U.S. Stock Market’s Tech-Fueled Rally Cools Off: What’s Next?

2023.06.08 08:27

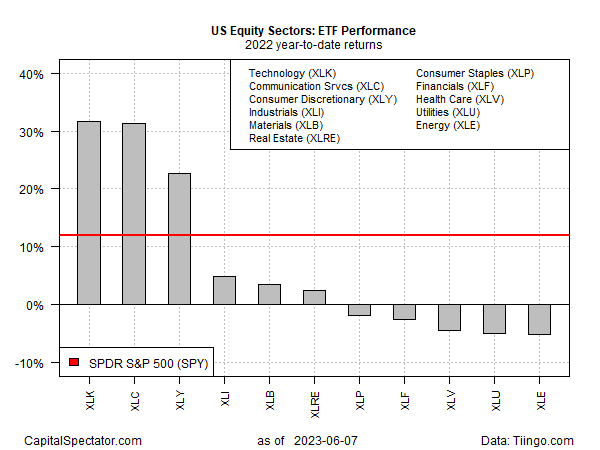

Shares of technology firms, along with digital communications and consumer discretionary stocks, are the US equity market leaders by a wide margin in 2023, based on a set of ETF proxies. The rest of the field is far behind, with nearly half underwater year to date, as of Wednesday’s close (June 7).

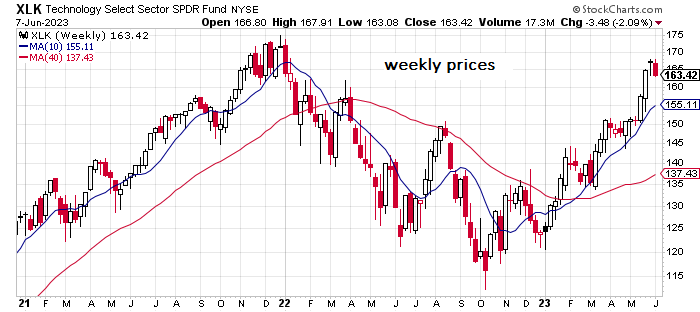

Technology Select Sector SPDR Fund () has rallied nearly 32% so far this year. After bottoming in October, the ETF has been on a relatively consistent upswing that’s carried the ETF to a 1-1/2 year high before pulling back in recent days.

As tech and related shares continue to dominate and drive the stock market’s gains this year, worries about the sector’s red-hot run are mounting amid warnings that the runup has gone too far too fast. As CTech noted earlier this week:

According to Bank of America, the seven technology giants last week reached a trillion dollar market value for the first time—make up 28% of the S&P 500 in market capitalization terms. This is the highest level historically reached by this group of companies in this measurement method. A similar level was also recorded during 2022.

In fact, the market value of the seven technology giants is greater than the combined market value of all the companies in the from the sectors of industry, finance and energy.

The communications sector () is nipping at XLK’s heels as the second-best sector performer, followed by consumer discretionary (), which is up nearly 23% year to date. The other sectors are behind the trio of leaders, with several sectors posting modest losses in 2023. The broad market, based on is enjoying a solid gain this year, rising 12%, thanks largely to the performance fortunes of the three sector leaders.

ETF Performance YTD Returns

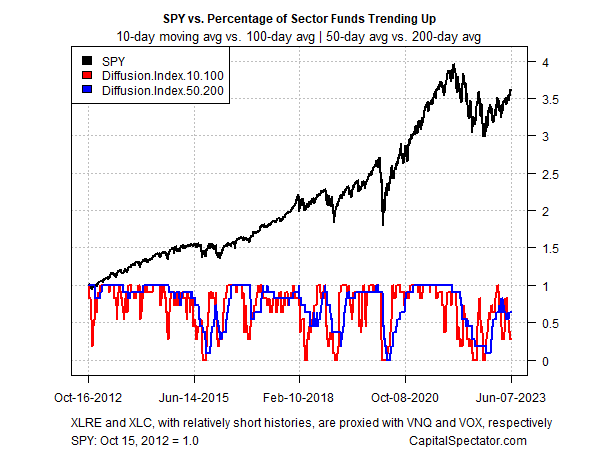

A review of the overall market trend, based on aggregating a set of moving averages for the sector funds listed above, suggests the rally is cooling. After rocketing higher following October’s trough, market sentiment has recently pulled back to a middling level. That alone doesn’t signal that the tech rally is over, but at the very least, the softer reading suggests a period of consolidation for the market overall lies ahead.

SPY vs Percentage of Sector Funds Trending Up