U.S. Inflation to Remain a Pain in Retail’s Side

2022.11.16 00:42

[ad_1]

The sector soared after the report last week.

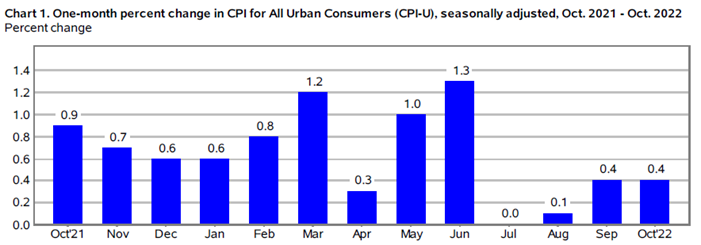

CPI came in at 7.7% versus 7.9% showing 0.20% less than expected and markets celebrated.

After rebounding off support levels at the 50-day moving average, XRT gapped higher. XRT has continued to rise and may see further resistance at the 200-day moving average.

Several retailers, beginning with Walmart (NYSE:), report earnings this week, and figures will be revealed on Wednesday. This data will be pivotal for Retail’s price trajectory.

XRT currently displays market leadership with our Triple Play indicator, and our Real Motion indicator demonstrates strong momentum trend strength.

The current XRT rally can always retrace, so paying attention to our proprietary indicators will signal if XRT might reverse course.

What is expected to happen this week to retail and beyond in 2023?

Unfortunately, there isn’t a simple answer.

If you think inflation is fully addressed or peaking because CPI came in 0.20% less, you could be in for an inflation shock.

The October print rose the same as in September shown above. The positive market reaction doesn’t mean we are in a new bull market.

Walmart will report before the open today.

Key points to watch for include guidance on inventory levels and transportation costs headwinds, as well as updates on pricing and Walmart+ subscriber growth.

Households are feeling the pinch from inflation, and this trend will likely continue into 2023.

The retail sector is in for a challenging quarter and year ahead, as global inflation, loss of purchasing power, and weak consumer sentiment continue to weigh on retail.

We will keep a close eye on Retail as an early indication of the holiday season and the economy’s overall health.

ETF Summary

S&P 500 () 393 support and 398 resistance

Russell 2000 () 182 support and 187 resistance

Dow () 333 support and 339 resistance

Nasdaq () 283 support and 289 resistance

(Regional Banks) 62 support and 67 resistance

(Semiconductors) 215 support and 224 resistance

(Transportation) 225 support and 233 resistance

(Biotechnology) 132 support and 136 resistance

XRT (Retail) 62 support and 67 resistance

[ad_2]