US Dollar: Recent Rally Stabilizes Ahead of Key Economic Events

2024.10.29 12:08

The stabilized in the 0.5% range for the fifth session, quietly finding its feet after a near 5% rally over the past thirty days. Since last week, currency market participants have taken a wait-and-see approach after four weeks of gains that fundamentally changed the US dollar’s technical picture.

However, a blockbuster of major news by the end of next week could strengthen or reverse the current trend.

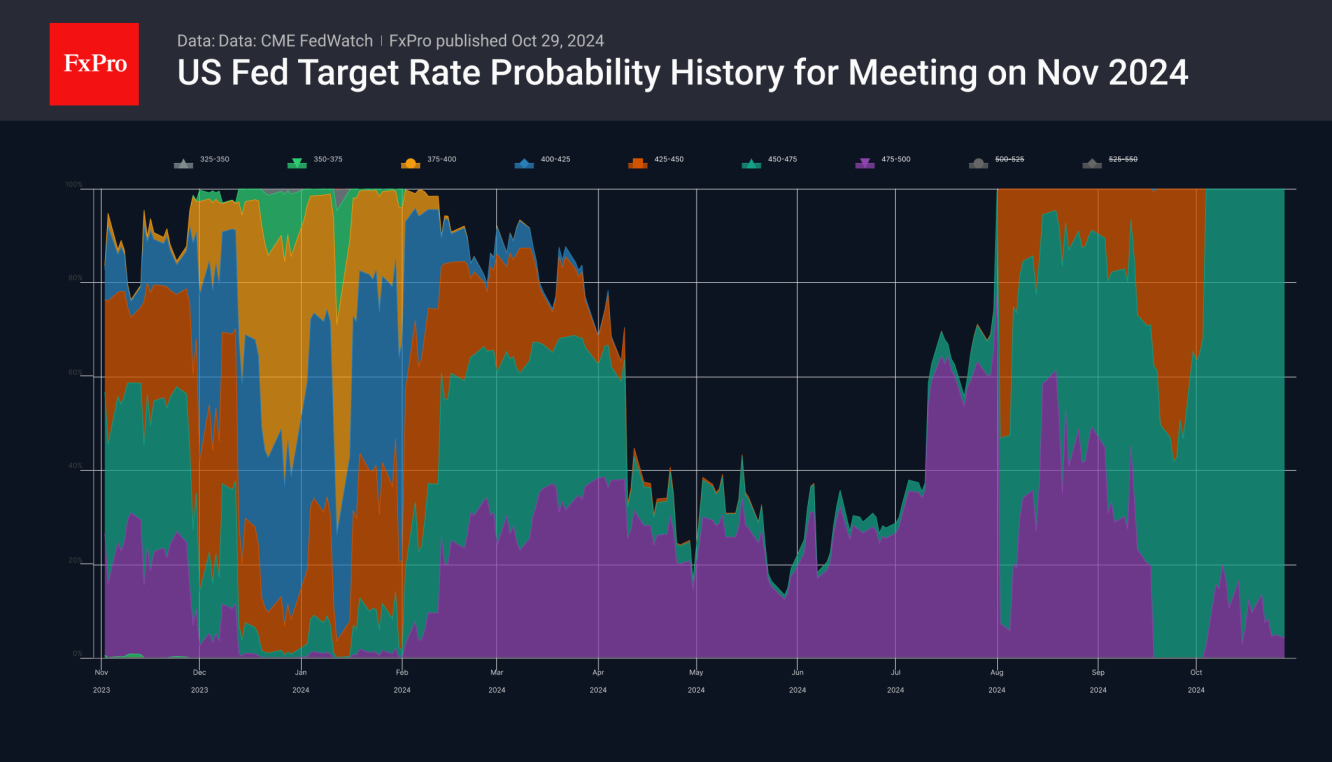

Firstly, the steadied as market expectations settled around the Fed’s key rate outlook. From the end of September to the 10th of October, the market oscillated between expectations of a 50-basis point cut and a 20% chance of no change.

However, in the last two weeks, there has been growing confidence in a 25-point easing, leaving about a 10% chance of no change. There is also a 30% chance that the Fed will only cut rates by 25 basis points before the end of the year. This is a hawkish scenario, attracting buyers of the dollar and sellers of long-term US Treasuries.

Several near-term events could dramatically affect market expectations. Until then, it is logical to expect a lull or pullback against the Dollar to take profits from earlier gains.

The regular monthly report is due on Friday, but other labor market indicators will refine expectations later in the week and could influence prices. Hiring is expected to have slowed sharply, with only 111k jobs added in October, although Hurricane Milton will complicate the assessment of the economy in the outgoing month.

Next week’s presidential election will be in the spotlight until Wednesday. The dollar may feel a sense of relief when the results are announced, as it often weakens ahead of elections. The longer-term trend will depend on what the president-elect says. The risk of new tariffs is bullish for the dollar, while increased fiscal spending is bearish.

Later, the will get into the game. The Fed has already entered a blackout period in which central bank officials will not comment on monetary policy until the meeting results are known. However, sentiment can be influenced by comments from influential journalists from the Wall Street Journal, Bloomberg, or the Financial Times, who many believe are familiar with the discussions or the real balance of power.

The DXY has a good chance of remaining in the 104.00-104.40 range until Friday or even retreating towards 103.5 as part of the correction of the previous rally.

However, only a sustained consolidation below 102.7 would shift the primary outlook to a renewed dollar decline, with the potential to drop below 100 and beyond. A rally above 104.5 on the back of all the important news will make us consider the next stop at 106—the area of the highs of the last two years.

The FxPro Analyst Team