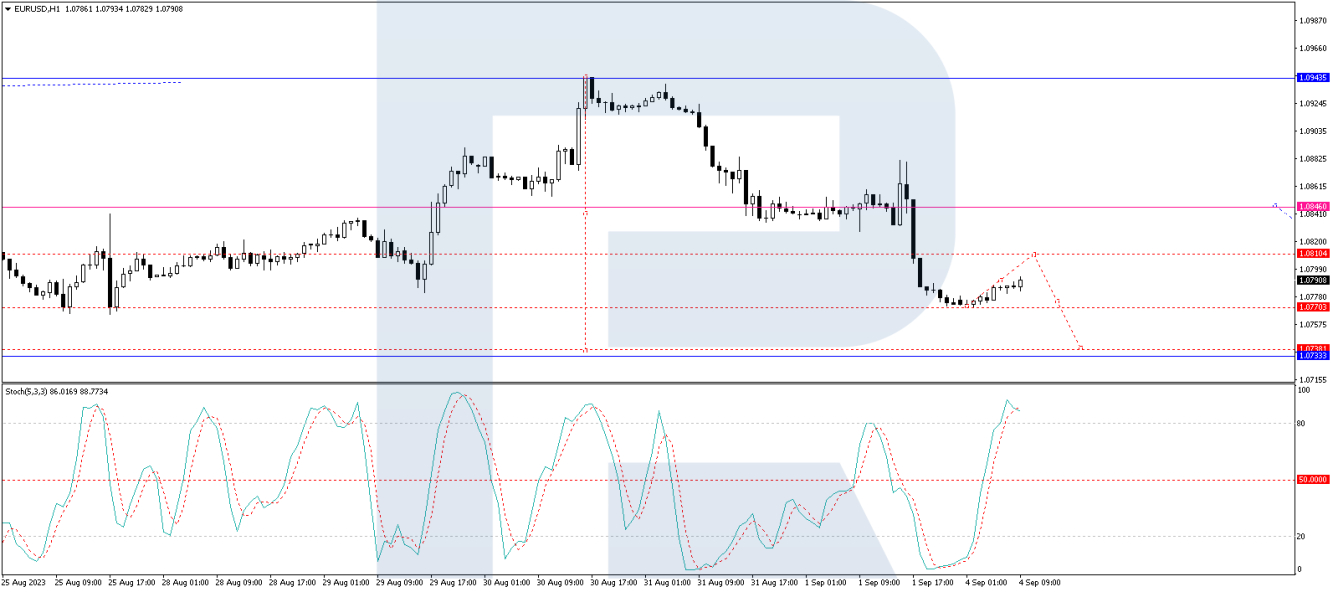

On the 1-hour chart, the EUR/USD has established a consolidation range around 1.0840. The pair briefly extended to 1.0881 before retreating, shifting the lower range boundary to 1.0771. A minor rise to 1.0810 is anticipated in the near term, followed by a decline to 1.0740, and potentially extending to 1.0733 thereafter. This scenario gains technical validation from the Stochastic oscillator, whose signal line currently resides above the 80 level and appears poised to descend toward 50. Should it cross this level, a further drop to 20 could become increasingly likely.

In summary, the U.S. dollar remains in a strong position, buttressed by mixed yet overall resilient employment statistics. Both short-term and medium-term technical analyses of the EUR/USD currency pair suggest a bearish outlook for the euro against the dollar, although market volatility may still be a factor.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.