US Dollar Eyes High-Velocity Breakout as PCE Looms: What to Keep an Eye on

2024.06.28 03:58

The was pretty flat ahead of the , and it still sits just below that trend line, which could lead to a more significant move after nearly a year of sideways consolidation. The momentum index is positive, and the could continue increasing.

The dollar could continue higher, especially depending on the outcome in France and the general election in the UK. Yesterday, we saw the spread between the and the widen to about 82 bps.

We also saw the 10-year spread of Italy and Germany widen to 1.6%.

These widening spreads suggest some nervousness, which is one reason why the has struggled versus the dollar more recently. The euro is nearing the lower end of the symmetrical triangle, making the current support level an important spot.

Despite the widening of spreads in Europe yesterday and in the ITRAXX XOVER Index, we didn’t see that happen in the US, with high-yield credit spreads trading flat.

It was a quiet session, with the rising by just nine bps ahead of the PCE report. Based on estimates, the PCE isn’t expected to be much of an event, and I have nothing to say.

Even the 1-Day hardly moved, rising to just 10.8, which tells you the market isn’t very concerned. It also means that an implied volatility crush isn’t likely to develop tomorrow.

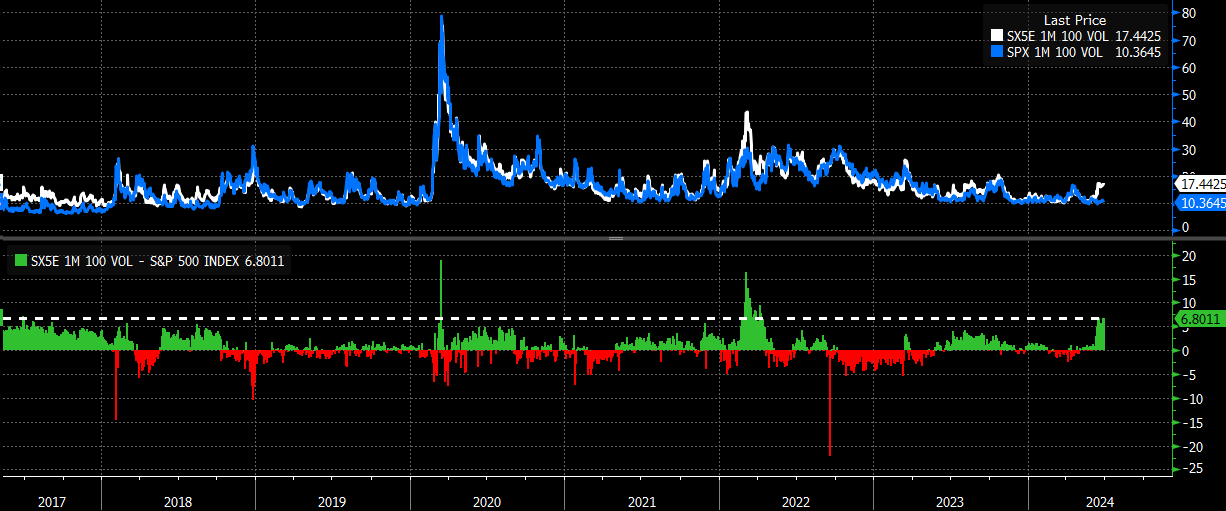

Additionally, the spread between 1-month at-the-money implied volatility for the and the S&P 500 widens to levels not seen since February/March 2022.

The S&P 500 IV is unresponsive to the move higher in implied volatility in the Stoxx 50, which is odd because while the spread may expand and contract, the two generally at least tend to trend in the same direction. That is not the case for now.

Going back over the ears, there are plenty of instances where the Stoxx 50 has led the S&P 500, whether it was topping in 2021/22 or rallying more aggressively off the 2022 lows. Indeed, the divergences yesterday look very similar to those seen in late 2021 and the summer of 2023. But that would also mean that the Stoxx 50 would need to keep falling for it to have any actual meaning.

Again, the overall market conditions have played out as expected, with reserve balances falling sharply this week and gamma at sharply reduced levels. But to this point, the conditions haven’t been enough.

I will be away all next week and not returning until Tuesday, 7/8. I will not have time to write these Free evening commentaries. If I get an hour, I will send an update; you will probably hear from me this Sunday, the last time for at least a week. Paying members will be updated tomorrow.

Original Post