Uber Q3 Earnings: Top-Line Growth, Profitability Could Propel Stock to New Highs

2023.11.07 06:35

- Uber’s quarterly results will be announced today

- The company has finally reached a settlement with current and former drivers over fees and taxes

- There’s a high possibility that the stock could make new all-time highs

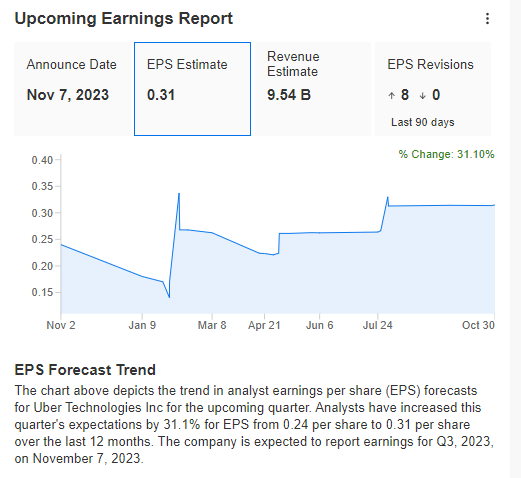

Uber (NYSE:), the U.S. ride-hailing giant, is set to unveil its Q3 2023 results today amid a prevailing sense of optimism. Ahead of the earnings, eight analysts have revised their expectations upward, and there are no downward revisions in sight.

In the previous quarter, Uber a remarkable turnaround, reporting a net profit of $394 million. This marked a substantial improvement compared to the same period in 2022 when the company incurred losses exceeding $2.6 billion.

Adding to the positive backdrop, Uber recently announced a settlement with current and former drivers over the passing on of fees and taxes that should have been charged to customers.

The settlement, amounting to $290 million and benefiting more than 100,000 drivers, was met with a favorable market response.

This positive reaction translated into a more than 5% increase in Uber’s share price during the session, as it helped mitigate existing legal risks, aligning them with acceptable revenue levels.

Furthermore, Uber’s earnings per share, which stood at $0.34 in the last quarter, significantly surpassed expectations of $0.23.

This robust performance underscores the company’s continuing upward trajectory in this crucial earnings metric. Let’s take a closer look at the current forecasts.

Uber Upcoming Earnings

Source: InvestingPro

The main source of new revenue is currently the advertising division, with Amazon former advertising director Mark Grether at the helm.

According to CEO Dara Khosrowshahi, it is possible to surpass the $1 billion barrier on this account as early as next year.

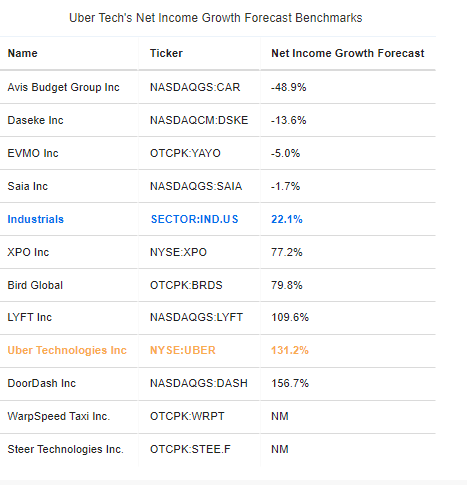

This is also reflected in the projected growth in net profit in 2024 of 131.2%, which puts the company at the top of its sector.

Uber Net Income Forecasts

Source: InvestingPro

Lyft Emerges as One of Uber’s Main Competitors

LYFT (NASDAQ:) is rapidly emerging as a formidable contender in the ride-hailing industry, challenging Uber’s dominance.

While Uber’s advertising segment is experiencing significant growth, other pivotal drivers of the company’s anticipated profitability and revenue expansion include UberEats and the ongoing positive trajectory of its cab division.

In Q3, booking growth for the cab division is projected to surge by 26%, with UberEats following closely behind at 16.2%.

The competitive landscape is also a focal point for investors, with Lyft establishing itself as a chief rival. Lyft has recently adopted an aggressive pricing strategy, impacting its current performance while effectively attracting a growing customer base.

Notably, in September, Lyft’s average fares were 4% lower than Uber’s, a trend that the market will closely monitor in the coming quarters for its influence on financial performance.

Technical View: Can Uber Stock Make New All-Time Highs?

The recent strong upward momentum of the stock within its local consolidation phase raises the prospect of it breaching the upper boundary at approximately $49 and extending the bullish trend.

The pivotal factor in sustaining this trajectory hinges on the forthcoming quarterly results. Should these results outperform the forecasts, it is expected to provide substantial support for buyers.

In such a scenario, the primary target level resides within the historical peaks, located in the price range of approximately $64 per share.

Uber Stock Daily Chart

The macroeconomic situation should also work in favor of the bulls, especially after Friday’s from the US labor market indicating a slowdown.

Unless we see an unexpected return of inflation to an upward trend, then we should not see any more interest rate hikes, and the Fed’s much-awaited pivot could take place as early as next year.

***

Find All the Info You Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.