U.S. recession risk up, but returns set to improve – Vanguard

2022.07.13 16:47

Budrigannews.com – Vanguard Group, the world’s second-biggest asset manager, said on Wednesday the U.S. economy had a growing chance of falling into recession in the next two years but raised its expectations for annual returns on stocks and bonds.

The Pennsylvania-based mutual fund manager noted a 25% probability of a U.S. recession over the next 12 months and 65% over the next two years. In the Euro area, the chance of a recession is around 50% over the next year and 60% over the next two years, it estimated.

Vanguard expects the U.S. economy to grow 1.5% this year, down from its previous 3.5% forecast, it said in a mid-year update of its 2022 economic and market outlook.

“Central banks have been forced to play catch-up in the fight against inflation, ratcheting up interest rates more rapidly and possibly higher than previously expected. But those actions risk cooling economies to the point that they enter recession,” Vanguard said.

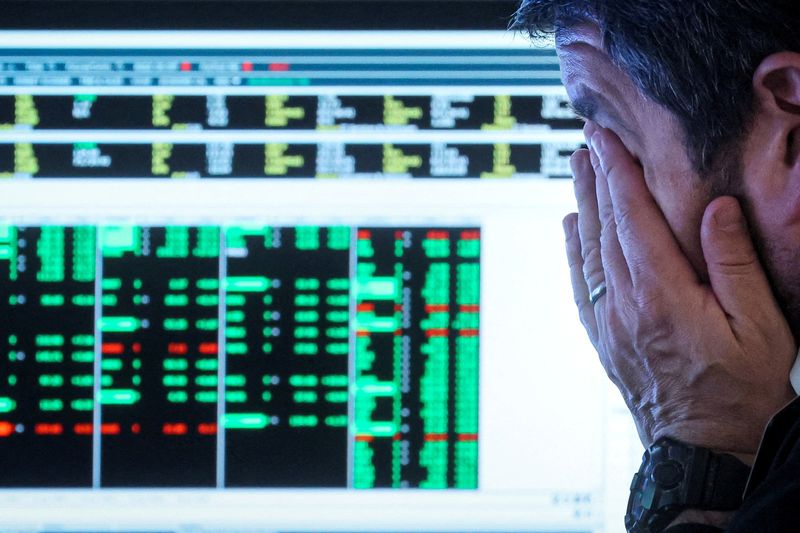

Recession worries have increased as the U.S. Federal Reserve tightens monetary policy, with some Wall Street banks in recent weeks raising their expectations of an economic downturn.

The S&P 500 index is down 20% this year while U.S. government bonds are on track for their worst year on record, according to an ICE (NYSE:ICE) BofA index which is down nearly 10% this year.

“There is an upside to down markets: Because of lower current equity valuations and higher interest rates, our model suggests higher expected long-term returns than our forecasts as of year-end,” Vanguard said.

The Fed last month raised its benchmark overnight interest rate by three-quarters of a percentage point, its biggest hike since 1994. It is largely expected to deliver a similar interest rate increase later this month to curb inflation, which has reached 40-year highs.

Vanguard expects the target federal funds rate to range from 3.25% to 3.75% by the end of this year, roughly in line with the Fed’s projections and market expectations. But it said the rate would reach at least 4% next year, higher than current market estimates.

While higher rates and growing recessionary concerns have weighed heavily on bonds and stocks in 2022, Vanguard’s forecasts for long-term investment returns have improved since the end of last year.

“There’s been a deterioration in valuations so valuations have become more attractive, whether you’re talking about higher yields or lower price-to-earnings multiples in equities markets,” said Andrew Patterson, Vanguard senior international economist, in an interview.

Ten-year annualized return forecasts for U.S equities now range from 3.4% to 5.4%, up from 2%-4% at the end of 2021. For U.S. bonds, forecasts are for 3%-4%, up from 1.5%-2.5% at the end of last year, Vanguard said.

The improved outlook for bonds means they will continue to offer diversification for investors using strategies such as the 60/40 portfolio, a standard approach that keeps 60% of assets in equities and 40% in fixed income, Patterson said.

“We are more constructive on fixed income returns going forward, unfortunately as a result of some of that yield increase pain that we felt,” he said.