US Congressmen Are Raking in Double-Digit Returns on These Stocks

2024.07.23 09:09

- In 2023, U.S. congressmen achieved an average return of 18% by investing in stocks.

- In this piece, we will take a look at some of the stocks they hold in their portfolios.

- Later on, we will also delve deep into the stocks that have the best upside potential.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Investors often find it intriguing to examine the portfolios of prominent figures such as Warren Buffett or leading mutual funds and hedge funds. Today, we turn our attention to a different set of investors: U.S. congressmen.

Recent media reports provide a glimpse into their investment choices, offering a fascinating look at the stocks they’re backing.

This exploration isn’t about mimicking their strategies but understanding the types of investments that have caught their attention.

So, let’s dive into their portfolios and see which stocks have been prominent in their financial decisions over the past year.

In 2023, members of Congress saw an average return of 18%, with Democrats outperforming Republicans. Here’s a look at the most common assets featured in most portfolios:

- Microsoft Corporation (NASDAQ:)

- Nvidia (NASDAQ:)

- Alphabet Inc Class A (NASDAQ:)

- Apple (NASDAQ:)

- Treasury Bonds

Sector Preferences:

Their investments predominantly focus on the following sectors:

- Technology (NYSE:)

- Energy (NYSE:)

- Healthcare (NYSE:)

- Defense (NYSE:)

- Financials (NYSE:)

Top Performers and Notable Investments

Several congressmen achieved impressive returns in 2023. Here’s a snapshot of their top investments and performance:

- Brian Higgins (Democrat): 239% return. Key stocks include NVIDIA, Booking Holdings (NASDAQ:), and Wells Fargo & Company (NYSE:).

- Mark Green (Republican): 122% return. Notable investments include Energy Transfer (NYSE:), NGL Energy Partners LP (NYSE:).

- Garret Graves (Republican): 108% return. Capitalized on Coinbase (NASDAQ:) Global Inc. (NASDAQ: COIN) when it was at historic lows in 2022.

- David Rouzer (Republican): 106% return. Investments include NVIDIA and Berkshire Hathaway B (NYSE:).

- Seth Moulton (Democrat): 80% return. Key stocks are Amazon.com Inc (NASDAQ:) and Divergent Energy Services Corp.

- Ron Wyden (Democrat): 79% return. Along with his wife, invested in United Parcel Service Inc (NYSE:), Walt Disney Company (NYSE:), Meta Platforms Inc (NASDAQ:).

Next, we’ll delve deeper into some of these stocks to understand what made them attractive investments.

Energy Transfer (ET)

Energy Transfer provides energy-related services. It was formerly known as Energy Transfer Equity and changed its name to Energy Transfer in October 2018. It was founded in 1996 and is headquartered in Dallas, Texas.

Its dividend yield is 7.73%.

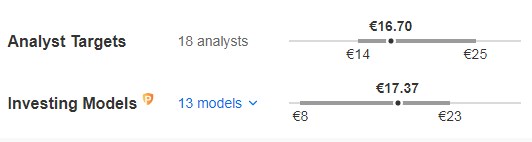

Source: InvestingPro

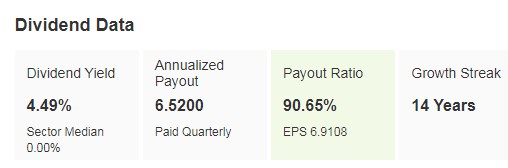

It reports its results on August 7. The market has lowered revenue expectations for this quarter from $22.727 billion to $21.485 billion.

Source: InvestingPro

Following the announcement of the acquisition of WTG Midstream for approximately $3.25 billion, this acquisition is expected to boost cash flow.

The company’s shares generally trade with low volatility, providing some degree of stability in an investor’s portfolio.

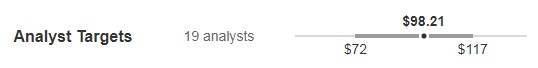

It has 17 ratings, of which 16 are buy, 1 is hold and none are sell.

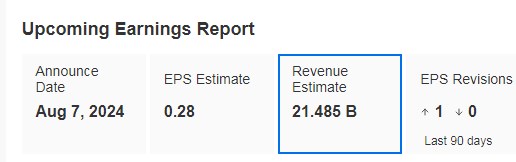

Its fair value or fundamental price is at $21.15, 28.7% above the closing price for the week ($16.44). The market gives it potential at $19.31.

Source: InvestingPro

UPS (UPS)

UPS is a global leader in package transportation and logistics services. Headquartered in Atlanta, Georgia, with additional operational headquarters in Bienne, Switzerland, the company oversees its activities across Europe, the Middle East, and Africa.

Founded in 1907, the company has grown into one of the most recognized names in the industry, known for its extensive network and reliable delivery services.

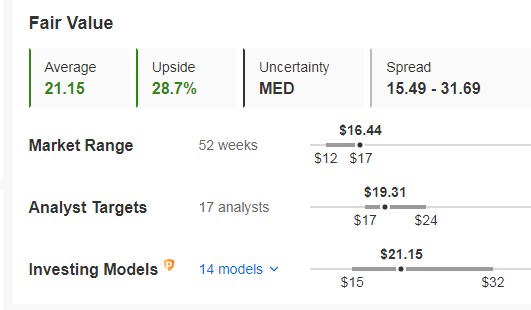

Its dividend yield is 4.49%. It has raised them for 14 consecutive years and has been distributing for 26 years.

Source: InvestingPro

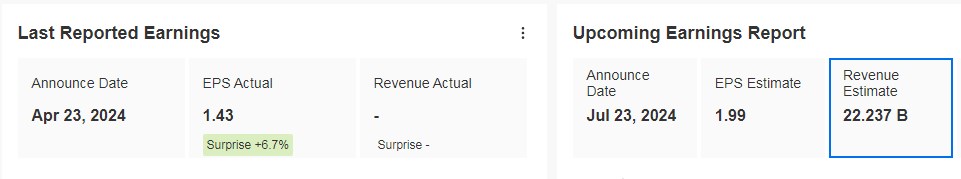

On July 23rd we will know its accounts. The market has reduced revenue expectations from 24.516 billion to 22.237 billion.

Source: InvestingPro

Announced the sale of its Coyote Logistics Truck Brokerage business to RXO for $1.025 billion and the transaction could be completed by the end of the year.

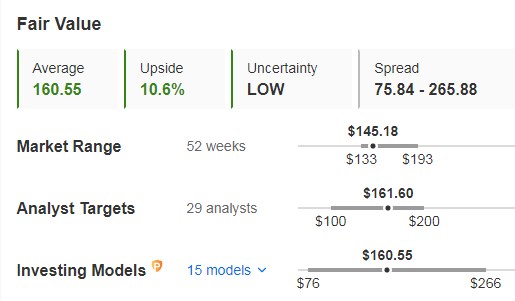

It trades with a moderate level of debt and is trading near its 52-week low, which could present a value opportunity for investors.

Its fair value or fundamental price is at $160.55, 10.6% above its closing price for the week ($145.18). The market gives it potential at $161.60.

Source: InvestingPro

Walt Disney (DIS)

Walk Disney produces and distributes content under the ABC Television Network, Disney, Freeform, FX, Fox, and National Geographic branded television channels. The company was founded in 1923 and is headquartered in Burbank, California.

Its dividend yield has increased again after a few years of being flat.

Source: InvestingPro

It will release its numbers on August 6. The market has lowered EPS expectations from 1.40 per share to 1.18.

Source: InvestingPro

Its fair value or price-to-earnings is at $119.41, 24.7% above the closing price for the week ($95.74). The market gives it potential at $124.26.

Source: InvestingPro

Netflix

Netflix (NASDAQ:) is an American entertainment company and streaming platform. Located in Los Gatos (California), the company was founded on August 29, 1997.

On October 15 it will present its next results. A few days ago we knew the latest report and Netflix’s results met the high expectations of investors. The company achieved 8.1 million paid subscribers, revenues increased by 16.8% to $9.559 billion and operating profit reached $2.603 billion, yielding a margin of 27.2%.

The decision to eliminate its Basic plan in the U.S. and France is expected to boost revenues.

Its beta is 1.27, which implies that the shares are moving in the same direction as the market but with more volatility.

Source: InvestingPro

Its financial health is good, earning a score of 3 out of 5.

Source: InvestingPro

The market assigns it an average price target of $676.77 versus the week’s close of $633.34.

Source: InvestingPro

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you’re left on the sidelines?

InvestingPro’s revolutionary AI tool, ProPicks, puts the power of Wall Street’s secret weapon – AI-powered stock selection – at YOUR fingertips!

Don’t miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.