U.S. targets China over semiconductors

2023.06.30 02:36

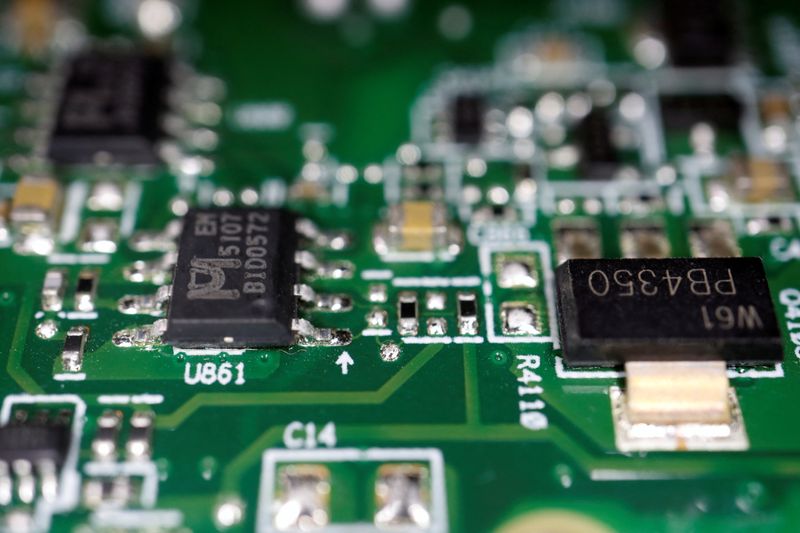

© Reuters. Semiconductor chips are seen on a printed circuit board in this illustration picture taken February 17, 2023. REUTERS/Florence Lo/Illustration

(Reuters) -U.S.-China tensions over semiconductors began with the Trump administration’s trade war and have ratcheted up under President Joe Biden’s leadership as Washington looks to undercut Beijing’s efforts to build its high-tech industry.

The U.S. and the Netherlands are set to deliver a one-two punch to China’s chipmakers by further curbing sales of chipmaking equipment, including some from Dutch firm ASML, the global leader in the critical process of lithography, Reuters reported on Thursday.

Here is a timeline of U.S. actions against China’s chip industry:

October 2018: Former U.S. President Donald Trump’s administration cuts off Chinese chipmaker Fujian Jinhua Integrated Circuit from its U.S. suppliers after the U.S. Justice Department indicted the state-backed firm for stealing trade secrets.

The case initially started as a dispute between Micron Technology (NASDAQ:) and the Chinese firm. Trump’s move escalated it into the realm of an international trade conflict between the United States and China.

January 2020: Reuters reported that the Trump administration had since 2018 had mounted an extensive campaign to block the sale of Dutch chip manufacturing technology to China. It resulted in ASML being unable to sell its most advanced lithography machine to a Chinese customer.

May 2020: The Trump administration blocks shipments of semiconductors to China’s Huawei Technologies from global chipmakers, crippling its HiSilicon chip and smartphone divisions.

December 2020: The U.S. adds China’s top chipmaker SMIC and dozens of other Chinese firms to a trade blacklist and said it would presumptively deny licenses to prevent SMIC from acquiring technology to produce semiconductors at advanced technology levels of 10 nanometres or below.

September 2022: U.S. chip designers Nvidia (NASDAQ:) and Advanced Micron Devices say U.S. officials have told them to stop exporting some top computing chips for artificial intelligence work to China.

October 2022: The Biden administration publishes a sweeping set of export controls, including a measure to cut China off from certain semiconductor chips made anywhere in the world with U.S. equipment.

December 2022: The U.S. adds Chinese memory chip maker YMTC and dozens of other Chinese firms to its trade blacklist.

June 29, 2023: Reuters reports the Netherlands is this summer planning to curb sales of certain ASML equipment from being sold to China’s chipmakers. The U.S. is expected to go one step further and use its long reach to withhold even more Dutch equipment from specific Chinese fabrication plants.

A separate report citing sources said U.S. officials are considering tightening an export control rule designed to slow the flow of AI semiconductors to China by clamping down on the amount of computing power the chips can have.