U.S. Dollar Could Add Another 5% Before G7

2022.09.14 20:49

[ad_1]

Yesterday we wondered whether the dollar retreat was a correction or a reversal. But the reaction of the financial markets to the US report has put everything in its place by confirming that we are still in a bull market for the dollar. Very often, though not always, this means a bear market for equities.

EUR/USD daily price chart.

EUR/USD daily price chart.

The Dollar Index’s corrective pullback from the extremes over the past week allowed players to accumulate liquidity for a new strike, which did not take long to come.

Dollar bulls took advantage of a rather average occasion – a slowdown in inflation to 8.3% instead of the expected 8.1% – to cause the to strengthen by almost two percent – the strongest one-day move since March 2020.

Similarly, the stock market crash recalled the worst moments for the market at the start of the pandemic. That said, the inflation surprise (difference between fact and expectation) was not the most significant during this time.

The money markets have shifted markedly in their expectations for next week’s , laying down a 100% chance of a 75-point increase and a 34% chance of a 100-point rise at once.

The previous day, we talked about less than 90% for 75 points and 0% for 100 points. However, an even bigger shock to expectations in July did not cause commensurate market turbulence.

In our view, yesterday’s move was purely technical. The dollar bulls proved that they hold control of the market, protecting the DXY from any severe test of the 50-day moving average. This was most telling in the , which reversed below this line with a decisive move.

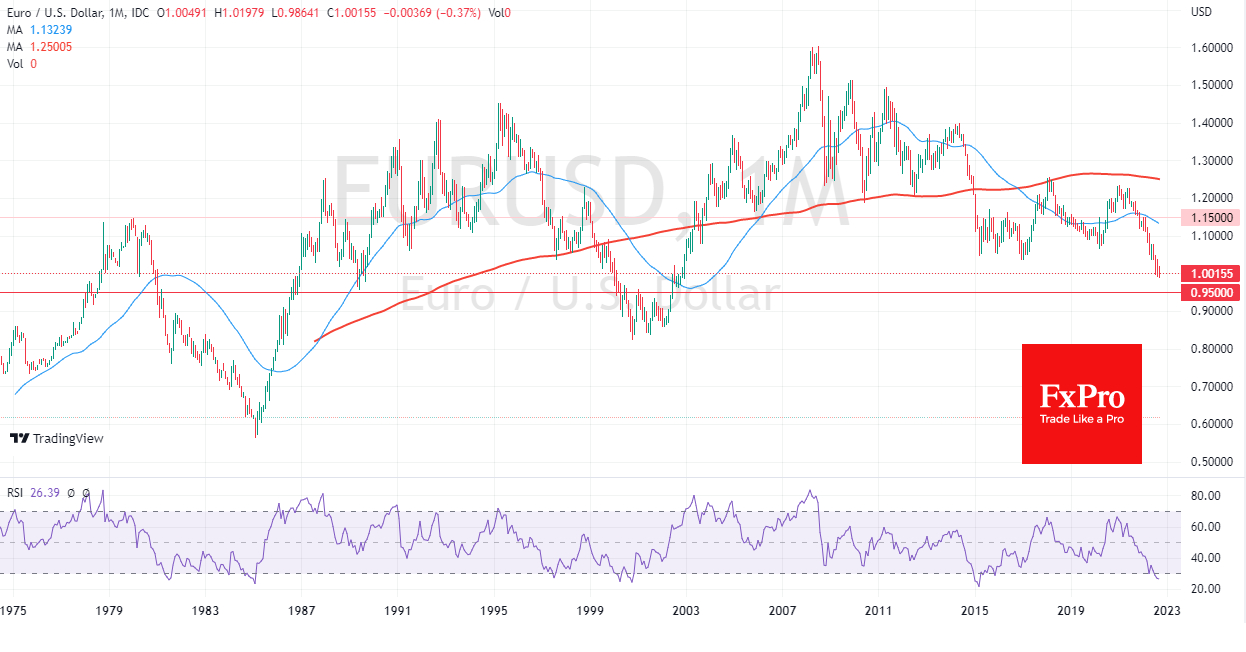

EUR/USD monthly price chart.

EUR/USD monthly price chart.

Usually, such strong moves at key levels will break the resistance of the second side for a long time. In other words, we could now see more of a dollar march in the coming days and weeks with the potential for a renewal of the DXY global highs.

A further rise in the dollar could deprive the EUR/USD pair of support near parity, sending it in search of a bottom lower in 0.95-0.96. We have seen quite a few reversals and accelerations in this area throughout the synthetic euro’s existence.

GBP/USD monthly price chart.

GBP/USD monthly price chart.

The would then risk a renewal of the lows from 1985, going down to 1.1000. For now, we consider a move below that year’s low (below 1.05) in an unlikely extreme scenario.

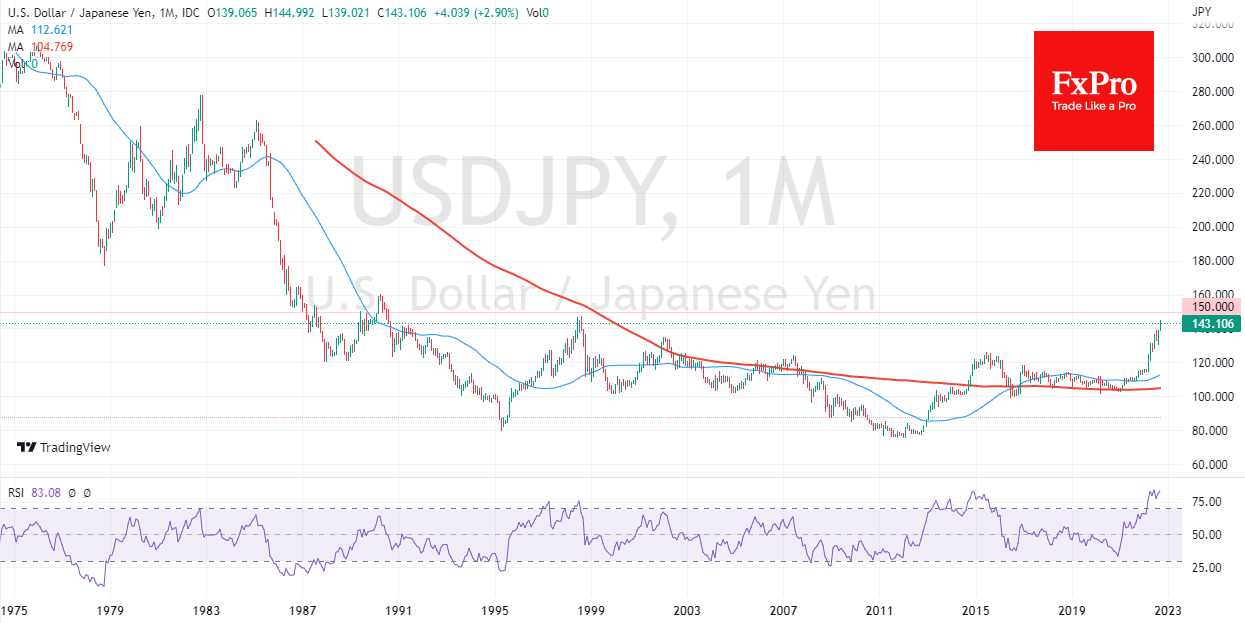

For the , the road to 150 seems to be opening. However, we are cautiously looking at the potential for further gains. There are now reports that the Bank of Japan is preparing for currency interventions.

The currency market values the dollar exceptionally highly, which could trigger a weakly controlled domino effect in the markets, which is hardly in the interest of the financial and monetary watchdogs.

USD/JPY monthly price chart.

USD/JPY monthly price chart.

Simply put, the dollar could easily add around 5% to current levels in the coming days and weeks. Still, one must watch the rhetoric of the G7 authorities at the abovementioned levels very closely.

[ad_2]

Source link