U.S. CPI Preview: Fed Rate Expectations Dive, USD/CAD Tests 1.37

2023.03.14 07:41

- The upcoming US CPI report could tip the scales for the Fed’s highly-anticipated interest rate decision next week.

- The report comes as traders sift through the confusion and uncertainty following the collapse of Silicon Valley Bank and fears of contagion in the banking sector.

- Rate expectations could still change dramatically if the CPI report misses expectations of a 6.0% y/y increase.

When will US CPI be released?

The US Bureau of Labor Statistics will release the consumer price index () for February on Tuesday, March 14 at 8:30 ET.

What are the expectations for the US CPI report?

Traders and economists are expecting the report to show headline consumer prices rose 6.0% year-over-year, down from 6.4% last month. Core (ex-food and -energy) CPI is expected to come in at 5.5% y/y, down slightly from 5.6% last month.

US CPI preview

Traders are on tenterhooks over the upcoming inflation report, which will test an already worried market with concerns over the Federal Reserve hawkishness and the potential fallout from the largest bank failure since the financial crisis.

What was expected to be one of the biggest CPI reports in recent memory has been upstaged to an extent by the weekend’s volatility, but Tuesday’s update on consumer prices should still nonetheless be a major market mover.

Put simply, the decline from 9% to 6% inflation was always going to be the “easy part” for policymakers; the big question moving forward is if the Fed can engineer a continued decline in price pressures without “breaking” any other aspects of the economy.

Despite aggressive action over the weekend, the collapse of Silicon Valley Bank has led to confusion and uncertainty in the market, with concerns that it could lead to contagion among other regional banks (see my colleague Josh Warner’s explainer of the situation here). In essence, the market is nervous that the Fed’s campaign to fight inflation by ending the era of cheap money has exposed cracks in the economy that could widen if it keeps up its rate hikes.

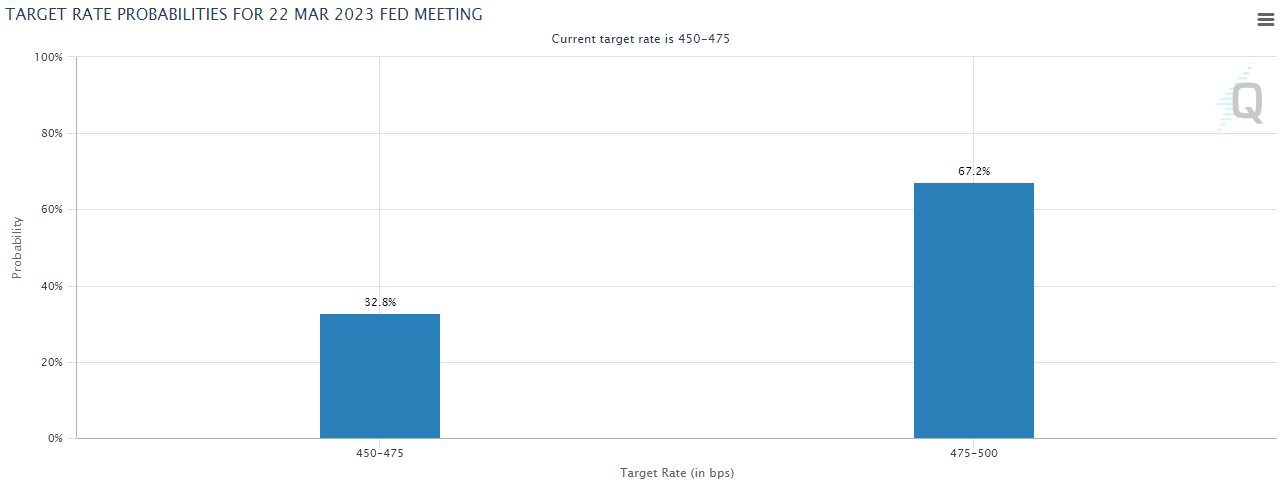

In the wake of the implosion of SVB, traders are dialing down their expectations for Fed hawkishness next week, with a 25bps interest rate hike 70% discounted and a 30% implied probability of no rate hike whatsoever, according to CME’s Fedwatch tool.

Fed Target Rate Probabilities

Fed Target Rate Probabilities

Source: CME FedWatch

Canadian dollar technical analysis – USD/CAD pulling back to 1.37

The is the weakest major currency on the day, but it is bouncing off its intraday lows as we go to press. One pair to watch closely around the US CPI report and beyond will be .

After breaking convincing out above the previous resistance at 1.3700 last week, the North American pair is pulling back to retest that level today. As many traders know, once a resistance level (price “ceiling”) is broken, it can provide support (a “floor” under the price) when the market pulls back to it.

If the 1.3700 level does bounce off 1.3700, bulls may start to look for a resumption of last week’s upside momentum, with room to retest last week’s highs near 1.3850 or even test the psychologically-significant 1.40 level in time.

Source: StoneX, TradingView

Original Post