Up 55% This Year, Can Tesla Stock Keep Outperforming?

2023.03.28 07:13

- Tesla’s stock currently trades at a discount to fair value and is up 55% YTD.

- The company’s fundamentals have improved over the last few years.

- However, concerns remain about Tesla’s ability to fend off competition and sustain growth in the future.

For many investors, Tesla (NASDAQ:) is just another car company. For others, it is a true disruptor and, in fact, more comparable to companies in the technology or even the luxury sector. So, let’s delve deep into the company’s fundamentals and determine if Tesla is worth investing in at current valuations.

Tesla, formerly known as Tesla Motors, Inc., is a company that designs, develops, manufactures, and sells electric vehicles and energy storage systems, as well as installs, operates, and services energy storage products. The company operates in two segments: automotive and energy generation & storage.

The automotive segment includes designing, developing, manufacturing, and selling electric vehicles. The energy generation & storage segment designs, manufactures, installs, and sells or leases residential and commercial energy efficiency products and solar energy systems.

Tesla manufactures and sells the Model S sedan, the Model X sport utility vehicle, and the Model 3, a mass-market sedan. However, It also develops electric products for use in homes, commercial buildings, and public places.

Fundamentals at a Glance

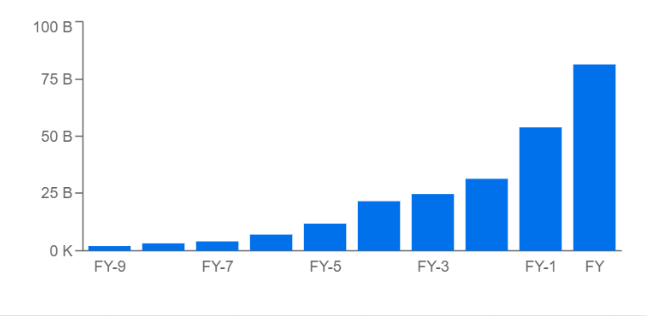

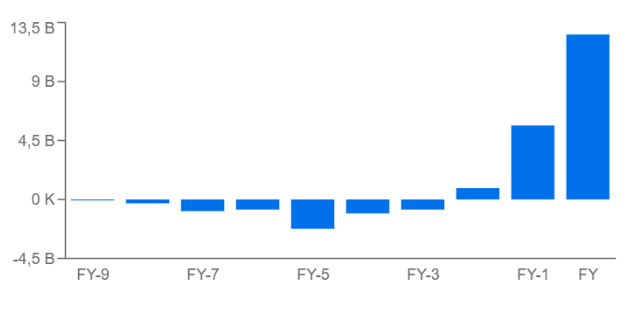

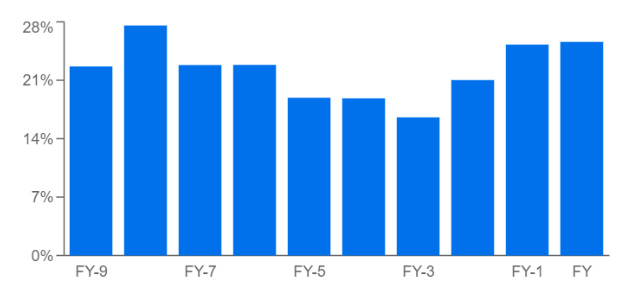

Let’s start with the financial history, which provides several valuable insights, including:

The increasing trend in revenues and profits over time, especially the latter. After years of Tesla being guilty of growing but not turning a profit, it is now turning a profit. Margins go up and down. But they never deviate from the 15-20% of revenue range.

Tesla Revenue Trend

Source: Investing Pro

Tesla Net Income

Source: Investing Pro

Tesla Gross Profit Margins

Source: Investing Pro

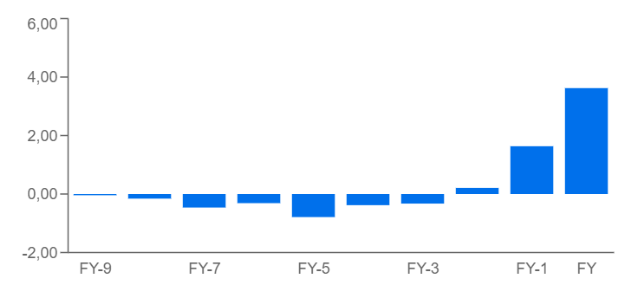

The growth rate of EPSd (diluted earnings per share) has been 315% over the last three years, which is truly incredible.

But let’s not forget that, like all companies; it will fall back to more normalized values (and so, as investors, we have to ask ourselves how much the company could be worth at that point).

Tesla Diluted EPS

Source: Investing Pro

Balance Sheet and Cash Flow

Between cash and short-term investments, Tesla has over $22 billion. Total current assets are around $41 billion. This provides an excellent short-term balance compared to current liabilities ($27 billion).

The debt-to-equity ratio is good (currently 0.78, in my opinion, a ratio of 0.5/0.6 or less is optimal).

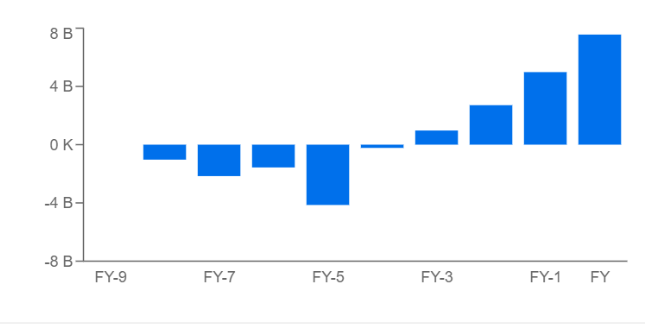

On the cash flow side, cash flow from operations is on a good growth trend, demonstrating Tesla’s recovery over the last couple of years.

Source: Investing Pro

With an FCF of $14.7 billion (most recently available), the FCF yield is around 2.5 percent, making it unattractive at these prices despite the good growth trend.

Valuations

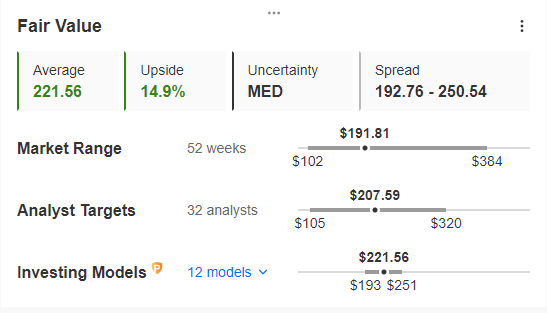

Moving on to valuations, the stock is trading at a discount of just under 15% to fair value, which is put at around $221 per share (based on the average of 12 different models).

So far, analysts are more conservative: The average target price is $207, and the upside is about 8%.

Tesla Fair Value

Source: Investing Pro

In general, the prospects for further growth are there. Still, with other carmakers gradually investing in building electric vehicles and considering all the unanswered questions in the sector, growth could slow in the coming years, making valuations high again.

For now, it is a good stock to hold. But it is not particularly cheap. I am also concerned about management. Elon Musk is undoubtedly a genius, but shareholders will be worried he could sell his shares at any moment, given that he is now involved in other projects, too, like Twitter.

The analysis was done using Investing Pro.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, consultation, or recommendation to invest and, as such, is not intended to induce the purchase of any assets. I would like to remind you that any investment is evaluated from multiple perspectives and is highly risky; therefore, any investment decision and the associated risk remain with the investor.

***

If you’re looking for more actionable trade ideas to navigate the current volatility on Wall St., check out our free webinar on Wednesday, March 29 at 10:00 ET (14:00 GMT) highlighting where to invest right now using the advice of billionaire investor Warren Buffett.