U.S. Fed Expected To Hike, But Is The Pivot Imminent?

2022.11.02 22:14

[ad_1]

The Federal Reserve’s Federal Open Market Committee (FOMC) will conclude its 2-day monetary policy today at 2:00pm ET, with Fed Chairman Jerome Powell’s press conference scheduled to kick off 30 minutes later at 2:30pm ET.

FOMC meeting expectations

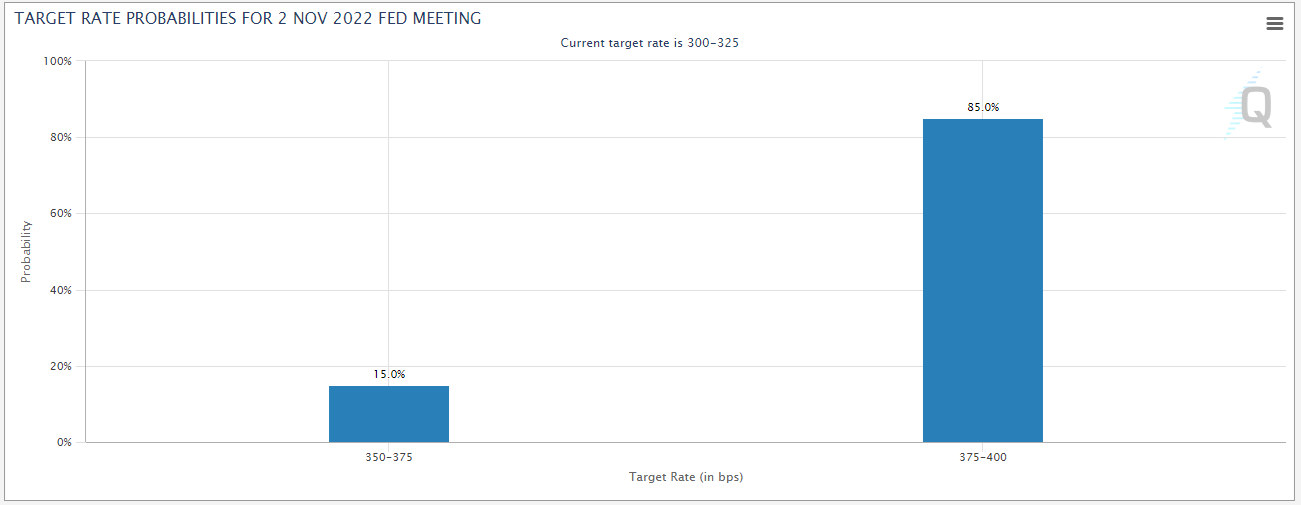

According to the CME’s FedWatch tool, traders are pricing in nearly 90% odds of a 75bps interest rate hike, an expectation that was supported by the Wall Street Journal’s new “Fed Whisperer” Nick Timiraos in this morning’s Fed preview article.

Target Rate Probabilities

Target Rate Probabilities

Source: CME FedWatch

Notably, traders are currently pricing in a peak Fed Funds rate around 4.9% in May 2023, and this is where we’re more likely to see expectations shift (and by extension, market movements) in the wake of this week’s Fed meeting. In other words, traders should be more focused on the Fed’s expected destination (peak interest rates), not the journey (the exact order and pace of rate hikes) in the coming months.

FOMC meeting preview

The stakes couldn’t be higher for this month’s FOMC meeting. While the decision for a 75bps hike itself seems relatively straightforward, the accompanying statement and press conference will be closely monitored for any hints that the central bank is thinking of slowing the pace of rate hikes in the coming months.

Based on the central bank’s September economic forecasts and comments from participants like San Francisco Fed President Mary Daly, the Fed will likely start to debate slowing the pace of rate hikes in its December meeting. Any hints in the monetary policy statement or (more likely) Fed Chairman Powell’s press conference that these discussions have started could provide an immediate boost to risk assets and a pullback in the US dollar. That said, with two more reports and another print scheduled before the Fed’s next meeting in December, the central bank will avoid pre-committing to any specific path this far in advance.

Notably, the remains near historic lows, with the most recent reading showing just 3.5% unemployment in September. In other words, the “full employment” half of the Fed’s dual mandate seems to be comfortably met for now, so we would expect the central bank to emphasize the risks of continued elevated inflation (the “price stability” half of its mandate), especially after the Fed’s preferred measure of inflation has risen for two straight months is currently running at 5.1%, more than twice the central bank’s 2% target and near the multi-decade highs that we saw in Q1 of this year.

Market implications

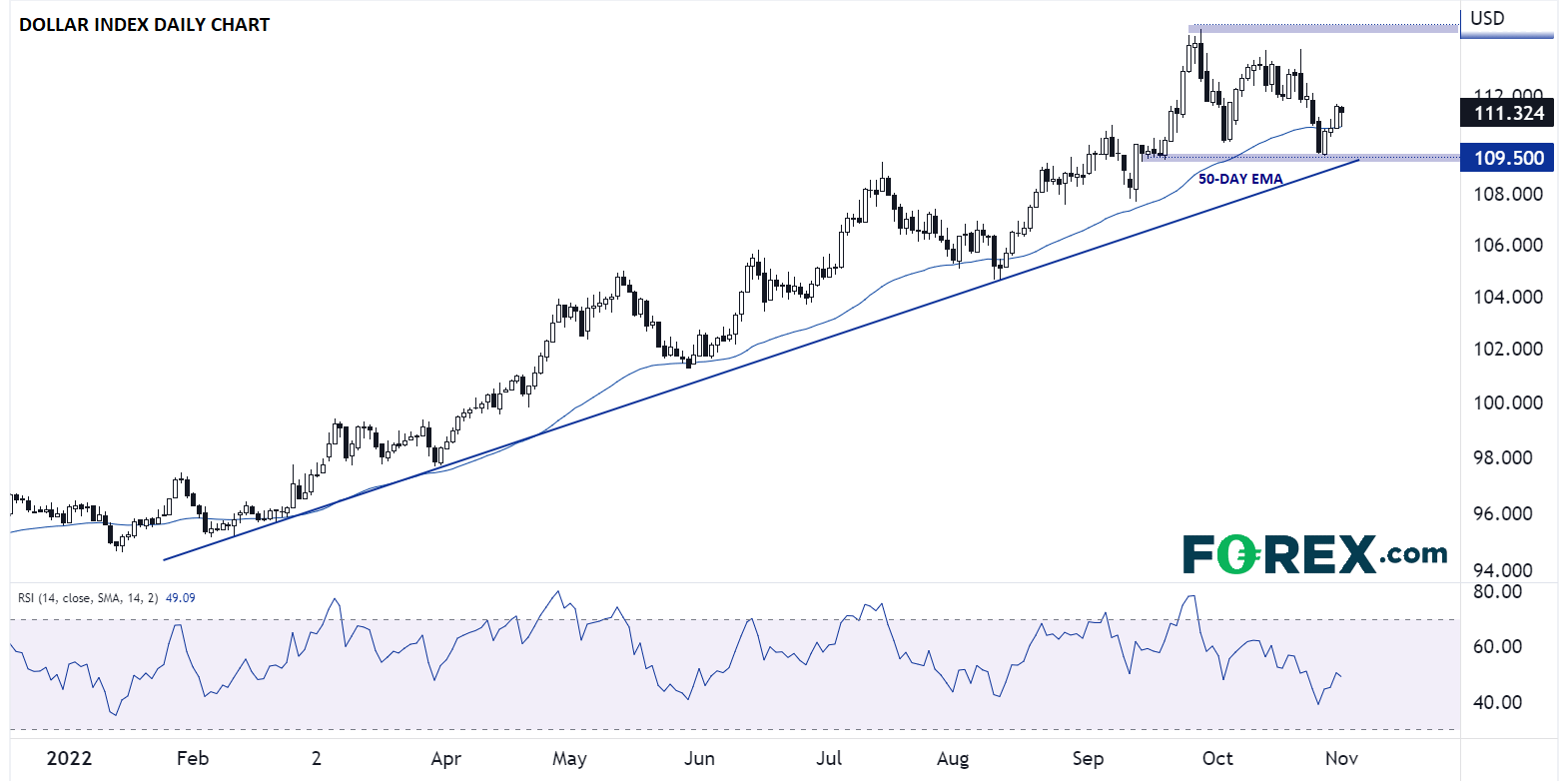

The clearest market impact from the Fed meeting will be on the . After forming a clear, consistent uptrend through the first three quarters of the year, the US dollar index has lost some momentum over the last month and is now testing support at its 50-day EMA and rising trend line. Any clear hint about a pivot to a 50bps rate hike in December could take the greenback below this key support zone around 109.50, opening the door for a pullback toward 108.00 next, whereas a “full steam ahead” message around interest rates would reinvigorate the dollar uptrend and take the dollar index back toward its highs above 114.00.

Source: TradingView, StoneX

Original Post

[ad_2]

Source link